US Producer Prices Surge 0.9% in July, Marking Biggest Monthly Gain Since 2022

✅ Key Takeaways

- US producer prices posted their strongest monthly gain since June 2022.

- Both headline and core readings far exceeded expectations, pointing to persistent inflation pressures.

- Services saw broad-based increases, particularly in machinery wholesaling and financial services.

- Goods inflation was driven by sharp rises in food and fuel categories, despite lower gasoline prices.

- The data could complicate the Federal Reserve’s path toward interest rate cuts.

US Producer Prices Surge 0.9% in July

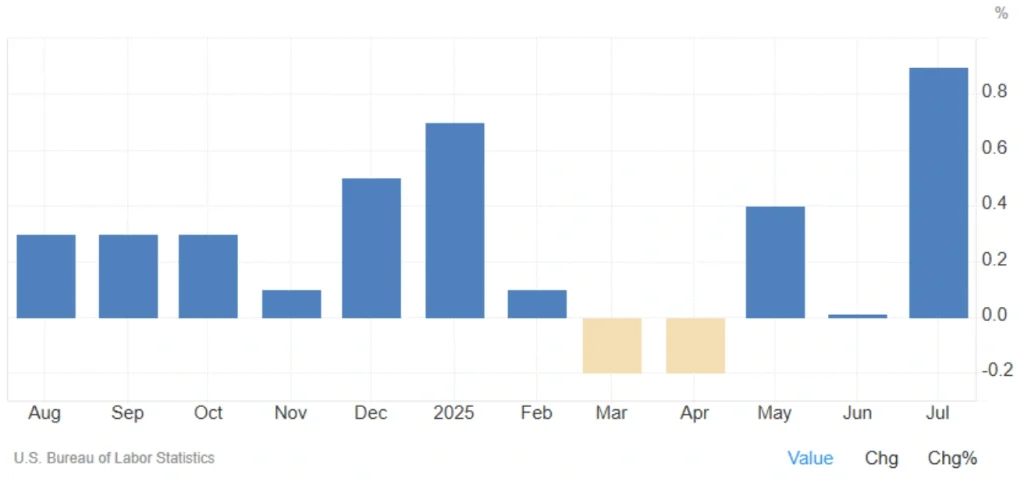

US producer prices rose sharply in July, posting their largest monthly gain in over three years and signaling renewed inflationary pressures in the supply chain.

Data from the Bureau of Labor Statistics showed the Producer Price Index (PPI) jumped 0.9% month-on-month, rebounding from a flat reading in June and well above the market expectation of a 0.2% increase. This marks the biggest monthly increase since June 2022.

On an annual basis, headline PPI accelerated to 3.3%, the highest in five months and above forecasts of 2.5%. Core PPI, which excludes food and energy, rose 0.9% on the month and 3.7% year-on-year—both substantially higher than estimates.

Read More: US Stock Rally Extends as CPI Data and Tariff Pause Boost Market Optimism

💹 Services Lead the Surge

The cost of services increased 1.1% in July, driven by:

- A 3.8% jump in margins for machinery and equipment wholesaling.

- Higher costs for portfolio management, securities brokerage, and investment advice.

- Rising prices in traveler accommodation services, automobile retailing, and truck freight transportation.

Goods Prices Also Climb

Prices for goods rose 0.7%, led by:

- A massive 38.9% surge in fresh and dry vegetables.

- Higher costs for meats, diesel fuel, jet fuel, nonferrous scrap, and eggs.

Gasoline prices were a rare drag, falling 1.8% during the month.

📊 PPI Data Snapshot

| Indicator | July 2025 | Forecast | Previous |

|---|---|---|---|

| Headline PPI (MoM) | +0.9% | +0.2% | 0.0% |

| Headline PPI (YoY) | +3.3% | +2.5% | +2.4% |

| Core PPI (MoM) | +0.9% | +0.2% | +0.3% |

| Core PPI (YoY) | +3.7% | +2.9% | +2.6% |

💬 Final Word

July’s PPI report shows inflationary pressures resurfacing across both services and goods, challenging expectations for a smooth disinflation path. The stronger-than-expected US producer prices may prompt the Fed to reassess its September policy stance.

Do you think the Fed will still cut rates next month? Share your thoughts below and follow our latest inflation coverage.

Share

Hot topics

what is Pip in Forex?

When you look at currency prices fluctuating on a trading platform, you have likely noticed one interesting thing: while the amounts may change only by a small percentage, traders seem...

Read more

Submit comment

Your email address will not be published. Required fields are marked *