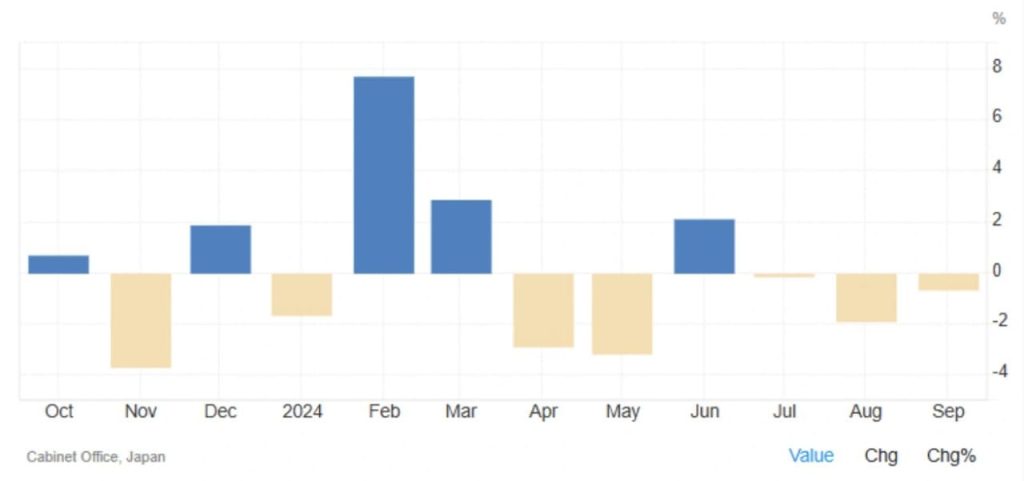

Japan’s Machinery Orders Decline for Third Consecutive Month

Japan’s core machinery orders saw a continued decline in September 2024, signaling potential weaknesses in the country’s industrial sector. The orders, which exclude those for ships and electric power companies, dropped by 0.7% month-on-month to 852 billion yen, marking the third consecutive month of negative growth. This figure also fell short of analysts’ expectations, who had forecasted a 1.9% increase during the period. The consistent decline in machinery orders raises concerns about Japan’s economic outlook and the challenges faced by its manufacturing and industrial sectors.

Sector-Specific Trends: Manufacturing vs Non-Manufacturing Orders

A closer look at the data reveals varying performance between Japan’s manufacturing and non-manufacturing sectors. Orders for the manufacturing sector, which is often seen as a key barometer of economic health, decreased slightly to 388.3 billion yen in September. This slight contraction reflects the struggles within industries reliant on production and factory output, such as automobiles and industrial equipment, as they face both domestic and international demand pressures.

In contrast, orders from the non-manufacturing sector showed more positive movement, rising by 1.5% to 453.7 billion yen. The increase in non-manufacturing orders highlights resilience in industries that support services, infrastructure, and construction, which seem to be maintaining a steady demand despite broader economic challenges. This divergence between the two sectors suggests a mixed economic environment, with the manufacturing side underperforming while the non-manufacturing side remains more stable.

Industries Struggling the Most

Certain industries were hit particularly hard by the downturn in machinery orders, with sharp declines seen across multiple sectors. The pulp, paper, and paper products industry reported the steepest fall, with orders plummeting by a staggering 32.8%. This sharp drop can be attributed to global supply chain disruptions and lower demand in the paper product sector, which has faced increasing challenges in recent years due to digital transformation and changing consumer behaviors.

The information services sector also saw a significant decline of 25.7%, reflecting the difficulties faced by tech and communication service providers in Japan, which may be dealing with both domestic regulatory issues and broader global market slowdowns. Other industries that saw notable decreases include the chemical products sector (-18%), food and beverages (-15.5%), and electrical machinery (-15.4%). These declines suggest that the overall industrial sector is grappling with multiple headwinds, including rising production costs, shifting market demand, and slower-than-expected recovery from pandemic-related disruptions.

Year-on-Year Decline: Private-Sector Machinery Orders Struggling

Looking at the year-on-year figures, Japan’s machinery orders are showing signs of deepening contraction. Private-sector machinery orders fell by 4.8% in September compared to the same month last year. This marks a sharp acceleration from the 3.4% decline seen in August, and the figure missed expectations, which had forecasted a 2.2% rise. The continued negative growth in machinery orders is concerning, as these orders are often a leading indicator of future economic performance, especially in sectors related to industrial production and investment.

The ongoing decline in machinery orders suggests that Japan’s industrial sector is facing more prolonged difficulties, which may spill over into broader economic activity. With the global economy still in flux and supply chains remaining unstable, Japan’s manufacturing sector may continue to struggle in the coming months. While some industries are managing to weather the storm, the overall picture remains challenging, and the Japanese economy may need further stimulus measures or strategic shifts to overcome these hurdles.

The weak performance in September is an indication that Japan’s recovery may not be as robust as hoped, with machinery orders continuing their negative trend and signaling potential stagnation in the manufacturing sector. The country’s industrial base will need to find new sources of growth and innovation to regain momentum in the face of global economic uncertainties.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *