Gold Price Retreats After Historic $3,500 Peak

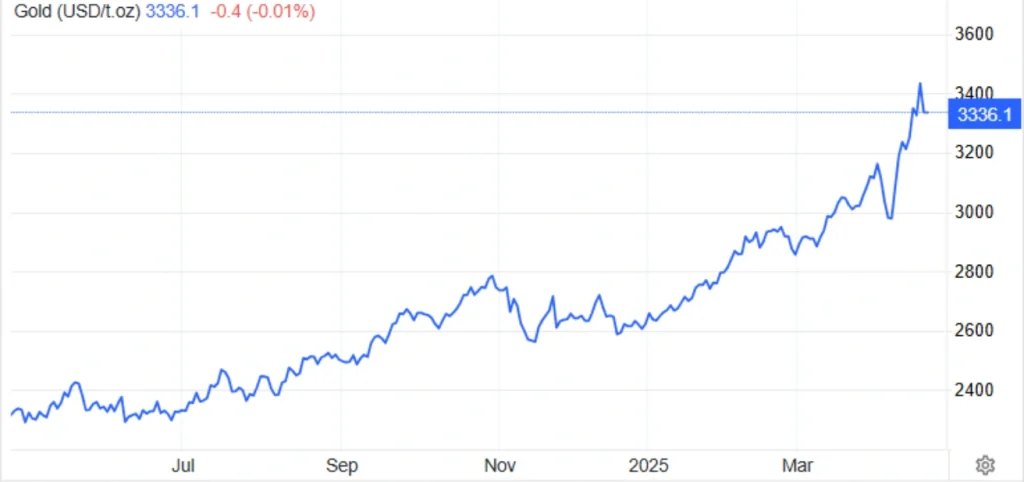

Gold prices dropped to around $3,310 per ounce on Wednesday, continuing a correction from the all-time high of $3,500 reached just a day earlier. This pullback reflects shifting global risk sentiment and changes in investor behavior.

Read More: Exploring Alternative Investments: Gold, Crypto & Beyond

Key Drivers Behind the Decline

🇺🇸🇨🇳 Reduced U.S.-China Trade Tensions:

- U.S. Treasury Secretary Scott Bessent stated that he expects a de-escalation in trade disputes with China.

- He described the tariff war as unsustainable and mutually damaging.

- Market relief over diplomatic progress lowered the demand for gold as a hedge.

Decreased Pressure on the Fed:

- Donald Trump has backed off from recent threats to fire Federal Reserve Chairman Jerome Powell.

- The move eased concerns about central bank independence and calmed financial markets.

📉 Shift Away from Safe-Havens:

- With geopolitical risk slightly reduced, investors moved towards riskier assets such as equities.

- This shift temporarily reduced gold buying pressure and contributed to price correction.

Annual Outlook Remains Strong

Despite the recent drop, gold is still up around 30% year-to-date in 2025.

Supportive long-term factors include:

- Global inflationary pressures

- Loose monetary policies

- Ongoing political instability worldwide

Many analysts believe that if the U.S. Federal Reserve lowers interest rates, gold may again test or surpass new highs.

Market Insight: Why Is Gold So Sensitive?

Gold is considered a safe-haven asset:

- It tends to gain value during periods of war, inflation, currency instability, or political crises.

- Conversely, as risks subside and economic outlook improves, gold demand — and prices — usually decline.

Conclusion

Gold’s retreat from its historic high reflects short-term relief in global tensions, but macro trends still support a bullish long-term outlook. Investors remain watchful for policy signals, especially regarding U.S. interest rates.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *