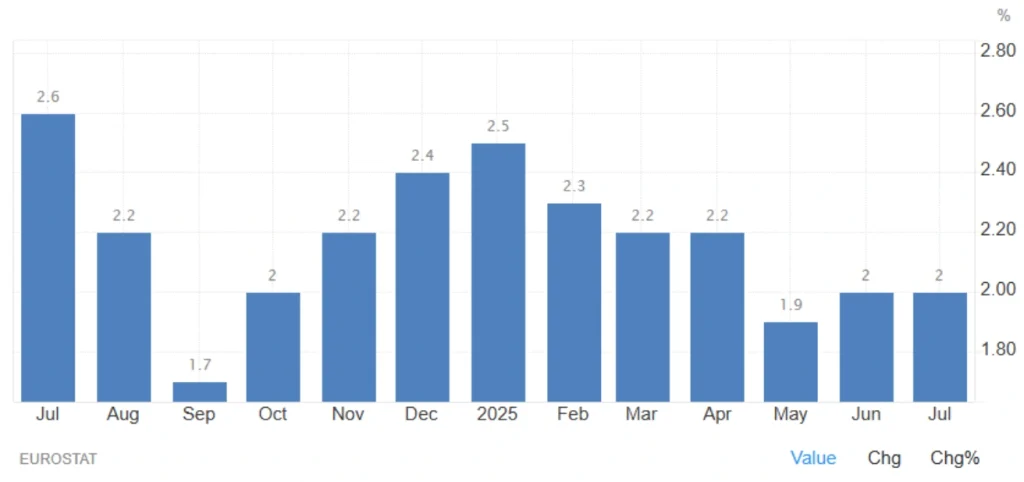

Eurozone Inflation Holds Steady at 2.0% in July 2025, Matching ECB Target

Eurozone consumer price inflation remained at 2.0% year-on-year in July 2025, unchanged from the previous month and slightly above analysts’ forecast of 1.9%, according to Eurostat’s preliminary flash estimate.

This marks the second straight month that inflation has aligned with the European Central Bank’s official target, offering some reassurance to policymakers as they assess the timing of potential rate cuts.

📌 Key Takeaways

- Headline inflation: 2.0% (vs 2.0% in June)

- Forecast: 1.9%

- Core inflation: 2.3% (unchanged from June)

- Services inflation: Slowed to 3.1% from 3.3%

- Food, alcohol & tobacco: Rose 3.3% (vs 3.1%)

- Non-energy industrial goods: Up 0.8% (vs 0.5%)

- Energy prices: Fell by 2.5%, continuing a disinflation trend

📈 Inflation Breakdown (YoY %)

| Category | July 2025 | June 2025 | Trend |

|---|---|---|---|

| Headline CPI | 2.0% | 2.0% | ➖ Flat |

| Core CPI | 2.3% | 2.3% | ➖ Flat |

| Services | 3.1% | 3.3% | 🔽 Slowing |

| Food, Alcohol & Tobacco | 3.3% | 3.1% | 🔼 Rising |

| Non-Energy Industrial Goods | 0.8% | 0.5% | 🔼 Rising |

| Energy | -2.5% | -2.6% | 🔽 Negative |

What This Means for the ECB

With inflation stabilizing at the 2.0% target, the ECB finds itself at a potential turning point. While core inflation remains above 2%, its steady downward trend (now at its lowest level since January 2022) adds weight to arguments for a more dovish stance in coming months.

The services sector, a major inflation driver, is showing signs of softening. Meanwhile, falling energy prices continue to offset pressure from other categories. However, food inflation remains sticky, posing risks to consumer sentiment and spending.

Outlook: Patience or Pivot?

Markets are closely watching upcoming ECB statements for signals of a policy pivot. While two months of aligned inflation offer some relief, officials may still demand more sustained evidence before loosening monetary policy, especially with core inflation still above target.

Future rate decisions will likely hinge on:

- August and September inflation prints

- Labor market trends

- Global supply chain risks and energy prices

Final Thought

Inflation is finally tamed for now. But for the ECB, the job isn’t done yet. As markets speculate on when rate cuts may arrive, all eyes remain on the data.

What do you think? Will the ECB cut rates before year-end? Let us know in the comments!

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *