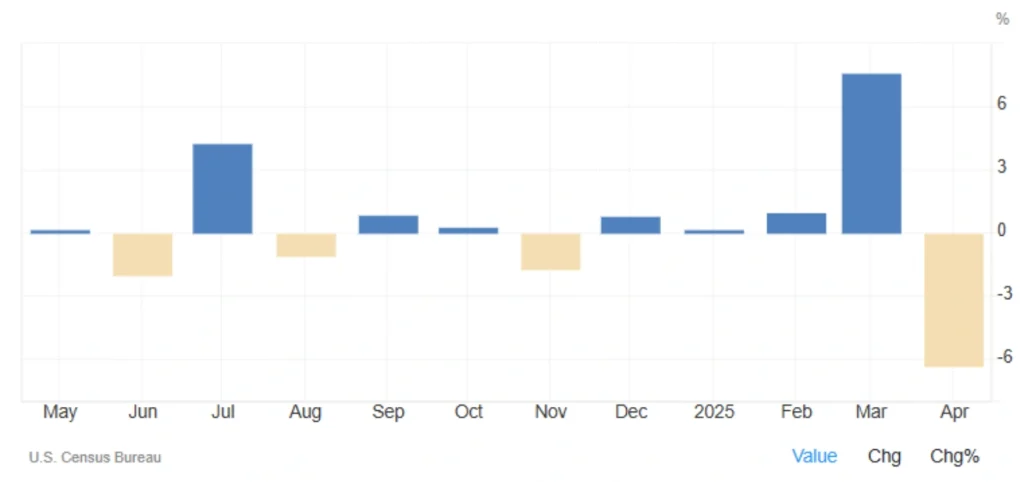

U.S. Factory Orders Plunge 6.3% in April

New orders for manufactured goods fell 6.3% month-over-month in April 2025, dropping to $296.3 billion — marking the steepest monthly decline since January 2024. U.S. Factory Orders reveal underlying trends in economic performance, and understanding U.S. Factory Orders is crucial to grasp the manufacturing landscape.

While slightly better than market expectations of a 7.8% drop, the fall erased much of March’s 7.6% surge. The decline in U.S. Factory Orders was largely attributed to the implementation of new 10% reciprocal tariffs and weakening demand following front-loaded purchases in the previous month. Consequently, understanding U.S. Factory Orders trends becomes essential for manufacturers.

Breakdown of April 2025 For U.S. Factory Orders:

| Sector | Monthly Change | Total (Billion USD) | Remarks |

|---|---|---|---|

| Total Manufacturing Orders | 🔻 -6.3% | $296.3 | Largest monthly drop in 15 months |

| Transportation Equipment | 🔻 -17.1% | $98.8 | Sharp decline in aircraft demand |

| Non-defense Aircraft & Parts | 🔻 -51.5% | $18.1 | Only 8 Boeing orders booked |

| Capital Goods | 🔻 -14.6% | $101.4 | Significant drop in business investment |

Educational Insight: Why Factory Orders Matter

Durable goods orders are a key economic indicator, reflecting business confidence, capital spending, and future consumer demand. U.S. Factory Orders are particularly informative in understanding manufacturing trends, offering insights into the overall health of the manufacturing sector.

🔍 Why this metric is important:

- It serves as a leading indicator of industrial production and GDP.

- Strongly influences employment and capital flows linked to U.S. Factory Orders.

- Sensitive to trade policies, interest rates, and financial conditions.

Read More: BTC/USD: Complete Guide to Bitcoin vs US Dollar Analysis

Economic Impact & Market Implications

April’s sharp drop in orders is mainly due to the start of 10% reciprocal tariffs, which increased costs and discouraged corporate purchases of U.S. Factory Orders.

The over 50% plunge in non-defense aircraft orders — with Boeing logging just 8 new orders — illustrates the heavy toll on the aerospace sector.

Meanwhile, the 14.6% drop in capital goods orders signals a worrying pullback in corporate investment, posing a serious threat to Q2 economic growth. Observing the U.S. Factory Orders offers a comprehensive view of these shifts.

The March surge in orders was partly driven by front-loading — businesses placing orders early to avoid incoming tariffs — leading to an artificially high March and a subsequent correction in April.

Summary: Opportunities & Risks

🔹 Opportunities:

- A potential trade agreement with Europe and Asia could help reverse some of the order losses related to U.S. Factory Orders.

- Weakness in real economic data may prompt the Federal Reserve to adopt a more dovish stance related to U.S. Factory Orders.

🔸 Risks:

- The sharp drop in capital goods may mark the beginning of a broader investment slowdown.

- Aerospace and transportation sectors face significant risks of job cuts and reduced revenues.

- Budget deficits, tariffs, and fiscal uncertainty could further dampen demand for U.S. Factory Orders.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *