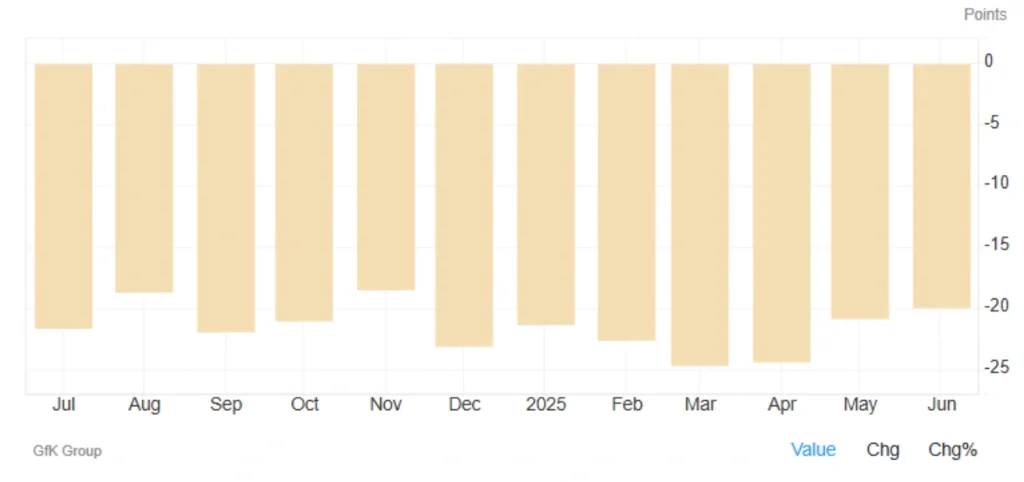

Improvement in Germany’s GfK Index for the Third Consecutive Month

Germany’s GfK Consumer Climate Index for June 2025 rose to -19.9, up from a revised -20.8 in May. While still below market expectations of -19.0, this marks the third consecutive monthly increase and the highest level since November 2024.

Key Components – June 2025 vs. May 2025:

| Indicator | June Value | May Value | Trend |

|---|---|---|---|

| Consumer Climate (GfK) | 🔺 -19.9 | -20.8 | Relative improvement |

| Economic Expectations | 🔺 13.1 | 7.2 | Highest in 2 years |

| Income Expectations | 🔺 10.4 | 4.3 | Significant growth |

| Willingness to Buy | 🔻 -6.4 | -4.9 | Decline resumed |

| Saving Inclination | 🔺 10.0 | 8.4 | Increased caution |

Educational Insight: What is the GfK Consumer Climate Index?

The GfK (Gesellschaft für Konsumforschung) Index is one of Germany’s most important consumer sentiment indicators. It measures economic confidence and consumer readiness to spend, based on monthly surveys of around 2,000 German households.

It evaluates:

- Economic outlook

- Income expectations

- Willingness to buy

- Inclination to save

Note: Values below zero indicate pessimism among consumers.

Analysis: Implications for the German Economy & Consumer Behavior

The rise in the GfK index to -19.9 indicates a gradual recovery in consumer confidence, particularly driven by a strong rise in both economic and income expectations.

However, the renewed drop in willingness to buy and the rise in saving inclination reflect persistent caution among consumers. They continue to prioritize financial security over spending.

According to Rolf Bürkl, senior consumer expert at the NIM Institute, key drivers of this cautious sentiment include:

- Uncertainty over U.S. tariff policy

- Stock market volatility

- Concerns about a potential third consecutive year of recession in Germany

These concerns could prolong weak private consumption — a key component of economic growth that has yet to fully rebound.

Read More: What Is Germany’s DAX Index?

Summary: Opportunities & Risks

🔹 Opportunities:

- Higher economic and income expectations suggest a rebound in consumer trust.

- Stabilization in geopolitical conditions could support improved consumer behavior.

- The current low-inflation environment may encourage future spending.

🔸 Risks:

- Persistent weak buying sentiment and increased savings point to a potential demand slump.

- Continued U.S. trade policy uncertainty and weak exports may dampen confidence.

- Fears of a third year of economic stagnation still weigh heavily on households.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *