US Initial Jobless Claims Rise to 226,000, Indicating Labor Market Softening

Key Takeaways

- Initial jobless claims rose to 226,000, exceeding expectations of 221,000

- Outstanding claims jumped to 1.974 million, the highest since November 2021

- Data signals a slowdown in US hiring and softening labor market

- Federal employee claims slightly decreased to 708, the highest in four months

- Early June elevated claim levels remain above current readings

US Initial Jobless Claims Signal Labor Market Weakness

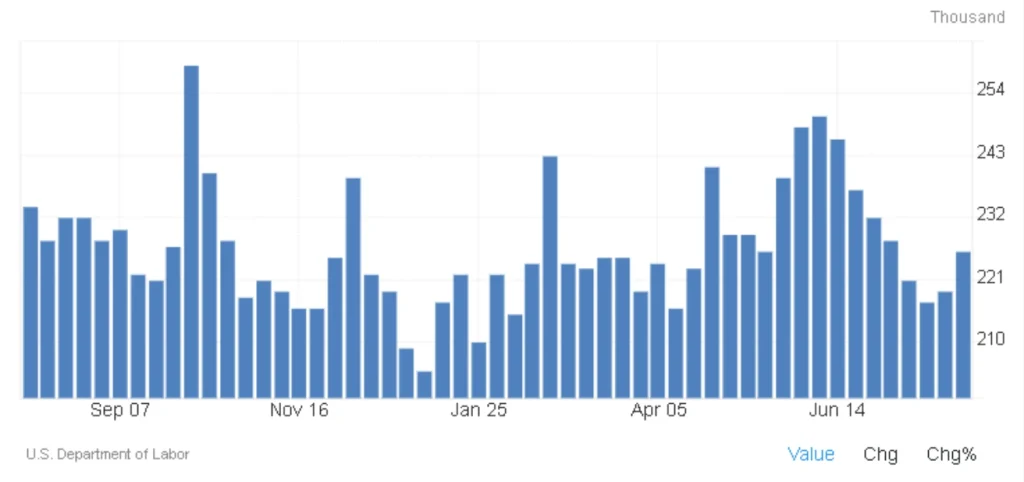

In the final week of July 2025, initial jobless claims in the US increased by 7,000 to 226,000, surpassing market forecasts of 221,000. This rise highlights growing signs of cooling in the US labor market, with hiring slowing after months of strong demand.

Simultaneously, outstanding jobless claims surged by 38,000 to 1.974 million, marking the highest level since November 2021. This sustained elevation in continuing claims indicates that workers remain unemployed longer than in recent months.

Federal Employee Claims and Labor Market Trends

Jobless claims filed by federal government employees fell slightly by 14 to 708, though this remains the highest level recorded in four months. This number has drawn attention due to recent workforce cuts by the Department of Government Efficiency (DOGE).

Despite recent fluctuations, the data consolidates the outlook for a softening labor market and slower hiring pace in the US economy. However, initial claims are still below the notably higher levels observed in early June, suggesting some resilience amid the softening trend.

Read More: US-EU Trade Agreement Boosts Global Stocks and Euro Amid Policy-Heavy Week

Summary Table

| Indicator | Value (Last Week of July 2025) | Previous Week | Market Expectation |

|---|---|---|---|

| Initial Jobless Claims | 226,000 | 219,000 | 221,000 |

| Outstanding Jobless Claims | 1,974,000 | 1,936,000 | 1,950,000 |

| Federal Employee Claims | 708 | 722 | N/A |

What This Means for the Economy

The rise in jobless claims points to a moderation in labor market strength, which could influence Federal Reserve policy decisions around interest rates. Slower hiring might ease wage pressures, potentially affecting inflation and economic growth forecasts.

Share

Hot topics

The best indicator for short term trading

When it comes to short-term trading, everything happens quickly. Movement can take place over a matter of minutes; momentum can build and fade quickly; and traders often have to make...

Read more

Submit comment

Your email address will not be published. Required fields are marked *