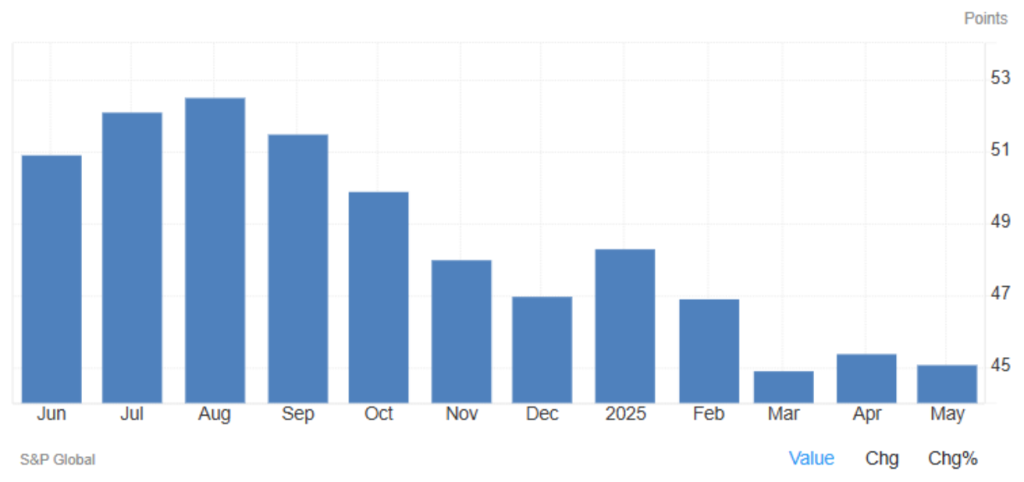

UK Manufacturing PMI Drops in May

The preliminary S&P Global UK Manufacturing PMI fell to 45.1 in May 2025, down from 45.4 in April and below market expectations of 46.0. This figure signals a sharp contraction in manufacturing activity, driven by falling output, weaker new orders, and increasing cost pressures.

UK Manufacturing PMI Breakdown – May 2025

| Indicator | May 2025 | April 2025 | Key Insight |

|---|---|---|---|

| Overall Manufacturing PMI | 45.1 ▼ | 45.4 | Below forecast |

| Output | Falling | – | Contraction accelerating |

| New Orders | Falling | – | Demand remains weak |

| Employment | Sharp drop | – | Fastest decline in 5 years |

| Supplier Delivery Times | Lengthening | – | Worst since Feb 2024 |

| Input Costs | Increasing | – | Growth slowing but still high |

| Business Confidence | Very weak | – | Near 2.5-year low |

Educational Note: What is the Manufacturing PMI and Why It Matters?

The Purchasing Managers’ Index (PMI) reflects economic activity in the manufacturing sector. It is derived from surveys of company managers. A value above 50 indicates expansion, while below 50 signals contraction.

PMI Importance for the UK Economy:

- Indicates health of employment and industrial production

- Influences GDP growth forecasts

- Helps guide monetary policy by the Bank of England

Economic Impact, Labor Market Outlook & Policy Implications

The PMI’s drop to 45.1 marks the second consecutive monthly decline, reflecting worsening conditions in manufacturing. The drop in output and new orders shows ongoing weakness in both domestic and international demand.

Employment in the sector fell at the fastest pace in five years—a worrying sign of deepening industrial slowdown. Main contributing factors include:

- Weak demand

- Wage pressures

- Low capacity utilization

Supplier delivery times lengthened due to global shipping delays and port congestion, increasing the risk of supply chain disruptions and higher input costs.

While input prices continue to rise, the pace of growth has slowed. However, cost inflation remains a burden for manufacturers.

Business confidence fell to one of its lowest levels in 2.5 years, with US tariff concerns cited as a key risk dampening the outlook for exporters.

Read More: UK Economy Grows 0.2% in March 2025

Summary: Opportunities & Risks

🔹 Opportunities:

- Potential monetary easing by the Bank of England if manufacturing weakness persists

- Possible government support for export-driven industries

- Slowing input cost growth may offer cost relief in the months ahead

🔸 Risks:

- Falling employment could hit the labor market and household income

- Extended delivery times and weak export demand cloud the outlook

- Ongoing trade tensions with the US may further hurt exports

In summary, the UK Manufacturing PMI’s drop to 45.1 in May 2025 paints a stark picture of industrial contraction, with declining employment, weak orders, and persistent cost pressure. Policymakers may soon face growing pressure to respond.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *