Bitcoin Hits $100,000: Is a Correction on the Horizon?

Bitcoin recently broke past the $100,000 mark, setting a new all-time high in its history. This significant milestone has garnered immense attention from traders and analysts, particularly those looking to safeguard their assets against a potential price correction. Recent reports indicate a surge in demand for put options, reflecting growing concerns about a possible price pullback in the near future.

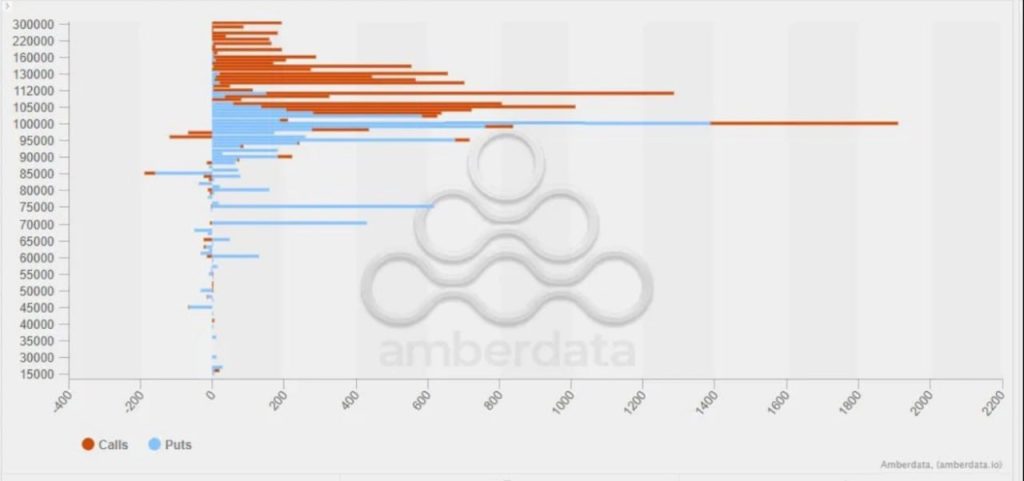

Spike in Demand for Put Options

Over the past 24 hours, the highest trading volumes have been recorded in put options with strike prices of $95,000 and $100,000. This trend highlights a strong interest in securing profits in case Bitcoin’s price declines. Additionally, demand for puts in the $75,000 and $70,000 price ranges is also on the rise, particularly for expiration dates in December and January, attracting significant attention.

What’s Driving Bitcoin’s Bull Run?

Bitcoin’s recent rally is partly attributed to the appointment of the new chair of the U.S. Securities and Exchange Commission, who is known for being crypto-friendly. This shift in U.S. policy has sparked a wave of optimism about greater acceptance of Bitcoin and other cryptocurrencies. Since last month’s election, Bitcoin’s price has surged by approximately 50%.

Funding Rate Trends in the Crypto Market

One of the key indicators in the crypto market is the funding rate, which reflects strong demand for leveraged positions. Currently, the funding rate is near its historical peak, signifying heightened interest in leveraged positions in futures contracts—a trend often seen during bullish market phases.

Market Analysis

Short-Term Call Option Demand Surges: Over the past 24 hours, short-term call options with strike prices of $100,000 and $110,000 have seen significant increases in demand, reflecting a bullish outlook.

Potential for Price Correction: Many analysts believe the sharp rise in funding rates may lead to a price correction. Historically, such trends often result in pullbacks and corrections in Bitcoin’s price.

Key Takeaways for Investors

Market Volatility: High market volatility can create opportunities for risk management and profit-taking.

Leveraged Positions: Given the rising funding rates, investors should exercise caution with leveraged positions and associated risks.

Diversified Strategies: To mitigate market risks, combining different strategies, such as buying put and call options, can be beneficial.

Conclusion

As Bitcoin surpasses the $100,000 mark, the cryptocurrency market continues to undergo significant changes. While the bullish outlook remains, investors should remain vigilant about market volatility and leveraged positions. History shows that corrections often follow such dramatic surges. Staying informed about market conditions and managing risk effectively are crucial for navigating this dynamic period.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *