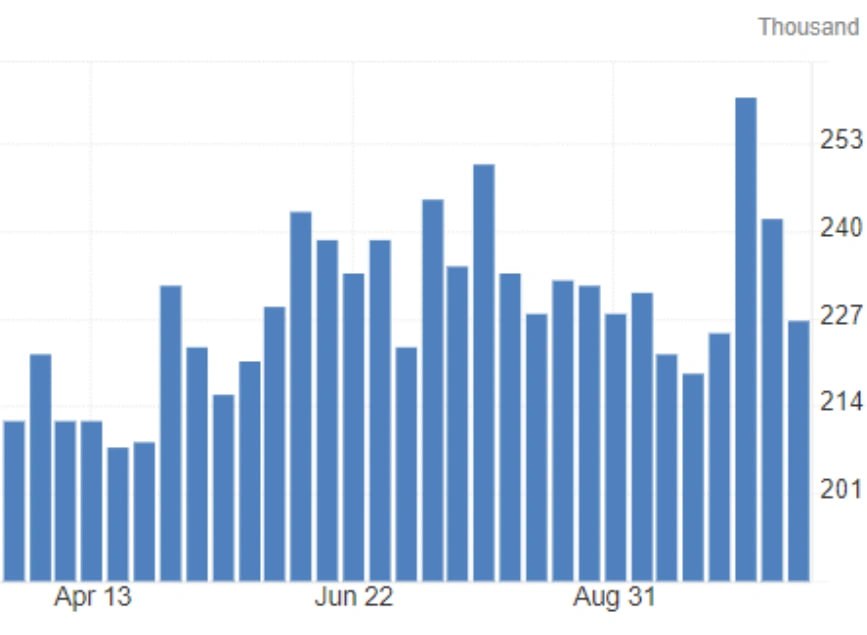

United States Initial Jobless Claims

In a positive signal for the US economy, jobless claims dropped by 15,000 to 227,000 for the week ending October 19, 2024, marking the lowest level since early October and significantly below market expectations of 242,000. This decline in unemployment claims reflects the enduring strength of the labor market, even as the Federal Reserve maintains its restrictive interest rate policies aimed at controlling inflation.

Labor Market Stays Strong Despite Economic Headwinds

The drop in jobless claims highlights the labor market’s resilience in the face of a challenging economic environment. The Federal Reserve has pursued a policy of higher interest rates to cool inflation and slow down economic activity, which typically leads to weaker job growth and higher unemployment. However, the decline in claims suggests that businesses are still retaining workers, even as the broader economy experiences tighter financial conditions.

This resilience is crucial, as the labor market is often seen as a key indicator of the overall health of the economy. The sustained low level of jobless claims signals that companies may still have enough confidence in economic demand to maintain staffing levels, despite concerns over slowing growth.

Below Expectations and Its Broader Implications

The lower-than-expected jobless claims figure not only points to the robustness of the labor market but also challenges assumptions about the necessity for aggressive monetary easing in the near term. Economists had projected claims to be around 242,000, but the actual figure of 227,000 suggests that labor market conditions are tighter than anticipated.

This comes at a time when many market participants were hoping that signs of economic weakness might prompt the Federal Reserve to consider rate cuts sooner rather than later. However, with the labor market showing continued strength, it reinforces the idea that the Fed may hold off on cutting rates, as the risk of an overheated economy with persistent inflationary pressures remains a concern.

Volatility in Jobless Data: A Look at the Four-Week Moving Average

While the weekly jobless claims figure shows a positive trend, it’s important to look at the broader context to understand long-term patterns. The four-week moving average of jobless claims, which smooths out weekly volatility and provides a more stable picture of the labor market, rose by 2,000 to 238,500.

This uptick in the moving average suggests that while the labor market remains strong, there is some underlying fluctuation in unemployment trends. It may reflect the effects of higher borrowing costs and slowing consumer demand, which could eventually weigh on businesses’ hiring and retention decisions.

Implications for Federal Reserve Policy

The jobless claims report is a critical data point for policymakers at the Federal Reserve, who are closely watching labor market dynamics as they weigh future decisions on interest rates. A strong labor market with low unemployment tends to fuel wage growth, which can lead to higher inflation—a key concern for the Fed as it aims to bring inflation closer to its 2% target.

The decline in jobless claims, coupled with the labor market’s overall resilience, suggests that the Federal Reserve will likely hold off on aggressive rate cuts in the immediate future. While some in the markets have been hoping for signs of economic weakness that could justify a more accommodative monetary policy, the robust job market may give the Fed more confidence to maintain its current stance or even consider further tightening if inflationary pressures resurface.

What’s Next for the Labor Market?

Looking ahead, the labor market’s strength will continue to be a critical factor in determining the direction of the US economy. Despite rising interest rates and signs of slowing economic growth in some sectors, businesses appear to be holding on to workers, which could support consumer spending and prevent a more severe downturn.

However, risks remain, especially if interest rates stay elevated for an extended period. Sectors that are highly sensitive to borrowing costs, such as housing and manufacturing, may begin to see deeper cuts in employment, which could eventually filter through to other parts of the economy.

Conclusion: A Resilient Labor Market, But Uncertainty Ahead

The significant drop in US jobless claims to 227,000 in mid-October underscores the labor market’s resilience, even in the face of restrictive monetary policies. This strength reinforces expectations that the Federal Reserve will refrain from aggressive rate cuts, as the economy remains stable enough to withstand higher interest rates.

At the same time, the slight rise in the four-week moving average of jobless claims serves as a reminder that volatility remains, and the full impact of the Fed’s policies may take more time to filter through the economy. For now, the labor market continues to defy expectations, but the months ahead will be crucial in determining whether this strength is sustainable or if cracks will begin to appear.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *