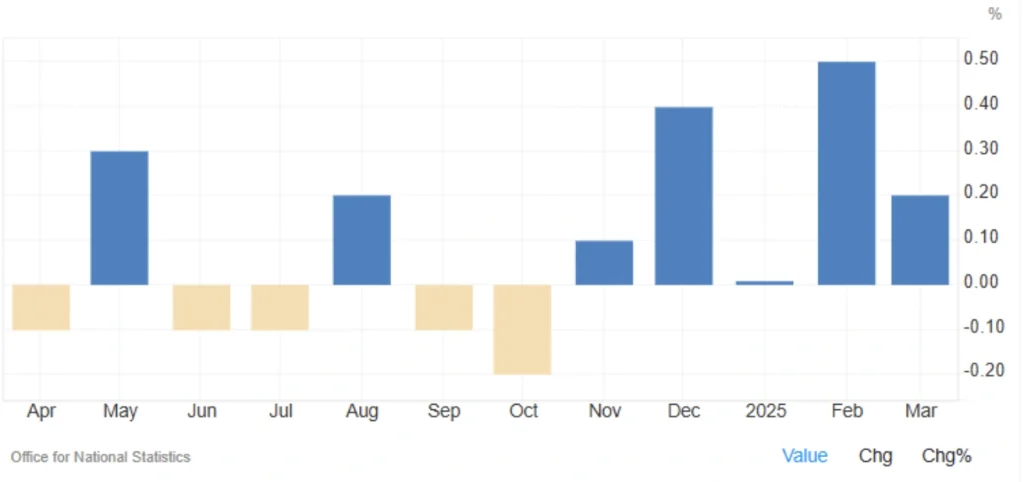

UK Economy Grows 0.2% in March 2025

The United Kingdom’s Gross Domestic Product (GDP) grew by 0.2% in March 2025 compared to the previous month, slightly exceeding market expectations (0.0%). Although slower than February’s 0.5% growth, this increase reflects a measure of economic resilience ahead of impending tax reforms and rising global trade tensions, particularly in light of upcoming tariffs proposed by Donald Trump.

Key UK GDP Breakdown – March 2025

| Sector | Monthly Change | Comparison to February |

|---|---|---|

| Total GDP | ▲ 0.2% | Slower than February (0.5%) |

| Services | ▲ 0.4% | Stronger than February (0.3%) |

| Construction | ▲ 0.5% | Stronger than February (revised to 0.2%) |

| Industrial Output | ▼ 0.7% | Decline after strong growth in February (1.7%) |

| Annual GDP Growth | ▲ 1.1% | Moderate year-on-year growth |

Why GDP Matters for Economic Analysis

Gross Domestic Product (GDP) represents the total value of goods and services produced in a country and is considered the most comprehensive measure of an economy’s health.

🔍 Why It’s Important:

- Positive GDP growth signals rising production, employment, and consumer demand

- Weak or negative GDP growth can indicate recession risks or the need for economic stimulus

- GDP directly influences central bank policy decisions, currency markets, and investor confidence

Analysis: Market Impact, Policy Implications & Outlook

While March’s 0.2% GDP growth slowed from February, it outperformed forecasts and suggests that the UK economy remains resilient—at least in the short term.

The services sector was the primary growth driver, reflecting stable domestic demand in areas like education, healthcare, trade, and financial services.

The construction sector also rebounded, likely benefiting from lower interest rates and easier access to credit.

However, the 0.7% contraction in industrial production is a concern. It could signal early warning signs for the coming months, especially as global supply chains face renewed stress from Trump-era trade tariffs.

Meanwhile, the upcoming employer tax hikes are expected to weigh on the labor market and potentially dampen private investment, limiting growth in Q2.

Read More: U.S. Stock Market: A Comprehensive Guide

Opportunities vs. Risks

✅ Opportunities:

- Continued expansion in services and construction

- Proactive monetary policy to sustain domestic demand

- Strengthening consumer confidence ahead of external shocks

⚠️ Risks:

- Employer tax burden possibly leading to reduced hiring

- Decline in industrial output amid export and tariff uncertainty

- Potential instability in future growth due to geopolitical and fiscal headwinds

Final Thoughts

The March 2025 GDP figures suggest that the UK economy is on a slow but steady growth path, maintaining momentum despite an increasingly challenging external environment. However, a series of domestic and global risks—from rising taxes to trade disruptions—could cloud the outlook in the months ahead.

The government’s and central bank’s next moves will be critical in maintaining stability and investor confidence.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *