US Core PCE Inflation Rises 0.3% in June 2025, Above Yearly Forecast

📌 Key Takeaways

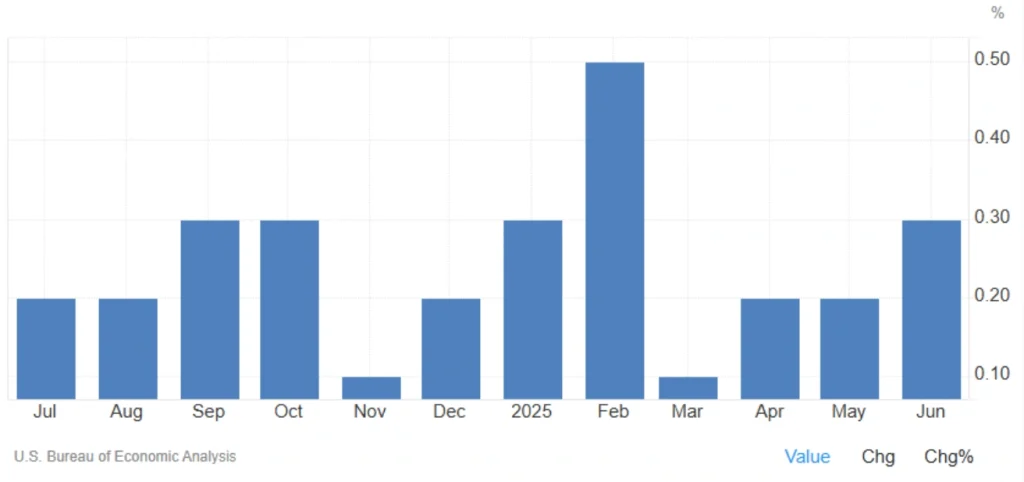

- Core PCE rose 0.3% MoM, the largest increase since February

- Annual core inflation reached 2.8%, beating the 2.7% forecast

- The index aligns with the Fed’s preferred inflation gauge

- Data adds complexity to Fed’s interest rate path

Inflation Pressures Persist in June

The core PCE price index in the United States, the Federal Reserve’s preferred measure of underlying inflation, increased by 0.3% month-over-month in June 2025, matching market expectations.

This marks the largest monthly gain since February, signaling that price pressures are not easing as quickly as hoped.

On a year-over-year basis, the core PCE index rose 2.8%, above forecasts of 2.7%, and up slightly from May’s 2.7% print.

📈 Why This Matters for the Fed

The core PCE index excludes volatile food and energy prices, making it a more stable view of inflation trends.

With the annual rate still above the Fed’s 2% inflation target, the data complicates the case for immediate interest rate cuts, especially as other indicators (like employment and GDP) suggest moderating but resilient growth.

Read More: Fed Holds Interest Rates at 4.25%-4.50% Amid Mixed Signals and Dissent

Monthly and Yearly Change Breakdown

| Timeframe | Change in Core PCE |

|---|---|

| June 2025 (MoM) | +0.3% |

| June 2025 (YoY) | +2.8% |

| Expected (YoY) | +2.7% |

| Previous (May YoY) | +2.7% |

Outlook: Fed in Wait-and-See Mode

While the Fed has held interest rates steady at 4.25%–4.50% for several meetings, stubborn core inflation may force policymakers to remain cautious.

Market watchers now look to upcoming labor market and CPI reports, as well as the Fed’s September policy meeting, for clues on whether rate cuts will begin before year-end.

Do you think inflation will keep the Fed on pause or will they move sooner than expected?

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *