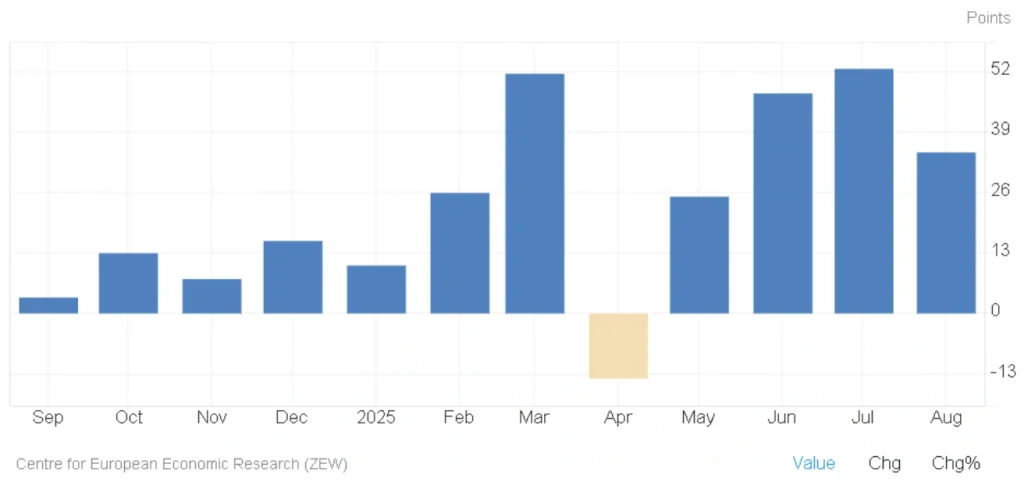

Germany’s ZEW Economic Sentiment Falls to 34.7 in August, First Drop in Four Months

The ZEW Indicator of Economic Sentiment for Germany fell sharply to 34.7 in August 2025, down from 52.7 in July (its highest reading since 2022) and well below market expectations of 40. This marks the first decline in four months, signaling that optimism among financial market experts has cooled amid renewed economic challenges.

ZEW President Professor Achim Wambach said the drop was largely driven by disappointment over the newly announced EU–US trade deal and the weak performance of the German economy in the second quarter of 2025.

📉 Industry Outlook Turns Negative

According to Wambach, the economic outlook has worsened notably for Germany’s chemical and pharmaceutical sectors, while mechanical engineering, metal production, and automotive industries are also facing significant headwinds.

The data suggest that these industries (many of which are export-dependent) could be feeling the pressure from global trade uncertainties, shifting demand, and structural challenges.

📊 Current Economic Assessment Weakens

Alongside the drop in sentiment, the Current Conditions Index fell to -68.6 from -59.5 in July, missing forecasts of -65. This reading indicates that financial experts view Germany’s present economic situation as notably worse than just a month ago.

Read More:UK Unemployment Rate Holds at 4.7% in June 2025, Highest Since 2021

The deterioration reflects not only weaker-than-expected GDP performance in Q2 but also ongoing industrial contraction and subdued consumer demand.

Germany ZEW Economic Indicators – August 2025

| Indicator | August 2025 | July 2025 | Forecast | Trend |

|---|---|---|---|---|

| ZEW Economic Sentiment Index | 34.7 | 52.7 | 40 | 📉 Down |

| Current Conditions Index | -68.6 | -59.5 | -65 | 📉 Down |

✅ Key Takeaways

- ZEW Economic Sentiment dropped to 34.7, the first decline in four months.

- Fall driven by trade deal disappointment and Q2 economic weakness.

- Outlook worsens for chemical, pharmaceutical, engineering, metal, and automotive sectors.

- Current Conditions Index fell to -68.6, below expectations.

- Signals rising concern about Germany’s short-term economic prospects.

💬 What This Means for Germany’s Economy

The August ZEW reading suggests that confidence in Germany’s economic trajectory is fading as both global trade dynamics and domestic industrial performance weigh on expectations.

With the automotive and manufacturing hubs under pressure and the services sector showing mixed signals, economists warn that policy adjustments and targeted industry support may be needed to prevent further sentiment erosion.

Your turn: Do you think Germany’s industrial sectors can bounce back before year-end, or will global trade tensions keep sentiment subdued?

Share

Hot topics

The best indicator for short term trading

When it comes to short-term trading, everything happens quickly. Movement can take place over a matter of minutes; momentum can build and fade quickly; and traders often have to make...

Read more

Submit comment

Your email address will not be published. Required fields are marked *