BlackRock Bitcoin ETF Options Shatter Records $1.9 Billion

Estimated reading time: 5 minutes

Table of contents

The cryptocurrency and financial markets witnessed a groundbreaking event as options contracts tied to BlackRock’s spot Bitcoin exchange-traded fund (ETF), the iShares Bitcoin Trust ETF (IBIT), recorded an unprecedented $1.9 billion in trading volume on their first day. This remarkable debut highlights a new era for Bitcoin adoption among institutional investors and offers a glimpse into the expanding role of Bitcoin in the global financial ecosystem.

A Historic Launch of BlackRock Bitcoin ETF

The launch of IBIT options set a new standard for Bitcoin-related ETFs, with a staggering 354,000 contracts traded on its debut day. These trades accounted for nearly $1.9 billion in notional exposure, a figure described by Bloomberg’s senior ETF analyst, Eric Balchunas, as “unheard of for day one.”

This record-breaking performance dwarfs the debut of the ProShares Bitcoin Strategy ETF (BITO), the first U.S.-based ETF providing Bitcoin exposure, which managed $363 million in trading volume on its first day. The stark contrast demonstrates the growing appetite for spot-based Bitcoin ETFs, which are viewed as a more direct and transparent way to gain exposure to the cryptocurrency.

Bitcoin Soars to New All-Time High

Coinciding with the IBIT options’ launch, Bitcoin’s price surged to an all-time high of $94,105 on Coinbase. This milestone reflects the profound impact that robust institutional trading activity can have on the broader cryptocurrency market. Bloomberg ETF analyst James Seyffart remarked, “These options were almost certainly part of the move to the new Bitcoin all-time highs today.”

How IBIT Options Reshape the Market

Options contracts give investors the right, but not the obligation, to buy or sell shares of the ETF at predetermined prices. These financial instruments allow traders to speculate on price movements or hedge their positions, offering flexibility in managing risk and leveraging potential returns.

For IBIT, the notional exposure — the total market exposure controlled by the options — highlights their significance. Unlike futures-based ETFs, which often suffer from inefficiencies like rolling costs, spot-based ETFs and their options provide a more accurate reflection of Bitcoin’s price movements.

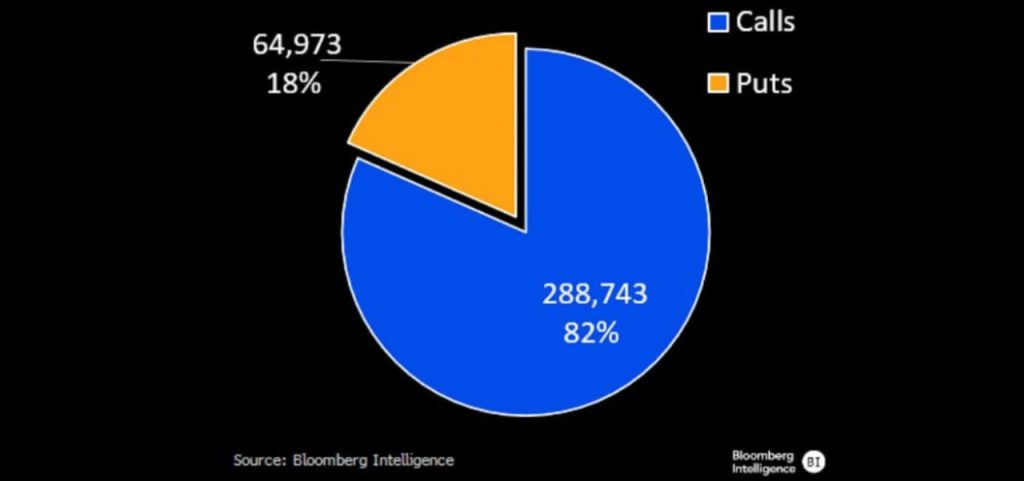

Bullish Sentiment Dominates

The trading activity on IBIT’s first day revealed a clear bullish outlook among investors. The put/call ratio a metric comparing bearish put options to bullish call options — stood at 0.225, indicating that most traders were betting on Bitcoin’s price rising rather than falling.

Balchunas noted that many contracts set to expire in a month show traders are speculating that Bitcoin’s price could double within that timeframe. This optimism reflects growing confidence in Bitcoin’s future, buoyed by institutional activity and broader market acceptance.

The Mechanics Behind Bitcoin’s Price Surge

Ran Neuner, former CNBC Africa host, explained the chain reaction triggered by IBIT options trading:

“As traders buy these options, market makers buy the spot ETF to hedge the trade. The result is huge net buying of the ETF that causes huge net buying in spot BTC.”

This process, known as delta hedging, creates upward pressure on Bitcoin’s price as market makers purchase spot Bitcoin to balance their positions, amplifying the bullish momentum.

The Broader Implications

The launch of IBIT options marks a significant step forward in integrating Bitcoin into traditional financial markets. Industry executive Joe Consorti emphasized the transformative potential of these contracts, stating that their introduction “opens the doors to the largest and deepest liquidity pools on the planet.”

The increased liquidity and participation from institutional investors contribute to market stability and encourage the development of more sophisticated financial products around Bitcoin.

Institutional Interest and a Bullish Year-End

Bitcoin’s record-breaking rally, coupled with the strong performance of IBIT options, suggests that institutional interest in cryptocurrency is reaching new heights. Many market participants are optimistic about Bitcoin crossing the $100,000 threshold by year-end, bolstered by growing demand and favorable market conditions.

Grayscale Enters the Arena

The competitive landscape is heating up as Grayscale prepares to launch options for its spot Bitcoin ETFs on Nov. 20. This move will likely expand the market further, offering more choices for investors and intensifying the race among major asset managers like BlackRock and Grayscale to dominate the Bitcoin ETF space.

Bitcoin’s Role in the Future of Finance

The overwhelming success of IBIT options highlights Bitcoin’s transformation from a niche digital asset to a cornerstone of modern finance. The introduction of options for spot Bitcoin ETFs not only enhances accessibility but also legitimizes Bitcoin as an asset class for institutional and retail investors alike.

The Road Ahead for Bitcoin

As Bitcoin continues to integrate into mainstream financial systems, its price trajectory is becoming increasingly influenced by institutional activity. With expectations of surpassing $100,000 and further advancements in Bitcoin financial products, the cryptocurrency is poised to play a pivotal role in shaping the future of investment strategies.

Conclusion

The launch of IBIT options marks a watershed moment in Bitcoin’s evolution, setting new records and redefining market dynamics. The nearly $2 billion in first-day trading volume underscores the immense demand for Bitcoin exposure among institutional investors, while the accompanying price surge signals the asset’s growing influence.

As competition heats up with players like Grayscale entering the market, and with Bitcoin poised to reach new heights, one thing is clear: the era of Bitcoin as a mainstream financial instrument has truly begun. The world will be watching closely as the cryptocurrency charts its next course, and the question remains—how high can it go?

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *