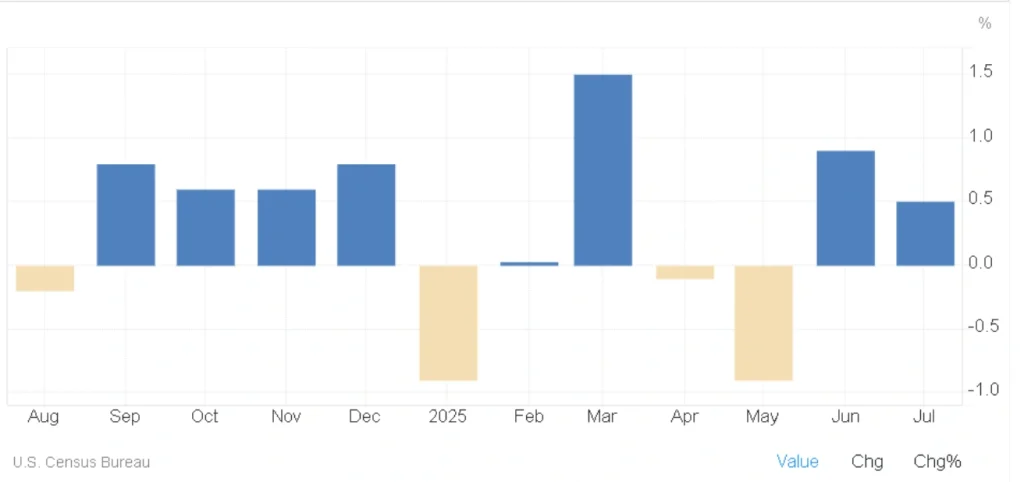

U.S. Retail Sales Rise 0.5% in July 2025: Key Drivers and Market Implications

Key Takeaways

- U.S. retail sales rose 0.5% month-over-month in July 2025, meeting expectations.

- Motor vehicle & parts dealers led growth with a 1.6% increase.

- Furniture & home furnishing stores saw a 1.4% boost.

- Declines were noted in electronics (-0.6%) and building materials (-1%).

- Core retail sales, excluding food, auto, gas, and building materials, rose 0.5%, slightly above forecasts.

📊 U.S. Retail Sales Data — July 2025

| Sector | Monthly Change (%) |

|---|---|

| Motor vehicle & parts dealers | 1.6 |

| Furniture & home furnishing stores | 1.4 |

| Sporting goods, hobby, musical instruments | 0.8 |

| Nonstore retailers | 0.8 |

| Clothing & clothing accessories stores | 0.7 |

| Gasoline stations | 0.7 |

| Miscellaneous store retailers | -1.7 |

| Building materials & garden equipment | -1.0 |

| Electronics & appliance stores | -0.6 |

| Core Retail Sales (excl. auto, gas, food) | 0.5 |

What’s Driving the Gains?

July 2025 retail sales were supported primarily by strong auto and furniture demand:

- Motor vehicle & parts dealers: Robust consumer spending on cars and trucks contributed the largest single-sector gain.

- Furniture & home furnishing stores: Home improvement trends continued to drive sales, with consumers upgrading living spaces.

- Specialty retail & nonstore sales: Online shopping and niche markets, including sporting goods and hobby items, also contributed modest gains.

Meanwhile, electronic appliances and building material sectors fell, reflecting slower demand and potential supply-chain constraints.

Read More: US Producer Prices Surge 0.9% in July, Marking Biggest Monthly Gain Since 2022

Core Retail Sales” A Signal for GDP

Economists often monitor core retail sales, which exclude volatile sectors like food services, auto dealers, gasoline stations, and building materials.

- July 2025 core sales increased 0.5%, slightly above forecasts of 0.4%.

- This is a positive signal for consumer-driven GDP growth, suggesting household spending remains resilient despite broader economic uncertainties.

Market Implications

- 💹 Equities: Retail-related stocks may gain momentum, particularly in auto and furniture sectors.

- 💰 Inflation & policy: Moderate retail growth supports stable inflation readings, potentially reducing pressure for aggressive Fed action.

- 🛒 Consumer confidence: Continued spending shows households are maintaining confidence, especially in durable goods.

Conclusion

U.S. retail sales in July 2025 met expectations, with strength in autos, furniture, and specialty retail offsetting declines in other sectors. Core retail sales growth above forecasts indicates resilient consumer spending, supporting GDP growth projections.

💬 How are you adjusting your investment or spending strategies based on July’s retail trends? Share your thoughts below!

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *