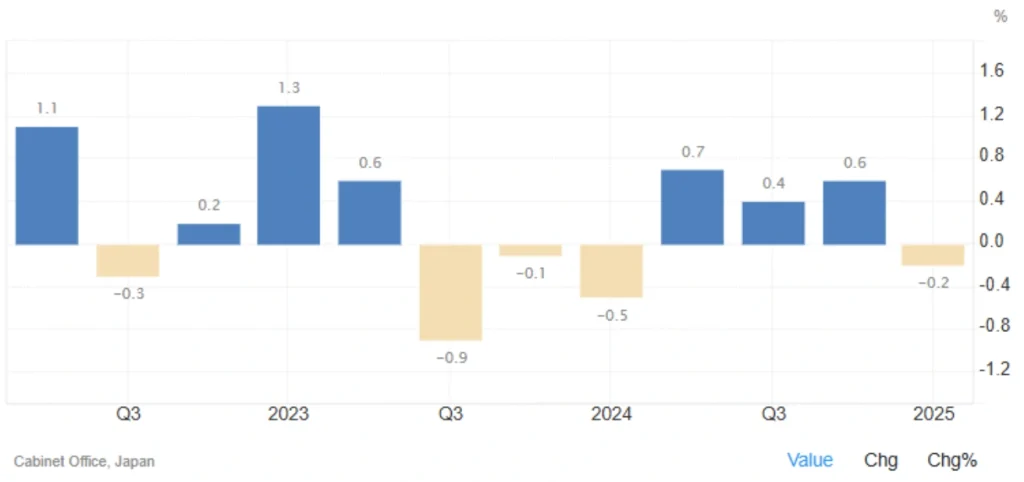

Japan’s Economy Contracts in Q1 2025

According to preliminary data, Japan’s Gross Domestic Product (GDP) shrank by 0.2% in Q1 2025, worse than the market expectation of a 0.1% contraction. Japan’s economy contracts for the first time since Q1 2024. On an annualized basis, GDP dropped 0.7%, signaling a return to recession after a 2.4% growth in the previous quarter.

Key Economic Indicators – Q1 2025:

| Indicator | Q1 2025 | Q4 2024 | Trend |

|---|---|---|---|

| Quarterly GDP Growth | ▼ -0.2% | ▲ 0.6% | Decline |

| Market Forecast | ▼ -0.1% | – | Worse than expected |

| Annualized GDP Growth | ▼ -0.7% | ▲ 2.4% | Reversal to contraction |

| Private Consumption | ➖ 0.0% | – | Below forecast (expected +0.1%) |

| Government Spending | ➖ 0.0% | ▲ for 3 previous quarters | Growth stalls |

| Exports | ▼ -0.6% | ▲ 1.7% | Decline |

| Imports | ▲ +2.9% | ▼ -1.4% | Surge |

| Net Trade Contribution | ▼ -0.8 percentage points | – | Negative impact |

| Business Investment | ▲ +1.4% | ▲ 0.8% | Strongest since Q2 2024 |

Educational Insight:

Why Japan’s GDP Trends Matter for Asia and Global Markets

As the world’s third-largest economy, Japan’s GDP is a critical indicator for:

- Asia-Pacific economic health

- Global industrial demand through export levels

- Policy direction of the Bank of Japan (BoJ) on interest rates and stimulus

- Valuation of the yen and Japanese government bonds

Analysis: Market Impact, Policy Implications & Outlook

The 0.2% quarterly of Japan’s Economy Contracts signals a renewed downturn, driven by declining exports and stagnant household consumption.

🛍️ Private consumption—which accounts for over half of Japan’s economy—was flat, likely due to high inflation, fiscal tightening, and political uncertainty.

📉 A major drag was net external trade, with exports falling and imports rising. The -0.8 percentage point contribution from net trade was largely due to declining shipments to China and the U.S., reflecting the impact of Trump-era tariff policies.

💡 On a brighter note, business investment rose 1.4%, indicating corporate confidence despite weak domestic demand and external headwinds—possibly driven by tech innovation or industrial subsidies.

Read More: Japan’s Annual Inflation Rate Rises in January 2025

Summary: Opportunities vs. Risks

🔹 Opportunities:

- Strong business investment could spark a recovery in H2 2025

- Potential for new stimulus from the Bank of Japan

- Export growth opportunities in non-U.S. markets (e.g., ASEAN, India)

🔸 Risks:

- Ongoing export weakness, especially to China and the U.S.

- Persistent domestic consumption slump amid inflation and financial pressure

- U.S. trade policy continues to impact Japan’s key trade relationships

Final Thoughts:

Japan’s 0.2% GDP decline rings alarm bells for policymakers, highlighting the urgent need for financial support measures and structural reforms to stimulate domestic demand and ensure export resilience.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *