U.S. to Impose 50% Tariff on Copper Imports: Futures Near All-Time Highs

📌 Key Takeaways

- 🇺🇸 Trump announces 50% tariff on copper imports, effective August 1

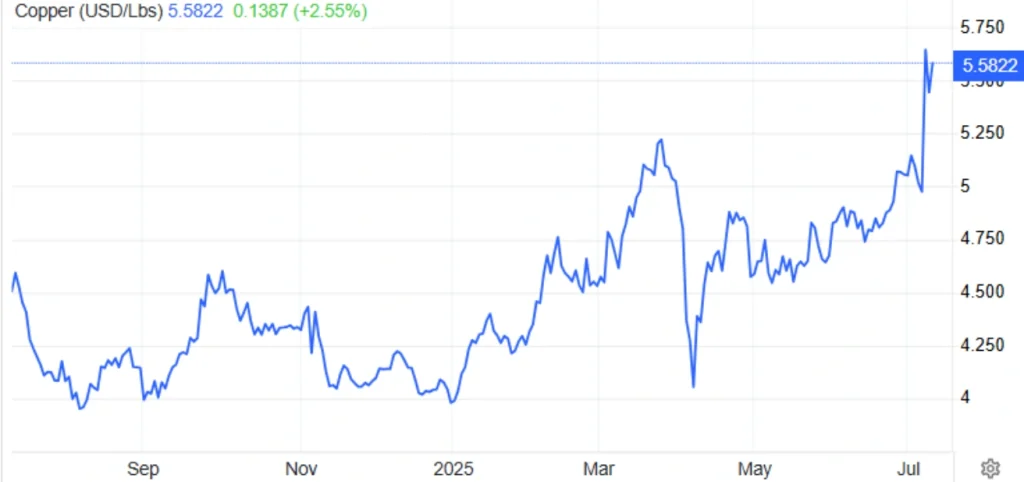

- 🧨 Copper futures surge to $5.60/lb, near all-time highs

- 💼 Defense & tech industries could face cost pressure

- 🌎 U.S. sources nearly 50% of copper imports from Chile

- 🔺 Copper premium over LME prices hits record 25%

📊 Copper Market Snapshot

| Metric | Value |

|---|---|

| U.S. Copper Futures Price | $5.60 per pound |

| Premium Over LME Copper | 25% (Record High) |

| Tariff Announcement Date | July 10, 2025 |

| Tariff Implementation Date | August 1, 2025 |

| U.S. Copper Import Share | ~50% of domestic demand |

| Main Supplier | Chile |

🚨 50% Tariff on Copper: What You Need to Know

Copper futures climbed to $5.60 per pound on Thursday, hovering near record highs, after President Donald Trump confirmed a 50% tariff on all copper imports starting August 1. The policy, announced via Truth Social, follows the conclusion of a national security review and aims to protect what Trump called a “strategic resource.”

Trump stressed that copper is the second most-used material by the U.S. Department of Defense, essential to a wide range of industries—from semiconductors and aerospace to missile defense and hypersonic weapons.

🧾 Why Copper Matters

Copper plays a key role in the modern economy, especially in:

- 🖥️ Data centers & servers

- 🔋 Lithium-ion battery manufacturing

- 🛰️ Radar and satellite systems

- 🛡️ Defense and weapons infrastructure

The announcement is already reshaping global copper flows. With tariffs looming, U.S. traders have been stockpiling copper since February, when the first threats emerged. This caused the premium on U.S. copper futures over LME contracts to reach a historic 25%, highlighting tightening domestic supply.

🌍 Global Supply Impact

The U.S. imports almost half of its copper consumption, primarily from Chile, the world’s largest copper exporter. The new tariff could disrupt this supply chain and spark price volatility, both domestically and internationally.

As global prices on the London Metal Exchange decline, the U.S. premium continues to rise—signaling an end to stockpile builds and a shift toward higher costs for domestic consumers.

💬 Final Thoughts

The copper tariff could reshape industrial and defense supply chains—and its ripple effects may be felt far beyond the metals market. Investors, manufacturers, and policymakers alike are now watching closely.

📢 What’s your take on the copper tariff? Share your thoughts below or read our latest updates on U.S. trade policies and commodity trends.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *