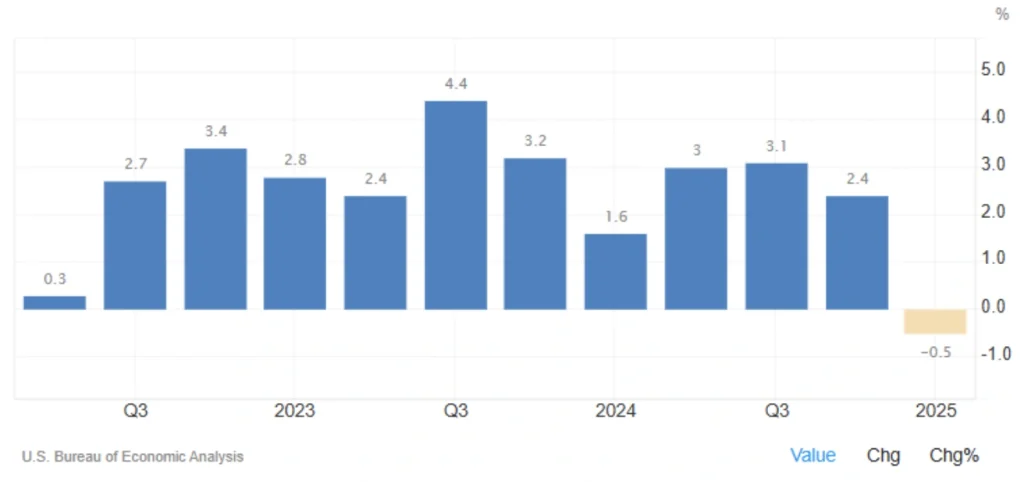

U.S. Economy Contracts 0.5% in Q1 2025

The U.S. economy shrank by 0.5% in the first quarter of 2025, marking the first quarterly contraction since the pandemic-driven collapse in early 2020. This deeper-than-expected decline reflects a broad-based slowdown in domestic demand, trade activity, and government spending — and may pave the way for Federal Reserve rate cuts as early as July. The news that the U.S. economy contracts has sparked concerns among economists.

Key Q1 2025 GDP Figures – Final Estimate

| Component | Final Q1 Data | Previous Estimate | Change vs. Forecast |

|---|---|---|---|

| 📉 Annualized GDP Growth | -0.5% | -0.2% | ❗ Deeper contraction |

| 🛍️ Household Consumption | ⬆️ 0.5% | 1.2% | ⚠️ Weakest since early 2020 |

| 🌐 Exports | ⬆️ 0.4% | 2.4% | ❌ Major slowdown |

| 📦 Imports | ⬆️ 37.9% | 42.6% | 🔻 Slight moderation |

| 🏛️ Federal Government Spending | ⬇️ 4.6% | No change | 📉 Sharpest drop since Q1 2022 |

| 🏗️ Fixed Business Investment | ⬆️ 7.6% | 7.8% | ✅ Still strong |

Educational: How GDP Components Shape Economic Growth

In the U.S., GDP is driven by four core components:

- Consumer Spending (≈70% of GDP)

- Business Investment

- Net Exports (Exports − Imports)

- Government Spending

Changes in any of these can significantly influence the economic trajectory — toward either expansion or recession.

Key Takeaways & Economic Implications

🧍♀️ Household Spending Weakens

- Consumer spending growth fell to just 0.5%, the lowest since COVID-19 lockdowns.

- Suggests soft demand across both services and durable goods.

- May indicate growing caution amid inflation fatigue and policy uncertainty.

Read More: US CPI Growth Slows in May 2025: A Small but Notable Shift

🌍 Trade Shock from Exports & Imports

- Exports plunged to 0.4% growth (from 2.4%), highlighting weak global demand and a strong dollar headwind.

- Imports surged 37.9%, likely due to business stockpiling ahead of new Trump-era tariffs.

⚠️ This short-term boost could lead to a future pullback in manufacturing and inventory overhangs.

🏛️ Federal Spending Cuts Continue

- Federal government expenditure dropped 4.6%, the steepest since Q1 2022.

- Reflects fiscal tightening despite 2025 being an election year.

🏗️ Private Sector Investment Remains Resilient

- Business investment rose 7.6%, slightly below estimate but still strong.

- Signals pockets of optimism among firms expanding capacity, especially in infrastructure and tech.

Final Outlook: A Warning Sign for Fed Policy

The 0.5% contraction in U.S. GDP confirms that the economy is entering a mild growth recession, triggered by:

- Weak consumer demand

- Deteriorating exports

- Policy-driven import distortions

Despite solid investment, overall momentum is faltering. With inflation data easing and growth slipping, the Fed may lean more decisively toward a rate cut in its July meeting.

📌 Bottom line:

Unless Q2 sees a strong rebound, economic softness and policy uncertainty could weigh on financial markets. This makes the upcoming jobs report and June CPI data critical in shaping the monetary path forward.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *