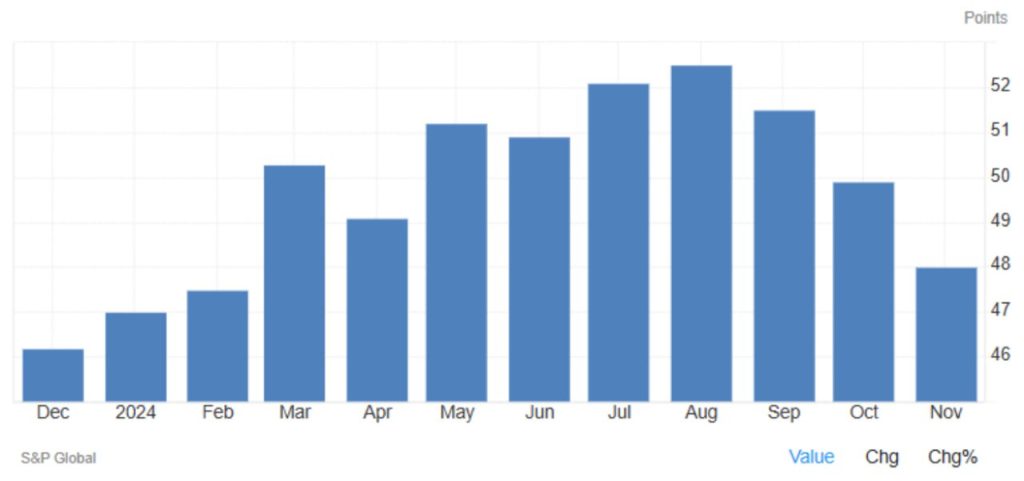

S&P Global UK Manufacturing PMI Falls to 48 in November

The S&P Global UK Manufacturing PMI for November 2024 was revised down to 48.0, from a preliminary 48.6, and compared to 49.9 in October. This marks the most significant contraction in the UK’s manufacturing sector since February. The PMI reading, which remains below the neutral 50 level, signals that the sector continues to struggle and remains in contraction territory. This downturn highlights the ongoing challenges faced by UK manufacturers amid uncertain economic conditions and fluctuating demand both domestically and internationally.

Decline in Output and New Orders

A major contributor to the PMI’s drop was a decline in output, which fell for the first time in seven months. This downturn came alongside the sharpest drop in new order intakes since February, signaling that demand has weakened significantly. The decline in output and new orders reflects continued concerns about the economic outlook, as well as rising costs and weak consumer demand. Manufacturers have been adjusting to these conditions by scaling back production and reducing their expectations for future growth. This contraction comes at a critical time, with many industries already facing uncertainty regarding the holiday season and the beginning of 2025.

Ongoing Challenges: Export Slump and Supply Chain Disruptions

The export climate remained bleak in November, as weaker demand from major trading partners, including the US, China, and the European Union, led to a further reduction in new export business. UK manufacturers have been particularly vulnerable to these shifts in global demand, with exports continuing to struggle due to the uncertain economic climate worldwide. This sluggishness in foreign trade has compounded the difficulties already faced by the sector.

Additionally, supply chain concerns have intensified, exacerbating the challenges for manufacturers. The combination of the ongoing Red Sea crisis, port disruptions, and new border regulation issues led to longer supplier delivery times, shortages of essential materials, and rising costs. These disruptions have strained production schedules, increased operational costs, and caused delays in fulfilling orders. The escalating pressure from supply chain bottlenecks, in combination with global political uncertainties, has further undermined manufacturers’ ability to stabilize output and improve their business prospects.

Modest Outlook Despite Ongoing Difficulties

Despite the sharp decline in the November PMI and the persistent challenges faced by the sector, the overall outlook for the UK manufacturing industry remains cautiously positive. Business expectations showed some signs of improvement, even though they are tempered by the ongoing difficulties that manufacturers are grappling with. There is some optimism that conditions could stabilize as we move into 2025, especially if global demand rebounds or if supply chain issues begin to resolve. However, manufacturers are still cautious, given the unpredictability of the global economy, the continued political instability in Europe, and the rising costs that continue to weigh on production.

The road ahead for the UK manufacturing sector remains uncertain. While business expectations are not entirely bleak, manufacturers are finding it difficult to plan for the future given the ongoing economic volatility and external challenges. Going into the final month of the year, UK manufacturers will need to adapt quickly to evolving market conditions to ensure they can recover from this prolonged period of contraction. However, with weaker demand, mounting costs, and supply chain issues continuing to dominate the landscape, a swift rebound remains unlikely in the short term.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *