What Does Lower Bitcoin-Ether Correlation Mean for Investments?

Estimated reading time: 4 minutes

Table of contents

Bitcoin (BTC) and Ether (ETH), the leading cryptocurrencies by market capitalization, have long exhibited a strong price correlation, guiding investor expectations and strategies. However, this relationship is evolving, particularly following Ethereum’s Shanghai Upgrade (Shapella hard fork) in April 2023. This shift is significant for understanding the dynamics of cryptocurrency markets, as it impacts portfolio management, investment strategies, and risk diversification. Below, we explore the causes behind this divergence, its implications for investors, and the broader market trends linking Bitcoin to traditional equities.

Understanding the Bitcoin-Ether Correlation

Bitcoin and Ether have historically moved in tandem, reflecting the interconnection of the cryptocurrency market. Their prices would typically rise or fall together during market-wide events, creating a strong correlation that investors relied upon for predictive analysis and portfolio structuring. During bull runs, both assets often surged, and during downturns, they typically declined in unison, emphasizing their synchronized market behavior.

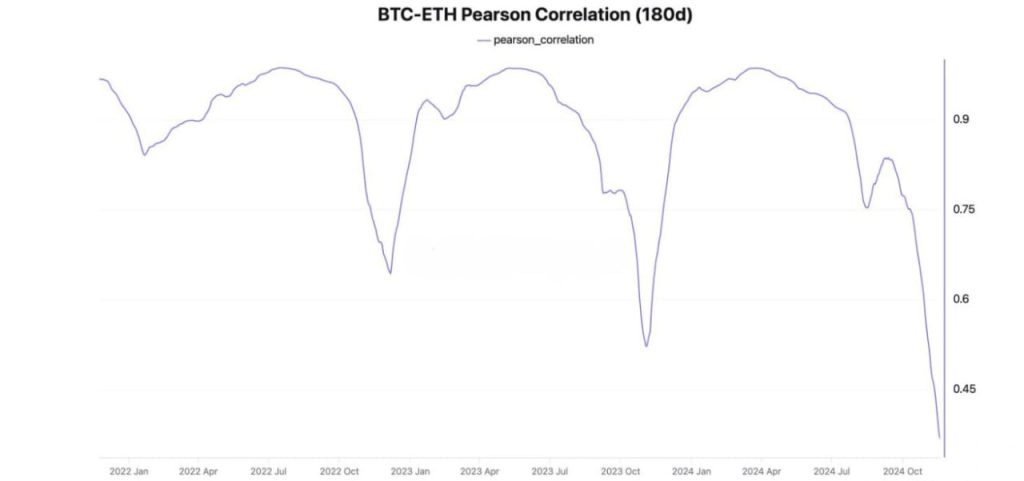

However, a Coinbase report highlights that this correlation began to decline in early 2023, with a sharper divergence occurring after Ethereum’s Shanghai Upgrade on April 12. The upgrade introduced the long-awaited ability for users to withdraw staked Ether, marking a significant milestone in Ethereum’s transition to a proof-of-stake (PoS) network. The 40-day rolling correlation between BTC and ETH dropped from 0.95—indicating near-perfect correlation—to 0.82. This shift represents one of the most notable decoupling events since Ethereum’s Merge in 2022. Factors contributing to this trend include Ethereum’s increased adoption for decentralized applications (DApps), its dominance in the non-fungible token (NFT) market, and its departure from Bitcoin’s proof-of-work (PoW) mechanism.

Implications for Investment Strategies

The declining correlation between Bitcoin and Ether introduces new opportunities for portfolio diversification. Historically, the strong correlation between these assets limited their ability to provide diversification benefits. Now, as their price movements diverge, holding both assets in a portfolio could reduce overall volatility and enhance returns. For example, when one asset experiences a downturn, the other may remain stable or even appreciate, creating a stabilizing effect. This dynamic could make a dual BTC-ETH investment strategy more attractive to investors seeking to optimize their risk-adjusted returns.

For institutional investors, the implications are particularly significant. Cross-hedging strategies—where one cryptocurrency is used to offset the risks of another—may need recalibration. Similarly, quantitative models that rely on historical correlations to predict price movements must be updated to account for the evolving relationship between these two assets. Coinbase analysts emphasize that while these changes create challenges, they also present opportunities for institutions to explore Ethereum-based assets as distinct investment avenues.

It is also crucial to recognize that correlation is not a static measure. Market conditions, technological advancements, and adoption trends could influence the BTC-ETH relationship in the future. Investors should remain vigilant and adjust their strategies as the cryptocurrency ecosystem evolves.

Bitcoin’s Strong Correlation with Nasdaq

While Bitcoin and Ether are decoupling, Bitcoin’s correlation with traditional equity markets remains robust. Recent data from CoinDesk reveals a strong link between Bitcoin and the Nasdaq 100-to-S&P 500 ratio, a measure of the relative performance of growth versus value stocks. Bitcoin’s 90-day correlation coefficient with this ratio reached a record high of 0.79 in March 2021, compared to -0.06 in September 2020. This growing alignment suggests that Bitcoin is increasingly influenced by the performance of growth-oriented technology stocks.

This trend has significant implications for Bitcoin’s perceived role in investment portfolios. While it is often touted as a hedge against inflation or a safe haven during economic uncertainty, its behavior increasingly mirrors that of a high-risk tech stock. The Nasdaq 100 index, heavily weighted toward technology and growth companies, reflects investor sentiment toward innovation and future earnings potential. Bitcoin’s correlation with these assets suggests that its price is closely tied to macroeconomic factors, such as interest rate changes, inflation, and shifts in market sentiment.

Key Takeaways

The divergence between Bitcoin and Ether marks a pivotal moment in the cryptocurrency market. For investors, this weakening correlation creates opportunities to enhance portfolio diversification and reduce volatility. Holding both BTC and ETH can now offer greater benefits compared to the past, as their price movements are less synchronized. Institutional investors, however, may need to reassess traditional hedging models and quantitative strategies in light of these changes.

At the same time, Bitcoin’s continued alignment with the Nasdaq 100 underscores its sensitivity to macroeconomic trends, raising questions about its role as a hedge against traditional markets. As the cryptocurrency market matures, these shifting dynamics highlight the importance of adapting investment strategies to evolving correlations and market conditions. Investors must remain informed and agile to capitalize on these changes while effectively managing risk.

Share

Hot topics

What Is GDP? A Complete Guide to Gross Domestic Product

GDP or Gross Domestic Product is one of the most powerful indicators used in global economics. It plays a central role in the decision-making processes of investors, central banks, governments,...

Read more

Submit comment

Your email address will not be published. Required fields are marked *