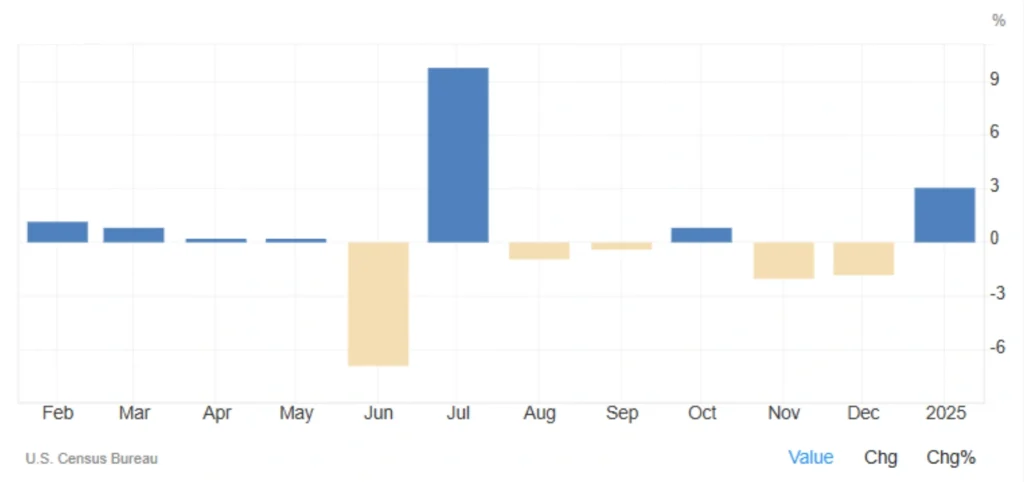

U.S. Durable Goods Orders Rise in January 2025

The latest durable goods orders data for January 2025 shows a 3.1% increase, signaling strong demand and growing business confidence in the U.S. economy. This surge, particularly in transportation equipment and capital goods, highlights increased investment in production and infrastructure. But what does this mean for markets, businesses, and Federal Reserve policy? Let’s break it down.

What Are Durable Goods Orders?

Durable goods orders track purchases of long-lasting products, typically with a lifespan of three years or more. These products are often major investments for businesses or long-term consumer goods.

Key Categories of Durable Goods Orders

- Transportation Equipment – Includes aircraft, motor vehicles, and parts.

- Capital Goods – Covers machinery, electronic equipment, and industrial products.

- Durable Consumer Goods – Consists of household appliances, furniture, and consumer electronics.

This indicator helps economists gauge future manufacturing activity and overall economic momentum.

Why the 3.1% Increase Matters

A rise in durable goods orders often signals economic expansion and growing confidence among businesses and consumers. In contrast, a decline may indicate economic uncertainty or slowdown.

Positive Economic Signals

Business Investment Growth – The increase in capital goods orders suggests that companies are investing in machinery and equipment, a strong indicator of economic confidence.

Stronger Job Market – More orders mean higher production levels, which can drive employment growth in manufacturing and related industries.

Stock Market Impact – Investors often view rising durable goods orders as a sign of a strengthening economy, potentially boosting stock prices, especially in the industrial and investment sectors.

Read More: U.S. Producer Prices Rise in January 2025: What It Means?

Potential Challenges

While the data is promising, continued growth in durable goods orders could also influence Federal Reserve policy. If demand keeps rising, inflationary pressures may build, prompting the Fed to consider interest rate hikes to keep the economy balanced.

Outlook for 2025 – What to Expect

Increased investment in transportation equipment and capital goods points to stronger industrial production.

The positive momentum may support further job creation in key sectors.

The U.S. dollar (USD) could strengthen as economic confidence rises.

The Federal Reserve may adjust interest rates if growth remains strong.

Final Thoughts

The January 2025 durable goods orders report delivers a strong vote of confidence in the U.S. economy. With rising investment in infrastructure and production, the outlook remains positive for businesses and investors alike. However, it’s essential to monitor how the Federal Reserve responds in the coming months.

What are your thoughts on the latest durable goods data? Share your insights in the comments!

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *