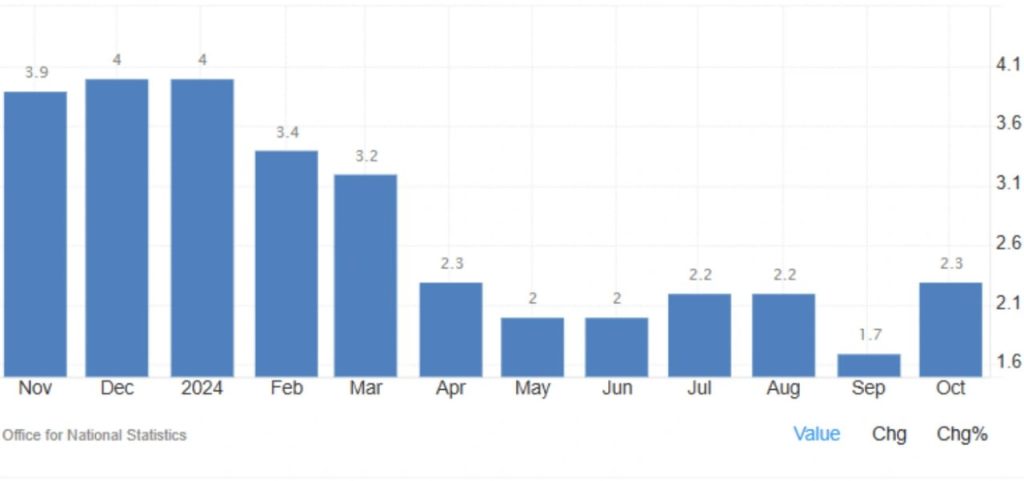

UK Inflation Jumps to 2.3% in October 2024

The UK’s annual inflation rate rose to 2.3% in October 2024, marking its highest level in six months. This increase, up from 1.7% in September, surpassed both the Bank of England’s target and market expectations of 2.2%. The inflationary pressure was largely driven by rising costs in housing and household services, which saw a sharp increase to 5.5% from 3.8% in September. The surge was primarily due to higher electricity and gas prices, which were impacted by the rise in the energy price cap set by the Office of Gas and Electricity Markets (Ofgem) in October. Electricity prices dropped by 6.3% compared to the previous year, a notable improvement from the 19.5% drop in September, while gas prices fell by 7.3%, a smaller decline than the previous month’s 22.8%.

Rising Prices in Services and Hospitality

Inflation in other sectors also contributed to the overall rise. Prices for restaurants and hotels increased by 4.3%, slightly higher than the 4.1% rise in September. Housing and utilities, which had seen a decline of 1.7% in September, rebounded with a 2.9% increase in October. Additionally, services inflation edged up slightly to 5% from 4.9%, aligning with the Bank of England’s projections. This reflects rising costs in services, which had been subdued earlier in the year but are now seeing steady upward pressure.

Food Prices Stable but Recreation and Culture Costs Fall

Food inflation remained stable at 1.9%, providing a bit of relief in the face of rising costs in other sectors. Meanwhile, the largest offsetting factor for overall inflation came from recreation and culture, where prices increased by 3%, down from 3.8% in September. This decline helped to balance out the upward pressure from other areas of the economy. On a monthly basis, the Consumer Price Index (CPI) rose by 0.6%, signaling that inflationary trends are continuing to climb, albeit at a more moderate pace than earlier in the year.

Core Inflation Edges Up Slightly

Finally, core inflation, which excludes volatile items like food and energy, increased slightly to 3.3% in October, up from 3.2% in September. This indicates a continued, albeit modest, rise in underlying price pressures, which may signal ongoing inflationary concerns for the UK economy. As inflation rises above the Bank of England’s target, policymakers will be closely monitoring these trends to gauge whether further action is needed to curb price increases in the coming months.

Share

Hot topics

What Is Spot Trading?

Spot trading refers to the buying or selling of an asset for immediate delivery in the current market (or “spot”) and does not contain any future obligations, expiration dates, or...

Read more

Submit comment

Your email address will not be published. Required fields are marked *