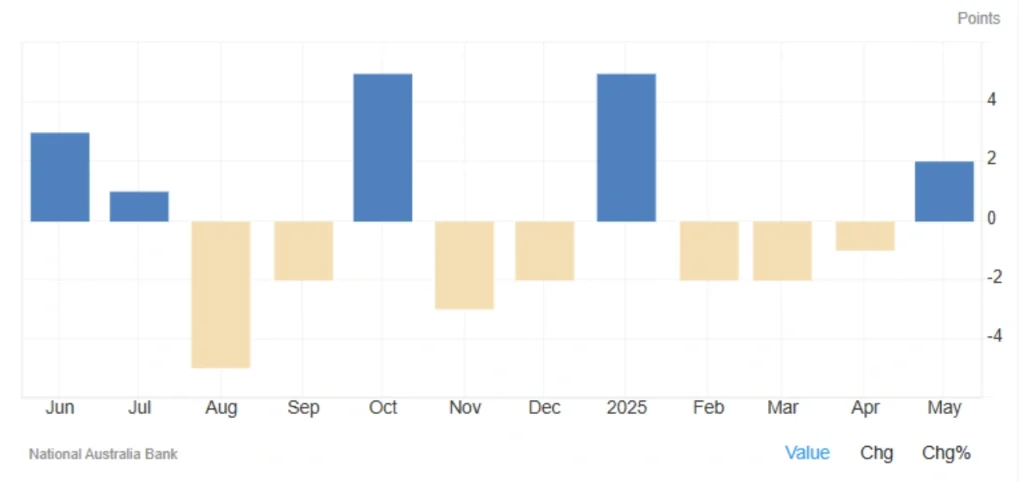

Australian Business Confidence Turns Positive

After months of sluggish sentiment, Australian businesses are finally showing cautious optimism but the rebound comes with major caveats. Let’s dive into the latest NAB survey and what it means for markets.

Key Takeaways at a Glance

Business Confidence: +2 (up from -1 in April) – first positive reading since January 2025

Business Conditions: Stuck at 0 (down from +2) – signaling weak economic activity

Profitability & Employment: Still in the red (-4 and 0, respectively)

Bright Spots: Retail, construction, and services improved – but mining & manufacturing lag

NAB Business Survey Snapshot (May 2025)

| Metric | Latest | Trend |

|---|---|---|

| Business Confidence | +2 | ↑ (Improving) |

| Business Conditions | 0 | ↓ (Weakening) |

| Employment Index | 0 | ↓ (Slowing hiring) |

| Profitability | -4 | → (No change) |

| Forward Orders | -2 | ↑ (Less bad) |

| Capacity Utilization | 82.3% | ↑ (Higher demand) |

What’s Driving the Shift?

👍 The Good News

- Retail & Services Rebound – Consumer-facing sectors are leading the recovery.

- Construction Uptick – Possibly linked to government infrastructure projects.

- Higher Capex (↑ to +6) – Businesses are investing more, a sign of medium-term optimism.

👎 The Bad News

- Weak Hiring (0) – Companies aren’t rushing to add jobs.

- Falling Profitability (-4) – Margins are under pressure.

- Manufacturing & Mining Struggle – Global demand and commodity prices remain a drag.

RBA & Market Impact: What’s Next?

💵 AUD (Australian Dollar)

- Short-term support from improved confidence.

- But rate cuts still possible if hiring & profits stay weak → AUD/USD could dip.

📉 Stocks to Watch

- 🛒 Consumer & Tech Sectors – Benefit from lower inflation (final product prices at 0.5%).

- 🏭 Industrial Stocks at Risk – Weak sales & orders = earnings pressure.

🏦 RBA Policy Outlook

- No hikes soon – Economy still too fragile.

- Rate cuts in H2 2025? If job market slows further.

Read More: Australia’s Central Bank Cuts Interest Rate

3 Possible Scenarios Ahead

1️⃣ Soft Landing (Best Case)

- Confidence keeps rising, hiring picks up → AUD strengthens, stocks rally.

2️⃣ Stagnation (Base Case)

- Conditions stay weak, RBA holds rates → Sideways markets, selective stock gains.

3️⃣ Downturn (Worst Case)

- Profit slump deepens → Rate cuts, AUD drops, defensive assets (gold) rise.

Bottom Line

Business mood is improving, but the recovery is uneven. Watch:

- Next jobs report → Will hiring rebound?

- RBA statements → Any dovish hints?

- Global demand → Can manufacturing recover?

What’s your take? Is this a turning point or just a blip? Drop a comment!

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *