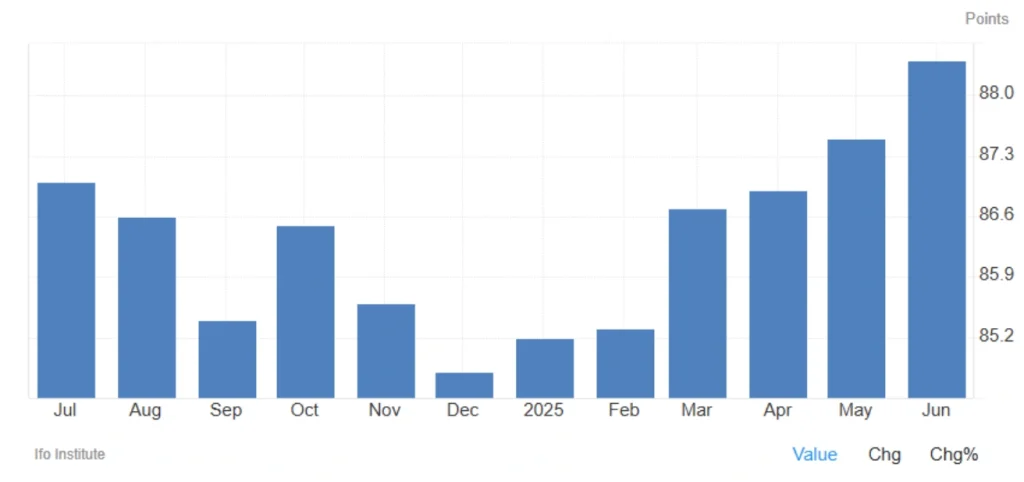

Rising Ifo Business Confidence Index in Germany

In June 2025, Germany’s Ifo Business Climate Index rose to 88.4 points, reaching its highest level in a year and surpassing both May’s 87.5 and market expectations of 88.2. The expectations component climbed to 90.7, marking its strongest reading since April 2023, while the current situation index edged up slightly from 86.1 to 86.2. Most notably, the service sector showed the greatest improvement, with positive sentiment also rising in retail. Although manufacturing outlooks improved, order volumes remained weak, indicating a cautious recovery in the industrial segment.

Initial Market Reactions to June 2025 Ifo Index

| Market | Reaction | Initial Analysis |

|---|---|---|

| 💶 Euro/USD | Slight Euro strengthening | Improved German economic outlook supports Euro |

| 🇪🇺 European Stocks | Minor gains in DAX & regional markets | Optimism driven by service sector growth |

| 💵 Bonds | Little change in 10-year yields | Slow growth prompts cautious monetary policy |

Educational Section: What is the German Ifo Index?

- Definition:

The Ifo Business Climate Index is a leading economic confidence indicator in Germany, compiled by the Munich-based Ifo Institute. It is based on surveys of over 9,000 companies across various sectors like manufacturing, construction, retail, and services. - Calculation:

The index averages two key components:- Current business situation assessment

- Expectations for the next six months

- Market Importance:

- Acts as a leading economic indicator for Germany and the EU

- Influences European Central Bank (ECB) policy decisions

- Vital for forecasting Germany’s GDP changes

Market & Policy Impact Analysis

🏦 Currency & European Monetary Policy

- The rise in the Ifo Index, especially expectations, signals returning business confidence.

- This may reduce pressure on ECB to cut interest rates.

- However, slow manufacturing growth and weak orders keep policymakers cautious.

💼 German Stock Market

- Service sector growth and rising confidence support domestic stocks, particularly in:

- Consumer goods

- Tourism

- Service technologies

- Manufacturing sector weakness could limit stock market gains.

📉 Bonds & Recession Risks

- Although improving, the index remains below historical averages.

- If industrial sectors don’t improve, recession concerns in H2 2025 persist.

- German government bond yields may stay stable in the near term.

Read More: What Is Germany’s DAX Index?

Final Summary & Possible Scenarios

Positive Signs:

- Ifo Business Confidence at highest level in a year

- Gradual economic confidence recovery in Germany

Key Caveats:

- Improvement mainly in services, not manufacturing

- Weak orders and global uncertainty still pose risks

- ECB likely to maintain cautious interest rate stance

Future Scenarios:

- 📈 If confidence keeps rising and industrial data strengthens, markets may see more sustained growth

- ⚠️ Continued manufacturing weakness and poor external demand may cause only short-term improvement, with recession fears returning

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *