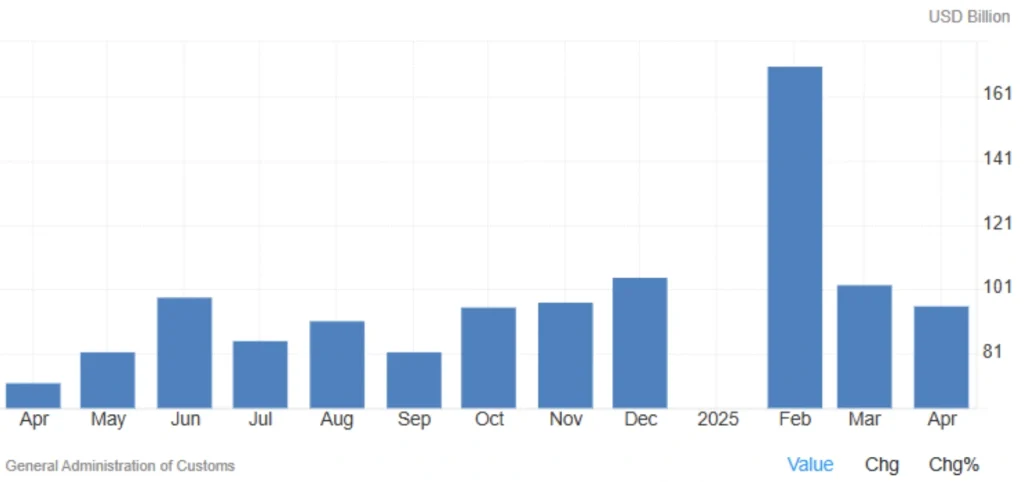

China’s Trade Surplus Soars to $96.18 Billion

China’s trade surplus climbed to $96.18 billion in April 2025, a significant leap from $72.04 billion a year earlier and well above market expectations of $89 billion. This surge was largely fueled by an 8.1% year-on-year export growth, even though exports to the U.S. dropped sharply due to renewed tariffs under the Trump administration.

Key Foreign Trade Highlights – April 2025:

| Indicator | Value / Change |

|---|---|

| Total Trade Surplus | 💰 $96.18B ▲ |

| April 2024 Surplus | $72.04B |

| Market Forecast | $89B |

| Export Growth YoY | 📈 8.1% (vs forecast 1.9%) |

| Import Change YoY | 📉 –0.2% (better than forecast –5.9%) |

| Exports to U.S. | 🔻 –21% |

| Imports from U.S. | 🔻 –13.8% |

| Trade Surplus with U.S. (April) | $20.46B (down from $27.58B in March) |

| Cumulative 4-Month Surplus (2025) | $368.8B |

| 4-Month Surplus with U.S. | $97.07B |

Educational Segment: What China’s Trade Surplus Means for the Global Economy

A trade surplus occurs when a country’s exports exceed its imports. For an export-driven economy like China, this metric is crucial to its financial health and international influence.

🔍 Why China’s Trade Surplus Matters:

- 💵 Ensures foreign currency reserves to stabilize the yuan

- 🏭 Supports employment in export-heavy industries

- 🧠 Acts as leverage in global trade negotiations

- 🏆 Reflects global competitiveness of Chinese products

China’s surplus, especially with the U.S., has long been a flashpoint in geopolitical and trade disputes.

Analysis: Global, Market & Policy Implications

🔸 Export growth of 8.1% far exceeded forecasts, indicating resilient global demand for Chinese goods—even if the pace slowed from March’s 12.4%.

🔸 U.S.-bound exports dropped by 21%, clearly impacted by Trump-era tariff reimpositions. However, diversified global markets appear to be offsetting this loss.

🔸 Imports slipped just 0.2%, a much better outcome than the projected 5.9% decline. This could suggest stable domestic demand or increased imports of raw materials for export production.

🔸 The trade surplus with the U.S. fell to $20.46B in April, yet the cumulative $97B surplus over four months remains a geopolitical concern for Washington.

On a global scale, China’s strong trade performance may boost the yuan’s strength 💴, Asian equities 📈, and commodity prices ⛏️, while also prompting tougher U.S. trade policies.

Read More: China’s Industrial Production Growth Surpasses Expectations in 2025

Summary: Key Opportunities & Risks Ahead

✅ Opportunities:

- Maintain China’s dominance as a global export powerhouse

- Deepen trade ties with non-U.S. markets

- Sustained surplus growth can support internal economic stability

❌ Risks:

- Prolonged drop in U.S. exports and escalating tariff tensions

- Weak import growth may signal sluggish domestic consumption

- Political pressure from the U.S. to curb the surplus

📍 Overall, the April 2025 trade data demonstrates China’s resilience in the face of external pressure. Yet, the road ahead hinges on how effectively it navigates ongoing trade frictions with the United States.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *