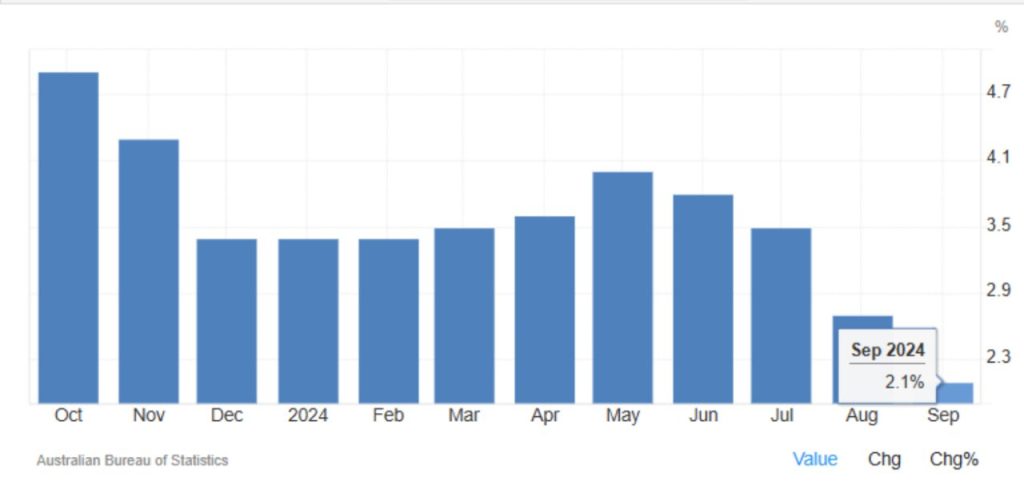

Australia Monthly CPI Indicator

In September 2024, Australia’s Consumer Price Index (CPI) increased by 2.1% compared to the previous year, marking a significant cooling in inflation. This rate not only undershot market expectations of 2.4% but also showed a noticeable drop from August’s 2.7%, reaching its lowest level since July 2021. The inflation rate remaining within the Reserve Bank of Australia’s (RBA) target range of 2-3% for a second straight month is a positive signal for the Australian economy, suggesting potential stability following prolonged price volatility. Many analysts are hopeful that this indicates the start of a period of balanced inflation, which may lead the RBA to consider less aggressive measures to control prices.

Energy Prices Lead the Decline with Government Rebate Support

One of the most significant contributors to the decline in inflation was the record drop in electricity prices, which fell by 24.1% year-on-year. This decline was supported by the federal government’s Energy Bill Relief Fund rebate, which offered financial relief to households grappling with rising energy costs. The rebate has had a substantial impact on the monthly CPI, making energy more affordable for consumers and easing a major driver of inflation. Additionally, fuel prices also dropped significantly, recording a 14.0% decline, further contributing to the easing of inflation. Lower fuel and energy prices have provided widespread relief across Australian households and businesses, particularly in regions and sectors where energy costs constitute a significant part of operating expenses.

Slowing Price Growth in Key Sectors Offers Broad-Based Stability

Beyond energy and fuel, September’s CPI data revealed slower growth in other essential sectors, including food, alcohol, healthcare, and recreation. These areas typically experience more resilience to price fluctuations, but the easing seen this month reflects a broader trend toward cost stability. Food prices, for instance, have been stabilizing, helping ease the financial pressure on households and aiding in reducing grocery bills. Healthcare and recreation costs also rose at a slower pace, supporting a broader trend of inflation moderation. This stabilization in essential sectors is critical, as it can significantly influence consumer spending behavior and contribute to overall economic stability.

Core Inflation Moderates as Volatile Items Excluded

When excluding volatile items like food and energy, the CPI recorded a more modest increase of 2.7% year-on-year, marking the smallest gain since November 2021. This core inflation measure is particularly important for policymakers as it reflects underlying price trends without the influence of highly variable items. The moderation in core inflation suggests that, beyond the effects of temporary factors such as government rebates, Australia’s inflationary pressures are genuinely easing. This shift might provide the RBA with more flexibility in its monetary policy decisions, potentially allowing it to avoid aggressive rate hikes in favor of a more balanced approach. Looking forward, a continued downward trend in both headline and core CPI could reinforce confidence in Australia’s path to sustainable price stability.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *