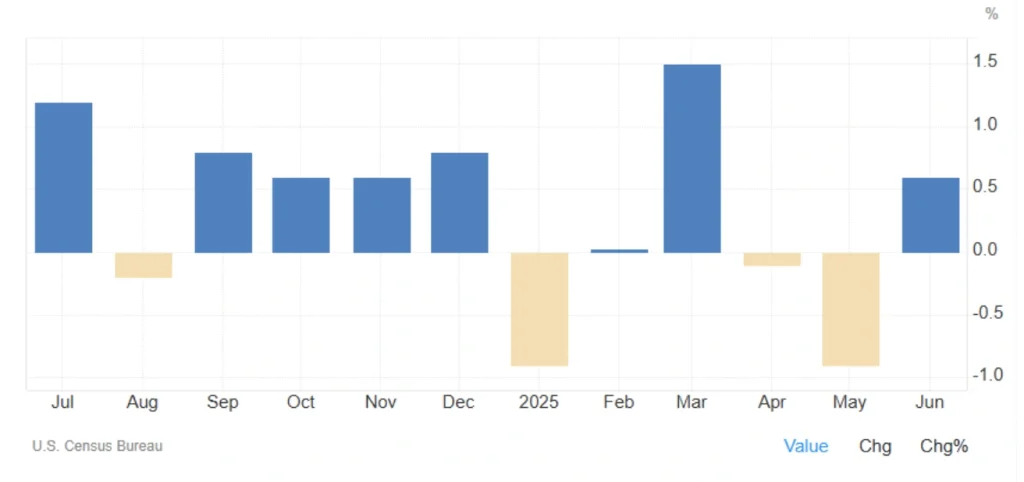

U.S. Retail Sales Jump 0.6% in June, Beating Expectations

🔍 Key Takeaways

- U.S. retail sales rose 0.6% MoM in June 2025, beating the 0.1% forecast

- Strongest gains came from miscellaneous retailers, auto sales, and clothing

- Core retail sales, used for GDP, rose 0.5%, exceeding estimates

- Sales fell slightly at furniture and electronics stores

📈 Consumer Spending Rebounds in June

U.S. retail sales rebounded sharply in June 2025, rising 0.6% month-over-month, after two months of declines. The reading beat economists’ forecast of a modest 0.1% increase, signaling that consumer demand remains resilient despite inflation and interest rate headwinds.

This strong rebound could ease recession fears and influence how the Federal Reserve views its rate policy going into the second half of the year.

Where Did Americans Spend?

The biggest monthly increases came from:

| Category | Monthly Change |

|---|---|

| Miscellaneous store retailers | +1.8% |

| Motor vehicles and parts dealers | +1.2% |

| Building materials and garden supplies | +0.9% |

| Clothing and accessories | +0.9% |

| Food services & drinking places | +0.6% |

| Food & beverage stores | +0.5% |

| Health and personal care stores | +0.5% |

| General merchandise | +0.5% |

| Nonstore (online) retailers | +0.4% |

| Sporting goods, books, and hobby stores | +0.2% |

Weak Spots in Retail

While overall sales were strong, some sectors lagged:

- Gasoline stations: Flat (0.0%)

- Furniture and home furnishing stores: -0.1%

- Electronics and appliance stores: -0.1%

These declines may reflect ongoing cautious consumer behavior in big-ticket discretionary items.

GDP-Related Core Sales Also Surprised

Sales excluding autos, food services, building materials, and gas, the category used to calculate core retail sales in GDP—rose 0.5%, also above the 0.3% expectation.

This follows a downwardly revised 0.2% increase in May, suggesting underlying consumer demand remains firm.

📊 Implications for the Fed

The strong June data, paired with firm inflation figures earlier this month, could complicate the Federal Reserve’s path forward on interest rates.

With the central bank scheduled to meet July 29–30, policymakers will weigh inflation resilience against robust consumer activity—possibly pushing back rate cut expectations.

💬 What’s Your Take?

Do these retail numbers show a confident U.S. consumer—or are higher prices simply inflating the data?

➡️ Drop a comment, share your thoughts, or subscribe for more U.S. economy updates!

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *