Bank of Japan Holds Rates at 0.5%, Raises Inflation Forecast for FY 2025

📌 Key Highlights

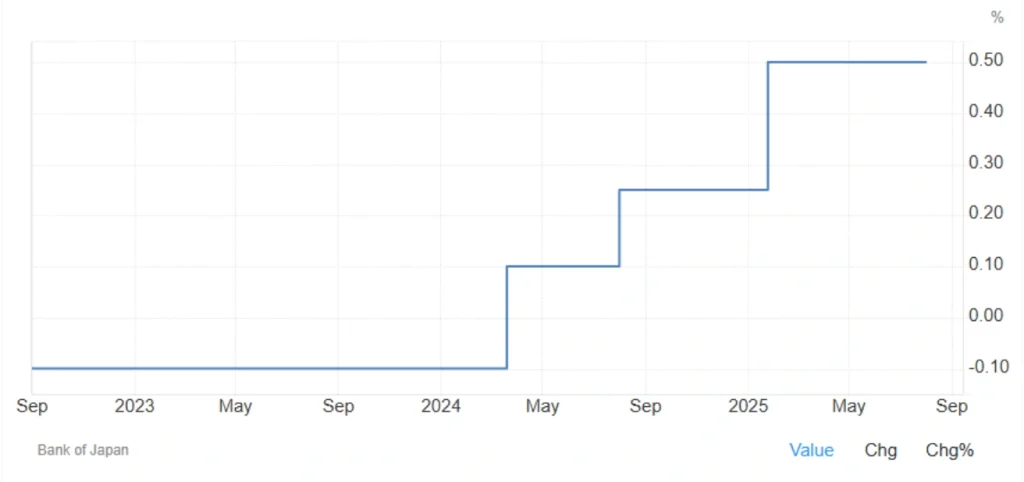

- BoJ holds short-term interest rate at 0.5% in July 2025, highest since 2008

- Core inflation forecast for FY 2025 raised to 2.7%

- FY 2025 GDP forecast upgraded slightly to 0.6% amid discussions around the BoJ interest rate in July 2025.

- U.S.-Japan trade deal supports economic outlook

- Decision was unanimous, reflecting cautious policy stance

BoJ Maintains Steady Policy

The Bank of Japan (BoJ) left its benchmark short-term interest rate unchanged at 0.5% during its July 2025 meeting, matching market expectations. The move marked the fifth straight hold and maintained borrowing costs at their highest level in 17 years, as discussions on the interest rate unfolded.

The decision was unanimous, highlighting the central bank’s careful approach to policy normalization amid lingering global uncertainties.

📈 BoJ Raises Inflation Forecast

In its quarterly economic outlook, the BoJ significantly raised its core inflation forecast for FY 2025 to 2.7%, up from the April forecast of 2.2%. With the backdrop of discussions on the BoJ interest rate, the central bank now expects inflation to:

- Ease to 1.8% in FY 2026

- Edge back up to 2.0% in FY 2027

The revised forecast reflects ongoing price pressures and the impact of robust wage agreements, but the BoJ expects inflation to moderate in the medium term.

📊 Economic Growth Outlook Improves

The BoJ also upgraded its GDP growth forecast for FY 2025 to 0.6%, slightly higher than the previous 0.5% projection. This revision comes after Japan and the United States reached a trade agreement that reduced uncertainty for Japanese exporters, amidst the BoJ interest rate deliberations.

The growth forecast for FY 2026 remains unchanged at 0.7%, suggesting a modest but steady recovery ahead.

Read More: Japan’s Inflation Eases; Monetary Policy Outlook!

Trade Deal with U.S. Brings Some Relief

Just days before the BoJ meeting, Japan finalized a new trade agreement with the United States, which eased tariffs and boosted business confidence. This development is expected to support exports and improve Japan’s fragile post-pandemic recovery.

🌐 Global Policy Contex

The BoJ’s decision comes shortly after the U.S. Federal Reserve also held its benchmark rate steady for the fifth consecutive time. As they weighed the BoJ interest rate in July 2025, both central banks are carefully navigating a complex environment marked by stubborn inflation, global trade tensions, and uncertain growth trajectories.

📌 Summary Table – Bank of Japan Economic Projections

| Fiscal Year | Core Inflation Forecast | GDP Growth Forecast |

|---|---|---|

| FY 2025 | 2.7% (↑ from 2.2%) | 0.6% (↑ from 0.5%) |

| FY 2026 | 1.8% | 0.7% |

| FY 2027 | 2.0% | Not stated |

Market watchers will keep a close eye on inflation and wage data to gauge when and if the BoJ might move toward further tightening. As the BoJ interest rate impacts discussions, the central bank seems committed to a patient, data-driven approach.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *