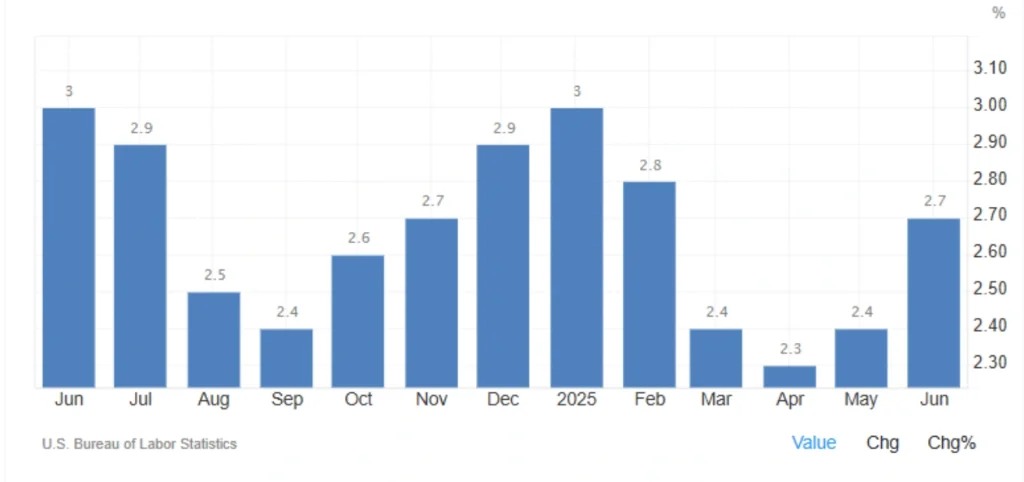

U.S. Inflation Accelerates to 2.7% in June 2025, Highest Since February

The U.S. inflation rate accelerated for the second straight month to 2.7% year-on-year in June 2025, marking a noticeable change when discussing U.S. inflation June 2025, the highest level since February and in line with market expectations. This rise reflects increasing costs in key sectors such as food, transportation services, and used cars.

Key Inflation Highlights: U.S. June 2025 📊

- Annual inflation rose to 2.7%, up from 2.4% in May, highlighting the trends in U.S. inflation for June 2025.

- Food prices increased by 3.0% (May: 2.9%). Key price hikes in food are significant in the context of inflation seen in June 2025 in the U.S.

- Transportation services climbed 3.4%, up from 2.8%, reflecting part of the inflation aspect in U.S. June 2025.

- Used cars and trucks prices jumped 2.8%, compared to 1.8% previously.

- Energy costs fell by 0.8%, a smaller decline than May’s 3.5%, indicating U.S. inflation changes in June 2025.

- Gasoline prices dropped 8.3%, less than May’s 12% fall.

- Natural gas prices remained high, rising 14.2%.

- Shelter inflation eased slightly to 3.8%.

- New vehicle prices increased by only 0.2%.

Monthly Consumer Price Index (CPI) also rose by 0.3% in June, indicating changes attributed to US inflation June 2025, the largest increase in five months and matching analysts’ forecasts.

Read More: What is CPI and How Does It Impact Financial Markets?

Core Inflation Trends

Core inflation, which excludes volatile food and energy prices, climbed to 2.9% year-on-year, a slight rise from 2.8% in May but below the anticipated 3%. Monthly core CPI grew 0.2%, less than the forecasted 0.3%, indicating unexpected shifts related to inflation seen in the U.S. June 2025.

| Inflation Component | June 2025 YoY Change | May 2025 YoY Change |

|---|---|---|

| Overall CPI | 2.7% | 2.4% |

| Food | 3.0% | 2.9% |

| Transportation Services | 3.4% | 2.8% |

| Used Cars and Trucks | 2.8% | 1.8% |

| Energy | -0.8% | -3.5% |

| Gasoline | -8.3% | -12.0% |

| Natural Gas | 14.2% | 15.3% |

| Shelter | 3.8% | 3.9% |

| New Vehicles | 0.2% | 0.4% |

What This Means for Consumers and Markets

The rebound in inflation reflects lingering supply chain issues and elevated demand in key sectors like food and transportation, particularly relevant for addressing U.S. inflation June 2025. Energy prices’ smaller decline and natural gas’s persistent rise contribute to upward inflation pressure. However, the moderation in core monthly inflation suggests underlying price pressures remain relatively contained, despite trends observed in U.S. inflation during June 2025.

💬 How do you expect inflation to impact consumer spending and Fed policy in the coming months, especially considering U.S. inflation data for June 2025? Drop your thoughts below and stay updated with our latest economic news! 🇺🇸📈

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *