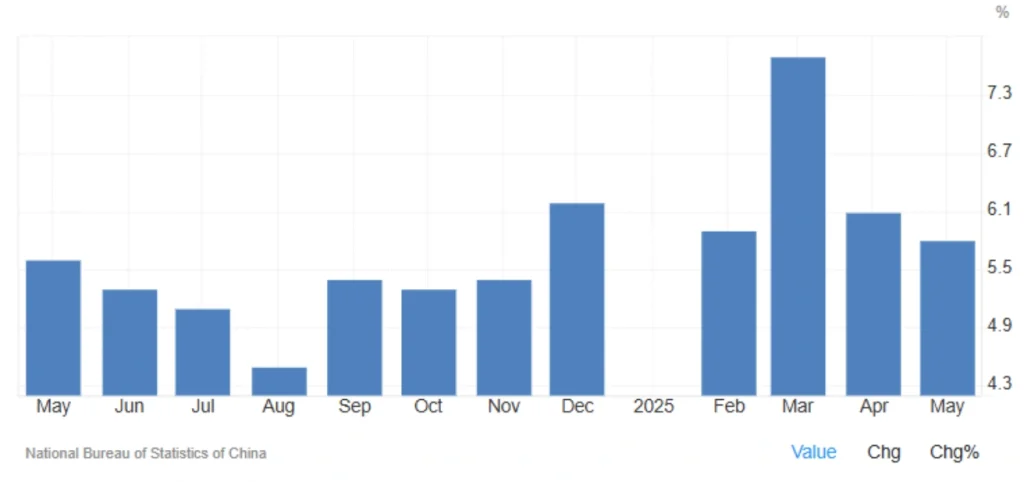

China’s Industrial Growth Slows in May 2025

Key Takeaways from May 2025

| Metric | May 2025 Value | Change from April | Market Forecast |

|---|---|---|---|

| YoY Industrial Production Growth | 5.8% | ↓ from 6.1% | 5.9% |

| MoM Growth | 0.61% | ↑ Improved | — |

| Jan–May Average Growth | 6.3% | Flat | — |

The 5.8% year-on-year growth in China’s industrial production during May 2025 marks the slowest pace since November 2024, falling short of forecasts. The decline reflects the growing impact of U.S. trade tariffs and waning global demand.

Sector Performance Breakdown

Out of 41 major industrial sectors, 35 registered growth. Here are the top performers:

| Industry | YoY Growth |

|---|---|

| 🚄 Railway & Shipbuilding | 14.6% |

| 🚗 Automotive | 11.6% |

| 💻 Computers & Communications | 10.2% |

| 🏗 Non-ferrous Metal Processing | 8.1% |

| 🌾 Agri-Food Processing | 7.6% |

| ⚗️ Chemicals | 5.9% |

| 🪨 Coal | 5.5% |

| 🛢 Oil & Gas | 5.3% |

| 🔥 Heating Utilities | 2.0% |

🔻 Declining Sector:

- Non-metallic mineral products: -0.6%

↳ This drop suggests weakened construction demand within China.

What Is Industrial Production and Why It Matters

China’s Industrial Production Index tracks changes in output across manufacturing, mining, and utilities. It’s a monthly indicator and a key signal of economic health, both domestically and globally — especially since China is the world’s largest industrial exporter.

📌 Market Sensitivity:

Changes in this index can influence:

- Commodities markets

- Asian equities

- Global forex dynamics

Market Impact & Strategic Insights

📉 Chinese Equities

- Slower growth may pressure indices like the CSI 300

- Strong auto and tech sectors may cushion broader declines

💱 Forex

- The Chinese yuan could weaken further

- More easing by China’s central bank may be anticipated

⚙️ Commodities

- Metals like copper and aluminum could face volatility

- Linked to construction and infrastructure spending

🛢 Energy

- Growth in coal, oil, and gas reflects steady demand

- Could support global energy prices

⚖️ Trade Policies

- Weak export-oriented output complicates U.S.–China talks

- Potential new tariffs under Trump-era policy pressure loom

Read More: China’s Trade Surplus Soars in March 2025

What’s Next for China’s Economy?

Short-Term Outlook:

- Trade tension escalation could hit tech exports

- Industrial growth may slow further without strong demand

Mid-Term Outlook:

- Government stimulus measures could stabilize growth

- Focus expected on technology, energy, and transport

📌 Risks & Opportunities for Investors:

| 🔎 Focus On | ⚠️ Be Cautious About |

|---|---|

| Automotive & Tech Growth | Export-reliant sectors |

| High-demand raw materials | Construction-related industries |

| Energy & logistics development | Policy-sensitive manufacturing |

Final Thoughts

May’s data shows that China’s industrial engine is still running, but the fuel is thinning. With external pressure from U.S. tariffs and internal strains like slowing construction, balanced policy support and targeted investment will be critical.

For investors and policymakers alike, this is a moment of strategic caution not alarm, but a need for watchful agility in adapting to shifting global dynamics.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *