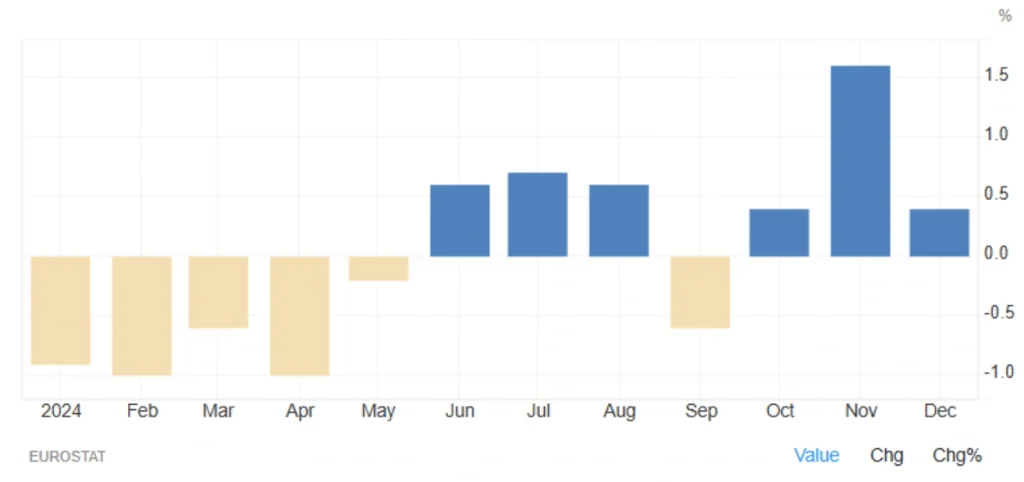

Eurozone Producer Prices See Modest Increase in December 2024

Producer prices in the Eurozone rose by 0.4% in December 2024, following a larger 1.7% jump in November. This marked the third consecutive monthly increase, largely driven by energy prices, which climbed 1.4% compared to 5.6% the previous month. Other contributing factors included moderate increases in intermediate goods, capital goods, durable consumer goods, and non-durable consumer goods. Each category showed slight price rises, reflecting ongoing cost pressures across the region.

Economic Variations Among Major Eurozone Countries

Among the region’s largest economies, France led with a 1% rise in producer prices, while Spain and Italy saw increases of 0.9% and 0.8%, respectively. In contrast, Germany experienced a small decline of 0.1%, highlighting the varied economic conditions across the Eurozone. These disparities reflect how different sectors and countries are responding to inflationary pressures and energy costs.

Stability in Year-on-Year Producer Prices

Year-over-year, producer prices in the Eurozone remained unchanged in December 2024, after a 1.2% decline in the same month of the previous year. This stabilization suggests that, despite some monthly fluctuations, the region’s pricing trends have reached a level of balance, with no significant shifts in the broader inflationary landscape.

The Outlook for Eurozone Inflation

While the December increase in producer prices suggests a continued rise in costs, the overall stability in year-on-year data indicates that inflationary pressures may be easing. Economists and policymakers will be closely monitoring future trends in producer prices to gauge the overall health of the Eurozone economy and assess the potential for further price adjustments in the coming months.

Read More: Decline in Eurozone Economic Sentiment Index

Educational Part: What is the Producer Price Index (PPI) and Why Does It Matter?

1. What is the PPI?

The Producer Price Index (PPI) is a metric used to measure changes in the prices of goods and services at the producer level. It reflects production costs before products reach the final consumer, offering insight into inflationary pressures within the production stage of the economy.

2. How Does the PPI Impact the Economy?

An increase in the PPI can lead to higher consumer inflation (CPI), as producers may pass on higher production costs to consumers. The European Central Bank (ECB) may adjust its monetary policies based on PPI trends. If the index shows an upward trend, the ECB could maintain higher interest rates to counteract inflationary pressures.

3. Why is the PPI Important for Investors and Analysts?

- Forecasting Inflation Trends: A rising PPI may indicate future inflationary pressures.

- Impact on Financial Markets: A sharp rise in the PPI can cause volatility in the stock markets as investors anticipate more stringent monetary policies.

- Effect on Commodity Prices: Higher production costs may be passed on to consumers, impacting the prices of raw materials and consumer goods.

Conclusion: Will Producer Inflation Continue to Rise?

The increase in the producer price index for the third consecutive month signals ongoing inflationary pressures in the Eurozone. However, the deceleration in energy price growth may slow the overall inflationary trend. Both the European Central Bank and investors must closely monitor PPI developments, as it will influence monetary policy decisions and financial market movements.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *