Bank of Canada Holds Interest Rate at 2.75% in July 2025 Amid Tariff Uncertainty

📌 Key Highlights

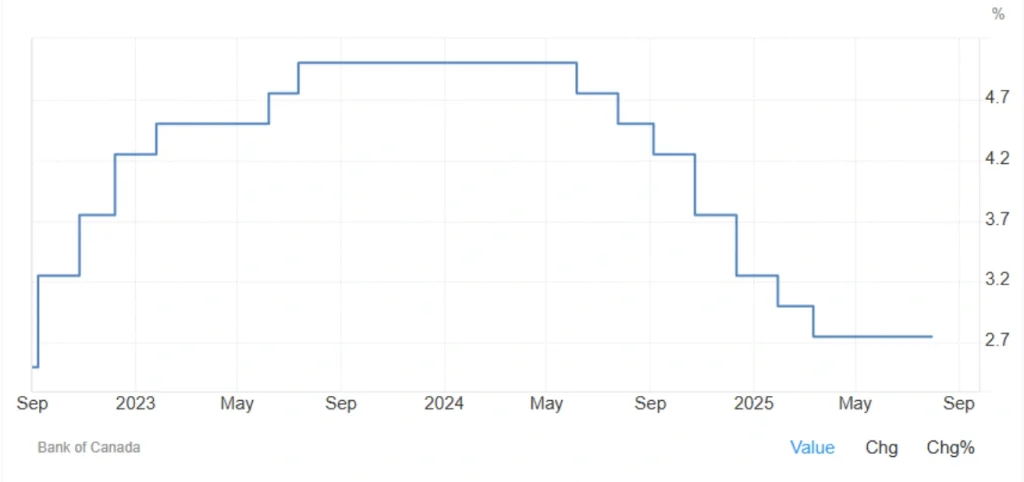

- Interest rate held steady at 2.75% in July 2025 according to the Bank of Canada interest rate report for July.

- This marks the third consecutive hold after 225 basis points in rate cuts

- Tariff unpredictability cited as a key obstacle to economic forecasting

- GDP expected to contract in Q2, following front-loaded exports in Q1

- CPI inflation seen near the 2% target over the medium term

Bank of Canada Keeps Interest Rate Unchanged

The Bank of Canada (BoC) left its benchmark interest rate unchanged at 2.75% during its July 2025 meeting, in line with market expectations. This marks the third straight pause following seven consecutive cuts totaling 2.25 percentage points earlier in the easing cycle.

🌐 Tariff Volatility Clouds Outlook

In its statement, the Governing Council pointed to U.S. sectoral and baseline tariffs as key drivers of uncertainty. The magnitude and unpredictability of these tariffs, the Bank said, made it impossible to provide clear forward guidance on future economic trends or the BoC’s policy reaction.

These trade frictions have created volatility in global supply chains and demand forecasts, particularly affecting Canadian exporters.

📉 Growth Outlook: Q2 Contraction Expected

While the broader economy has shown resilience with steady employment and positive H2 growth expectations—the BoC anticipates a GDP contraction in Q2 2025. This follows a surge in exports earlier in the year, as companies front-loaded shipments in anticipation of tariff hikes.

Read More: Canada’s Inflation Slows in April 2025

📊 Inflation Remains Anchored

On the price front, the BoC projects Consumer Price Index (CPI) inflation to hover around the 2% target over the medium term, consistent with its mandate. This gives the central bank flexibility to maintain current rates while monitoring risks.

Policy Commentary

“With tariff impacts still unfolding and inflation anchored, the BoC has little reason to move rates in either direction for now,” said a senior economist at RBC Capital Markets.

📅 What’s Next?

Markets will watch closely for the Q2 GDP release and updates on tariff negotiations, which could influence future BoC moves. As of now, economists expect the BoC to remain on hold unless trade conditions change dramatically.

📌 Summary Table – BoC Policy Snapshot

| Date | Rate Decision | Benchmark Rate | Key Reason Cited |

|---|---|---|---|

| July 2025 | Hold | 2.75% | Tariff uncertainty |

| June 2025 | Hold | 2.75% | Watching inflation trends |

| May 2025 | Hold | 2.75% | Assessing earlier cuts |

How do you see Canada’s economy evolving amid global trade tensions?

Will the BoC resume cuts later this year?

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *