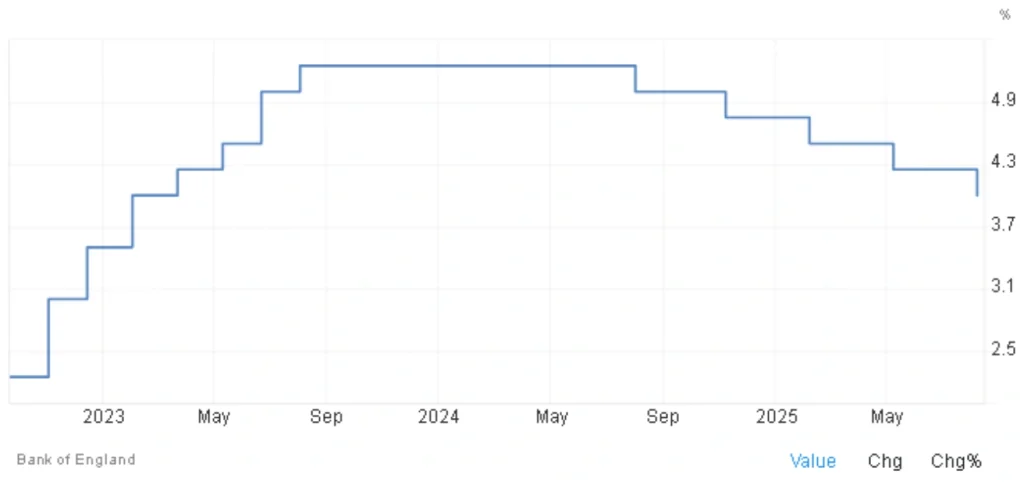

Bank of England Cuts Interest Rate to 4% in Historic Split Vote

The Bank of England cut interest rates to 4% in August 2025, marking the first reduction in over a year and the lowest level since March 2023. The decision, which came through a rare two-round vote, reflects growing tension between sticky inflation and a slowing economy.

🔍 Key Takeaways

- BoE lowers interest rate by 25 bps to 4%

- First-ever two-round vote: 5 members voted for a cut, 4 for no change

- Inflation now expected to peak at 4% in September

- Growth forecast for 2025 revised up to 1.25%

- Market eyes one more cut in 2025, rates seen near 3.5% by 2026

- Potential changes to bond sales flagged for September

📉 A Historic and Divided Move

In a narrow 5-4 decision, the BoE’s Monetary Policy Committee (MPC) voted to lower the benchmark interest rate by 25 basis points. The unusual two-round voting process, the first in the central bank’s history, underscores deep internal divisions over how to balance inflation risks with signs of economic softening.

Governor Andrew Bailey described the outcome as a “finely balanced” decision and emphasized that future rate cuts would be “gradual and careful.”

📊 Inflation vs. Growth

Despite the cut, inflation remains a central concern. The Bank now sees UK inflation peaking at 4% in September, driven by persistent price pressures in services and energy.

At the same time, there are signs of weakness in the labour market, including slowing job growth and stress from recent payroll tax hikes and minimum wage increases. Still, the BoE raised its 2025 growth forecast slightly to 1.25%, suggesting cautious optimism.

Read More: Bank of England Cuts Interest Rate to 4.25%

💼 Bond Sales and Market Outlook

The BoE hinted at changes to its quantitative tightening (QT) program in September, citing stress in long-dated gilt markets. Analysts believe this could mean fewer bond sales or adjustments in maturity structure to reduce volatility.

Markets now expect one more rate cut in 2025, with interest rates likely to stabilize around 3.5% by 2026.

📈 Summary Table

| Metric | Value (August 2025) |

|---|---|

| Interest Rate | 4.00% |

| Previous Rate | 4.25% |

| Inflation Forecast Peak | 4.00% (Sept 2025) |

| 2025 GDP Growth Forecast | 1.25% |

| QT Policy Change | Under review for September |

| 2026 Rate Expectation | ~3.5% |

📌 Conclusion

This BoE interest rate cut is a significant turning point for the UK economy. While it offers relief for borrowers, it also reflects the Bank’s caution amid inflation uncertainty and economic fragility. With internal divisions and market stress emerging, the road ahead for UK monetary policy remains complex and closely watched.

Share

Hot topics

The best indicator for short term trading

When it comes to short-term trading, everything happens quickly. Movement can take place over a matter of minutes; momentum can build and fade quickly; and traders often have to make...

Read more

Submit comment

Your email address will not be published. Required fields are marked *