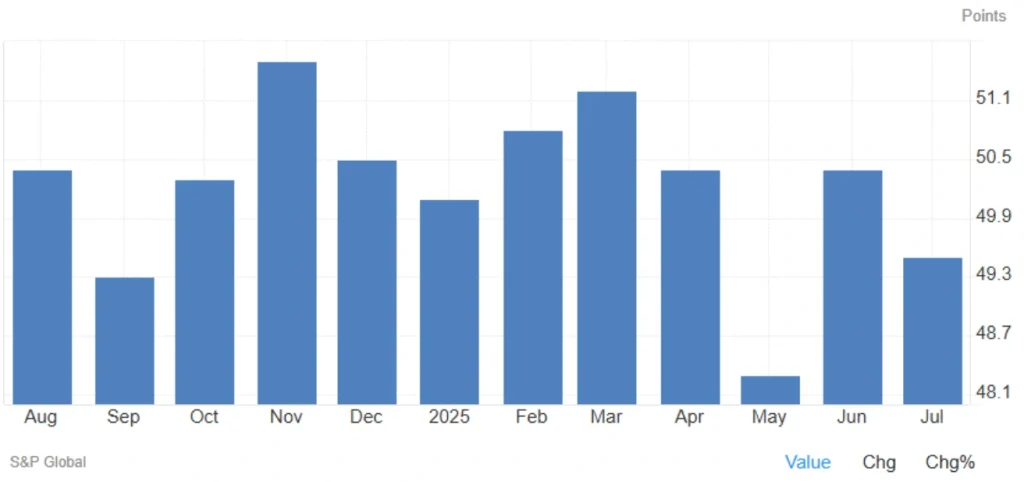

Caixin China Manufacturing PMI Falls Below Forecasts in July 2025

The Caixin China General Manufacturing PMI dropped to 49.5 in July 2025, slipping below both June’s 50.4 reading and market expectations of 50.2. This marks the second contraction in three months, raising concerns about the resilience of China’s industrial sector amid continued global trade uncertainty.

A PMI below 50 signals contraction in activity, and the latest data underscores persistent weaknesses in export demand, supply chain issues, and intense price competition.

Key Takeaways from China’s July 2025 Manufacturing PMI

- PMI fell to 49.5, below the 50.0 neutral line and June’s 50.4

- Export orders declined sharply amid trade uncertainty

- Factory output dropped for the second time since October 2023

- Employment declined, showing weaker labor market confidence

- Purchasing activity expanded, breaking a two-month decline

- Supplier delivery times lengthened due to delays and shortages

- Input costs rose after five months of declines

- Selling prices dropped, reflecting tighter competition

- Business sentiment improved, but remains below long-term average

📊 July 2025 Manufacturing PMI Snapshot

| Indicator | July 2025 | June 2025 | Forecast |

|---|---|---|---|

| Headline PMI | 49.5 | 50.4 | 50.2 |

| New Export Orders | ↓ | ↑ | – |

| Factory Output | ↓ | ↓ | – |

| Employment | ↓ | → | – |

| Input Prices | ↑ | ↓ | – |

| Selling Prices | ↓ | → | – |

| Supplier Delivery Times | ↑ (delays) | ↑ (delays) | – |

| Business Outlook | ↑ | ↑ | – |

What’s Driving the Weakness in China’s Manufacturing Sector?

1. Export Challenges Weigh on Growth

New export orders declined at the fastest rate in months as geopolitical tensions, trade restrictions, and sluggish overseas demand hampered external sales. Manufacturers remain cautious about global prospects, especially with key markets like the U.S. and Europe facing economic headwinds.

2. Rising Costs, Falling Prices

While raw material costs rose (ending a five-month streak of easing input prices) selling prices fell, reflecting the challenge of maintaining margins amid heightened domestic competition and slower demand recovery.

Read More: China’s Consumer Inflation Dips Again!

3. Labor Market Softens

With output slowing and uncertainty rising, firms became hesitant to hire. The employment sub-index dropped, signaling cautious workforce management heading into H2 2025.

Outlook: Hope Amid Headwinds

Despite the weak data, business sentiment improved slightly in July. Companies are pinning hopes on policy support, marketing campaigns, and seasonal demand to lift sales in the months ahead. Still, optimism remains below the historical average, suggesting that many firms remain skeptical about a strong rebound.

Final Thoughts

The July 2025 Caixin PMI data signals that China’s manufacturing sector faces renewed stress, especially on the external front. With falling output, contracting exports, and rising input costs, pressure is building for Beijing to offer more supportive measures to stabilize factory activity.

➡️ What’s your view on China’s economic outlook for the rest of 2025? Drop your thoughts in the comments below or share this article with others following Asian markets.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *