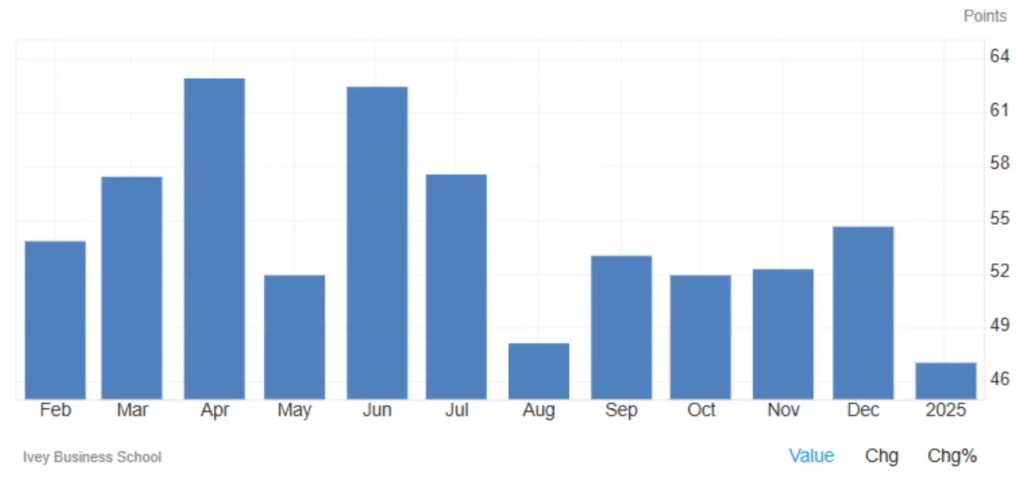

Canada’s PMI Drops to 47.1 in January 2025

The Ivey Purchasing Managers’ Index (PMI) for Canada fell sharply to 47.1 in January 2025, down from 54.7 in December and below the market expectation of 53. This drop pushes the index into contraction territory, marking its lowest level since December 2020.

Economic Indicators Signal a Slowdown

Employment Growth Slows: Dropped from 55.3 to 52.9.

Inventory Levels Fall: Decreased from 55.2 to 52.7.

Price Pressures Rise: The price index climbed from 61.5 to 64.4, adding to inflation concerns.

Unadjusted PMI Improves Slightly: Rose from 44.3 in December to 46.2 in January but remains in contraction territory.

Is Canada Heading Toward a Recession?

With the PMI below 50, Canada’s economy may be slowing down. Rising costs and lower business activity suggest that inflation could remain high, while businesses might cut back on hiring and investment in the coming months.

What is the PMI and Why Does It Matter?

Understanding the PMI

The Purchasing Managers’ Index (PMI) measures business activity across manufacturing and services. It is based on new orders, production, employment, prices, and inventories.

How to Interpret the PMI

Above 50: Economic growth

Below 50: Economic contraction

Near 50: Stability

Why Canada’s PMI Matters

It is a key economic health indicator.

Investors and policymakers use it to predict interest rate changes by the Bank of Canada.

It influences the financial markets, currency value, and business decisions.

Will the Bank of Canada Change Interest Rates?

The sharp drop in PMI signals a slowing economy, but rising inflation may prevent the Bank of Canada from cutting interest rates soon. Policymakers face a tough decision: support growth or control inflation?

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *