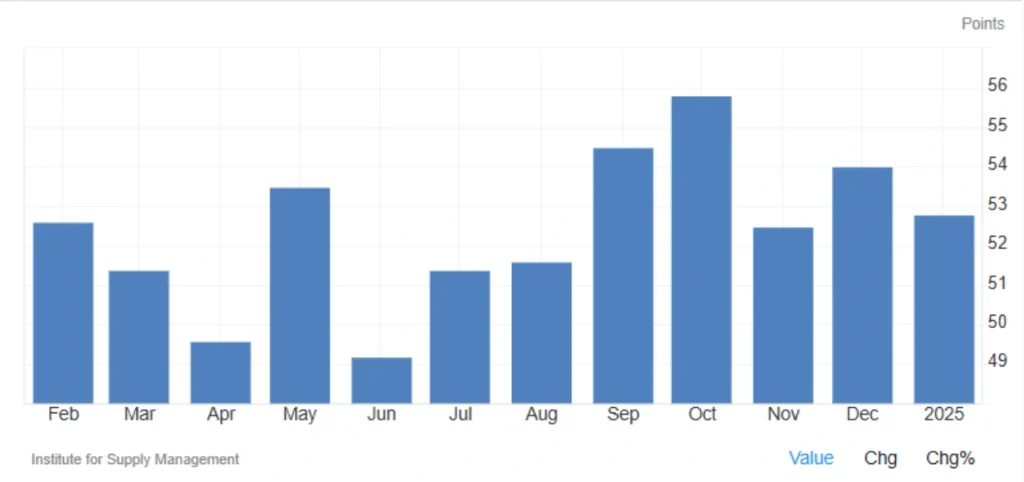

US Services PMI Index Declines in January 2025

The US Services Purchasing Managers’ Index (PMI), released by the Institute for Supply Management (ISM), fell to 52.8 in January 2025, down from 54.0 in December and below the forecast of 54.3. This decline signals a slower growth rate in the US services sector, which is a key driver of the overall economy.

Key Takeaways from the US Services PMI Report

The latest PMI report highlights several important shifts in business activity:

Business Activity Slows

- The Business Activity Index dropped from 58.0 in December to 54.5, reflecting reduced output and demand.

New Orders Decline

- New Orders Index fell from 54.4 to 51.3, signaling weaker demand for services.

Inventory Contraction Continues

- The Inventories Index remained in contraction territory for the third straight month, falling to 47.5 from 49.4 in December.

Employment Sees Modest Growth

- The Employment Index rose from 51.3 to 52.3, suggesting businesses are still hiring, albeit at a slower pace.

Export Orders Improve

- The Export Orders Index climbed from 50.1 to 52.0, showing stronger demand from international markets.

Price Pressures Ease

- The Prices Paid Index declined from 64.4 to 60.4, indicating reduced inflationary pressures within the services sector.

Read More: US CPI Surges 0.4% in December 2024

Expert Insights: What’s Driving the Slowdown?

According to Steve Miller, Chair of ISM’s Business Survey Committee:

- Weather Disruptions: Harsh winter conditions affected business activity and demand.

- Trade Policy Concerns: Many businesses are cautious about potential changes in US trade policies, including tariffs, but the direct impact remains limited for now.

What This Means for US Economic Growth

Despite the decline, the Services PMI remains above 50, meaning the sector is still expanding, just at a slower rate. Here’s what this could mean for the broader economy:

- Stronger export orders and employment growth could help offset some economic pressure.

- Lower price pressures suggest inflation is easing, which might influence the Federal Reserve’s interest rate decisions in the coming months.

- Weaker new orders and slowing business activity raise concerns about future growth momentum.

Understanding the US Services PMI

What is the Services PMI?

The Purchasing Managers’ Index (PMI) for services is an economic indicator that measures business activity across industries like transportation, technology, tourism, and finance. It is based on surveys from purchasing managers in these sectors.

How to Interpret the PMI?

- Above 50 → Economic expansion

- Below 50 → Economic contraction

- Declining but above 50 → Slower growth

Why is the Services PMI Important?

- Indicator of Economic Growth: The services sector accounts for over 70% of the US economy, making PMI a critical economic signal.

- Impact on Federal Reserve Decisions: A weakening PMI could push the Fed to adjust interest rates to support growth.

- Financial Market Influence: Investors use PMI data to anticipate stock market trends and monetary policy shifts.

Final Thoughts: Should Investors Be Concerned?

While the decline to 52.8 suggests moderating growth, the services sector is still expanding. Investors and analysts should closely watch:

- Future employment trends

- New orders movement

- Upcoming trade policies

The coming months will be crucial in determining whether the US economy continues expanding or slows further. Monitoring future PMI reports will provide valuable insights into upcoming economic trends.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *