Reserve Bank of New Zealand Cuts Rates Again as Inflation Slows

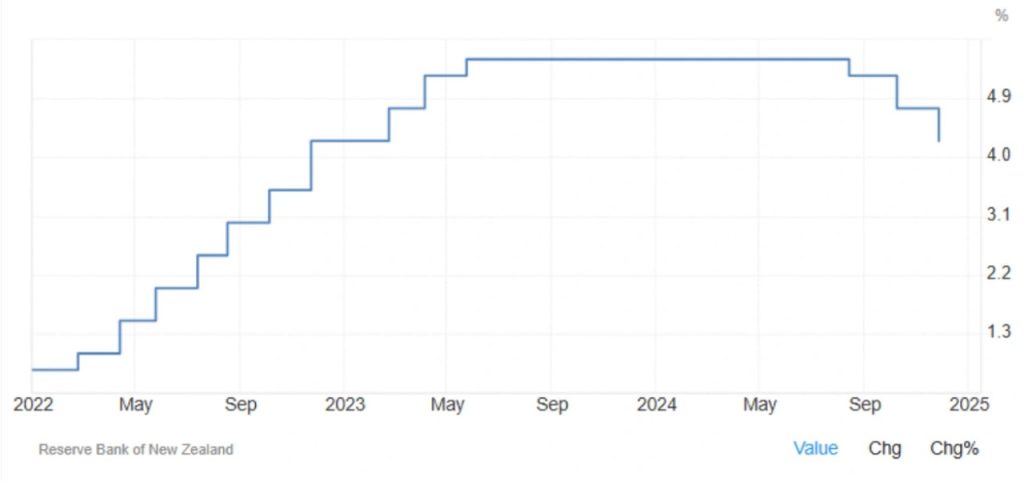

In its November 2024 policy meeting, the Reserve Bank of New Zealand (RBNZ) announced a 50 basis point reduction in its official cash rate (OCR), bringing it down to 4.25%. This marks the third consecutive rate cut this year, underscoring the bank’s ongoing efforts to support the economy in the face of subdued economic activity and weakening employment growth. The decision is in line with market expectations, signaling the RBNZ’s commitment to maintaining accommodative monetary policies to foster economic stability amid a cooling inflation environment.

Inflation Drops to Lowest Level Since 2021

One of the key drivers behind the RBNZ’s rate cut is the notable slowdown in inflation. New Zealand’s annual inflation rate fell to 2.2% in the third quarter of 2024, its lowest level since March 2021. This is a significant drop from 3.3% in the previous quarter, signaling that price pressures are easing. The decrease in inflation comes as a result of several factors, including reduced costs for energy and goods, as well as the effectiveness of previous rate hikes. With inflation now sitting comfortably within the RBNZ’s target band of 1-3%, the central bank finds itself in a more favorable position to focus on stimulating economic activity rather than curbing rising prices.

The cooling inflation rate provides a sense of relief for both consumers and businesses, as it suggests that the aggressive price hikes of the past few years may be nearing an end. With inflation under control, the RBNZ has more flexibility to adjust its monetary policies to support other areas of the economy, such as employment and growth. The central bank’s focus has shifted from inflation control to fostering economic stability, which is crucial as the country continues its recovery from the effects of the global pandemic and other economic challenges.

Economic Growth and Employment Struggles

While inflation may be cooling, New Zealand’s broader economy is still facing significant challenges. Economic activity remains subdued, with output still below potential. This weak economic performance is compounded by sluggish employment growth, which is expected to persist through mid-2025. Despite the RBNZ’s efforts to stimulate growth, New Zealand’s labor market remains under pressure, with many sectors experiencing slow recovery and low job creation.

The current economic environment, marked by a lack of strong growth in output and employment, is a key factor influencing the central bank’s decision to continue cutting interest rates. With weak GDP growth and an underperforming labor market, the RBNZ is increasingly concerned about the economy’s ability to regain momentum without further intervention. The bank is cautious in its approach, aware that while inflation may be under control, the broader economic recovery is still fragile.

Future Outlook for Monetary Policy

Looking ahead, the RBNZ remains open to the possibility of further rate cuts if economic conditions do not improve. With inflation now sitting at a manageable level, the central bank is in a position to ease monetary policy further if necessary. The continued weakness in GDP and employment growth makes it likely that the RBNZ will continue to monitor these indicators closely and adjust interest rates as needed to support a more robust economic recovery.

The central bank’s stance on monetary policy will depend largely on how the economy evolves in the coming months. If GDP growth remains sluggish and the labor market continues to struggle, the RBNZ may take additional steps to provide economic stimulus. However, the central bank is also mindful of the potential risks associated with prolonged low interest rates, including the possibility of fueling financial instability or creating asset bubbles. As such, it will carefully balance its approach, aiming to ensure that New Zealand’s economy can continue to recover while maintaining inflation within its target range.

In conclusion, the RBNZ’s decision to cut rates for the third time in 2024 reflects its commitment to supporting New Zealand’s economic recovery. With inflation now under control and the economy still facing challenges, the central bank remains focused on fostering growth and stability. As the country navigates these uncertain times, further rate cuts may be on the horizon if economic conditions warrant them. The outlook for New Zealand’s economy remains cautious, but the RBNZ’s actions suggest it is prepared to take whatever steps are necessary to ensure a steady path forward.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *