Canada’s Industrial Producer Prices Experience Strong Rebound in October 2024

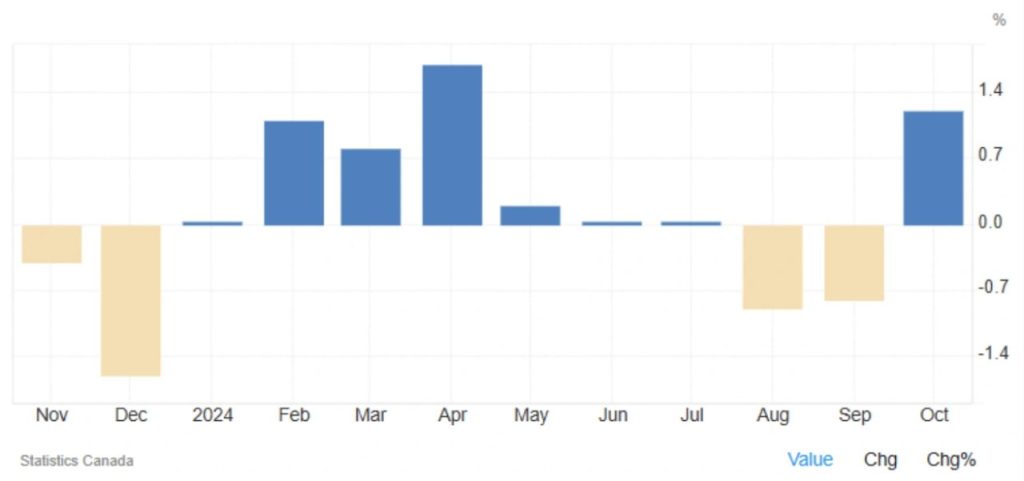

Canada’s industrial producer prices surged by 1.2% month-over-month in October 2024, marking a significant recovery following two consecutive months of declines. The increase exceeded analysts’ expectations, which had forecasted a more modest 0.3% rise. This strong rebound comes after a revised 0.8% drop in September, and it signals a return to growth for Canada’s industrial sector after a period of stagnation. Notably, this marks the first rise in producer prices since August, with the 1.2% increase being the largest monthly jump since April of the same year.

Key Contributors to the October Price Increase

The October price growth was driven by a substantial 5.5% surge in primary non-ferrous metal products, which played a pivotal role in boosting the overall index. These metals, which include key industrial materials like copper, aluminum, and zinc, have seen increased demand, contributing to rising prices in the sector. Additionally, the energy sector saw a notable increase, with prices for petroleum and related products rising by 2.5%. This reflects fluctuations in global energy prices, which have been volatile in recent months.

Alongside energy, the wood products industry also contributed to the overall price hike, with lumber and other wood products seeing a 1.3% increase. This uptick in wood prices follows the global recovery in housing and construction markets, which rely heavily on these materials. Even the motorized and recreational vehicle sector saw a smaller but still positive increase of 0.3%, suggesting that consumer demand in these areas remains steady. The broad-based nature of these price increases suggests that the recovery is not limited to one or two sectors, but rather reflects a more general uptick in industrial activity.

A Strong Rebound After Two Months of Decline

This 1.2% increase in October is significant not just for its size, but for its timing. It comes after two consecutive months of declines in producer prices—down 0.8% in September and 0.2% in August—indicating that the industrial sector had been facing some headwinds. The October rebound is the strongest monthly growth since April, when prices also saw a notable rise. This suggests that industrial prices may have reached a bottom in late summer and are now beginning to recover, driven by renewed demand in key sectors such as metals, energy, and construction materials.

Such a strong monthly performance also points to the potential for a more stable economic environment heading into the final quarter of 2024. With supply chain disruptions easing and production levels beginning to stabilize, industries could see continued upward price pressure in the months ahead. If this trend continues, it may signal that Canadian industries are entering a phase of more consistent growth after a volatile period.

Annual Trends and Broader Economic Outlook

On an annual basis, Canada’s industrial producer prices rose by 1.1% in October 2024, reversing a 1% decline in the previous month. The year-over-year increase highlights that despite the challenges faced earlier in the year, the industrial sector is gradually recovering. Although the October figure is modest, it suggests that inflationary pressures are stabilizing, and price growth is becoming more sustainable. This annual increase indicates that, while inflation is still a factor, the sharp price hikes experienced earlier in 2023 have started to moderate.

Looking ahead, the continued growth in industrial prices may offer insights into broader economic recovery trends in Canada. Sectors like metals, energy, and construction, which have seen significant price movements, are crucial to the nation’s economic performance. If these industries continue to see positive growth, it could bode well for Canada’s economic stability as it navigates the rest of 2024 and beyond. However, much will depend on external factors such as global commodity prices and the pace of demand recovery in key markets.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *