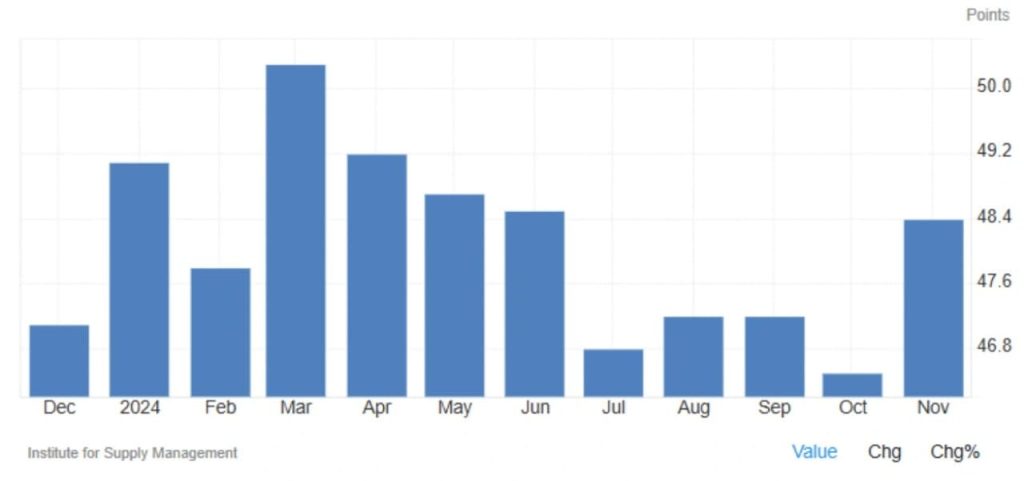

US ISM Manufacturing PMI Shows Softer Contraction in November 2024

The ISM Manufacturing PMI for the United States increased to 48.4 in November 2024, up from 46.5 in October, surpassing forecasts of 47.5. While still indicating a contraction in the manufacturing sector, the slight improvement points to a softer decline compared to previous months. The PMI reading suggests that while the industry continues to face challenges, there are signs of stabilization in several key metrics, indicating that the manufacturing sector may be slowly regaining some strength after a prolonged period of weakness.

Rebound in New Orders and Improvement Across Key Metrics

A significant development in November was the rebound in new orders, which rose to 50.4 from 47.1, marking the first growth in this index after seven months of contraction. This shift suggests that demand, while still weak, may be showing early signs of recovery. Other important components of the PMI also saw improvements. Production increased to 46.8 from 46.2, signaling a slight recovery in manufacturing output, while employment climbed to 48.1 from 44.4. This increase in employment suggests a more stable labor market within the manufacturing sector, although it is still in contraction. Inventories also contracted less, with the index rising to 48.1 from 42.6, suggesting better inventory management and a potential easing of some supply chain issues.

Easing Price Pressures and Faster Supplier Deliveries

Another positive sign from the November report was the easing of price pressures. The prices index dropped to 50.3 from 54.8, indicating that inflationary pressures in the manufacturing sector are slowing down. This decline suggests that while costs are still rising, the rate of increase has moderated, which may offer some relief to manufacturers facing higher production costs. Additionally, the supplier deliveries index improved to 48.7 from 52, pointing to faster deliveries from suppliers. This shift indicates that supply chain disruptions are beginning to ease, as suppliers are able to deliver goods more efficiently. However, it is important to note that some product shortages have reappeared, indicating that while there is improvement, certain areas of the supply chain remain strained.

Outlook and Insights from ISM Survey Chair

Timothy Fiore, Chair of the ISM Manufacturing Business Survey Committee, provided insight into the current state of the manufacturing sector. He noted that demand remains weak as companies prepare for 2025, especially with the election cycle coming to an end. “Production execution eased in November, consistent with demand sluggishness and weak backlogs,” Fiore explained. This suggests that while some aspects of the manufacturing process are improving, the overall demand for goods remains subdued, and manufacturers are struggling with weak order backlogs. On a more positive note, Fiore also mentioned that suppliers have available capacity, with lead times improving, which is a good sign for future supply chain stability. Despite this, some shortages persist, highlighting the uneven recovery across different parts of the sector.

Overall, the November ISM Manufacturing PMI report offers a mixed but cautiously optimistic view of the U.S. manufacturing sector. While the industry continues to face challenges, the data shows signs of improvement in key areas, such as new orders, production, and supplier deliveries. With the ongoing adjustments to supply chain issues and the easing of price pressures, there is hope that the sector may experience a more sustained recovery in the months to come. However, demand remains weak, and companies will need to navigate this uncertainty as they plan for the year ahead.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *