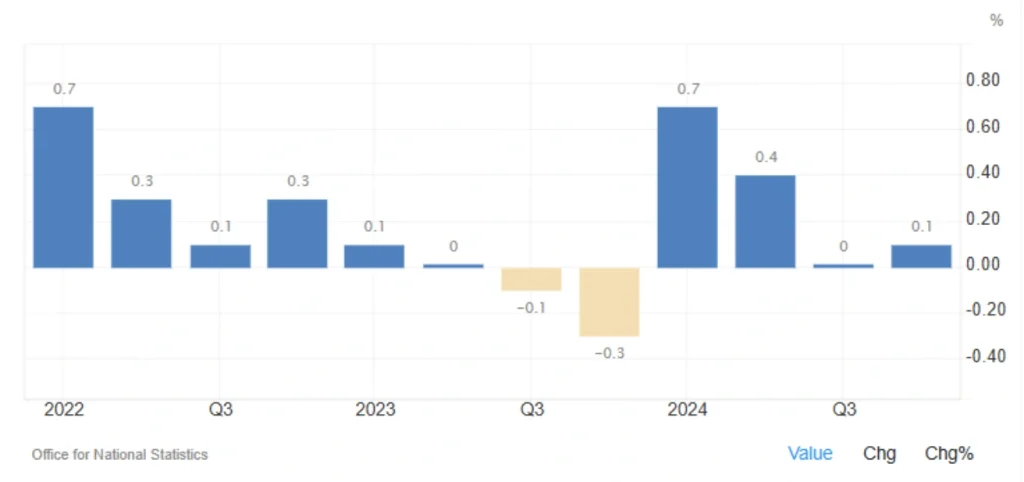

UK Economic Growth in Q4 2024: A Sign of Recovery

The UK economy showed slight improvement in the fourth quarter of 2024, growing by 0.1%—a welcome contrast to the stagnation seen in Q3 and outperforming forecasts of a 0.1% contraction. But does this small uptick signal a sustainable recovery, or are deeper economic challenges still at play?

Let’s dive into the key factors behind this growth, the sectors driving it, and what it means for the future of the UK economy.

A Closer Look at Q4 2024 GDP Growth

What Drove the UK’s Economic Growth?

The economy’s modest expansion was largely fueled by strong performance in services and construction, even as industrial production and exports took a hit.

Growth Sectors:

- Services Sector: Increased by 0.2%, reflecting stronger business activity.

- Construction Sector: Grew by 0.5%, supported by infrastructure projects.

Struggling Sectors:

- Industrial Production: Contracted by 0.8%, marking the fifth consecutive quarter of decline.

- Manufacturing Output: Fell by 0.7%, with major downturns in:

- Transport Equipment: ↓ 2.3%

- Pharmaceuticals: ↓ 4%

- Mining & Drilling: ↓ 2.5%

The Spending Side: Consumers Hold Back, While Government Steps Up

A closer look at spending trends reveals a mixed picture for the UK economy:

- Exports Declined (-2.5%): A drop in fuel, machinery, and transport equipment exports weighed on trade performance.

- Imports Rose (+2.1%): Driven by increased trade in non-monetary gold.

- Investment Took a Hit (-0.9%): A 22.9% plunge in transport-related investments dragged down overall capital formation.

- Government Spending Increased (+0.8%): Higher expenditures in public administration, defense, and healthcare provided support.

- Household Spending Stagnated (0%): Consumer confidence remained weak, leading to flat consumption levels.

Read More: UK Economy Contracts in October 2024

Is UK Economic Growth Sustainable?

While avoiding contraction is a positive sign, the UK’s economic challenges remain significant. Here’s why:

- Industrial Weakness & Export Struggles: The decline in manufacturing and trade could put future growth at risk.

- Government Spending as a Crutch: While public sector spending boosted GDP, it’s not a long-term growth solution.

- Consumer Demand Remains Weak: Without stronger household spending, sustained economic recovery will be difficult.

If industrial production and fixed investment continue to decline, the UK economy could face stagnation—or even recession—by Q1 2025.

Why GDP Growth Matters: A Quick Refresher

What Is GDP?

Gross Domestic Product (GDP) measures the total value of goods and services produced within a country. It’s the most widely used indicator of economic health.

Why Should You Care About GDP Growth?

- A Growing GDP Signals a Healthy Economy: Expansion means more jobs, investment, and business opportunities.

- It Influences Interest Rates & Policy: The Bank of England (BoE) uses GDP data to decide on interest rates and monetary policy.

- It Affects the Stock Market & Currency Value: Strong GDP growth boosts market confidence, while stagnation raises concerns.

Final Thoughts: What’s Next for the UK Economy?

The 0.1% growth in Q4 2024 is better than expected, but it’s not enough to declare a full recovery. The UK still faces major challenges in exports, industrial production, and consumer confidence.

What needs to happen next?

- Encouraging business investment and manufacturing revival.

- Strengthening trade relationships post-Brexit.

- Boosting consumer spending confidence.

Unless these issues are addressed, the risk of economic stagnation—or even recession—remains on the horizon. Stay tuned as we watch how the UK economy navigates 2025.

Share

Hot topics

The best indicator for short term trading

When it comes to short-term trading, everything happens quickly. Movement can take place over a matter of minutes; momentum can build and fade quickly; and traders often have to make...

Read more

Submit comment

Your email address will not be published. Required fields are marked *