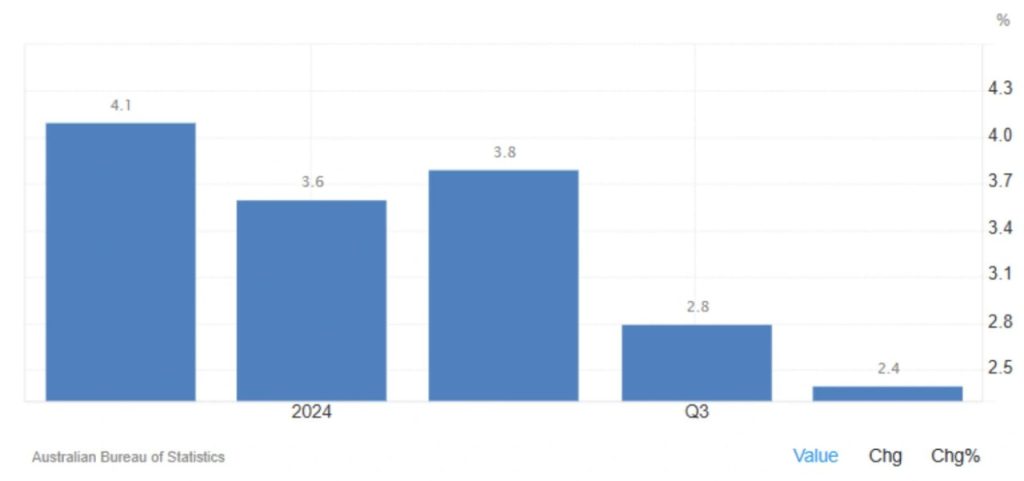

Australia’s Inflation Rate Falls to 2.4% in Q4 2024

Australia’s inflation rate dropped to 2.4% in Q4 2024, down from 2.8% in Q3, marking the lowest level since Q1 2021. This decline was slightly better than market expectations of 2.5%. The primary driver behind this slowdown was a significant easing in goods inflation, which fell to 0.8% from 1.4%. A sharp reduction in electricity prices (-25.2% vs -15.8%) and fuel costs (-7.9% vs -6.2%) played a major role, largely due to the continued impact of Energy Bill rebates. Additionally, the cost of new dwellings increased at a slower rate, further contributing to the easing inflationary pressure.

Services Inflation at a Three-Quarter Low

While services inflation remained elevated, it declined to 4.3% from 4.6%, reaching its lowest level in three quarters. The price slowdown was observed across multiple sectors, including food (3.0% vs 3.3%), alcohol and tobacco (6.2% vs 6.7%), clothing (1.3% vs 1.7%), housing (1.0% vs 2.8%), health (4.0% vs 4.8%), and insurance & financial services (5.4% vs 6.2%). These broad-based reductions indicate easing cost pressures for Australian consumers, which may help improve household spending power.

Rising Costs in Select Sectors

Despite the overall decline in inflation, certain sectors experienced rising costs. The recreation category saw inflation accelerate to 3.3% from 2.1%, while education costs inched higher to 6.5% from 6.4%. Household services also saw an increase, rising to 1.5% from 0.7%. These areas of inflationary pressure suggest that while general price stability is improving, some industries continue to face cost increases.

Read More : Australia Monthly CPI Indicator

RBA’s Inflation Target Still Unmet

The Reserve Bank of Australia (RBA) closely monitors the Trimmed Mean CPI, a key measure of core inflation. In Q4 2024, this metric rose 3.2% year-over-year, marking the slowest gain in three years. However, it still remained slightly above market forecasts of 3.3% and exceeded the RBA’s 2-3% target range. While the declining inflation rate is a positive development, the central bank may continue its cautious approach to monetary policy until inflation firmly settles within its preferred range.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *