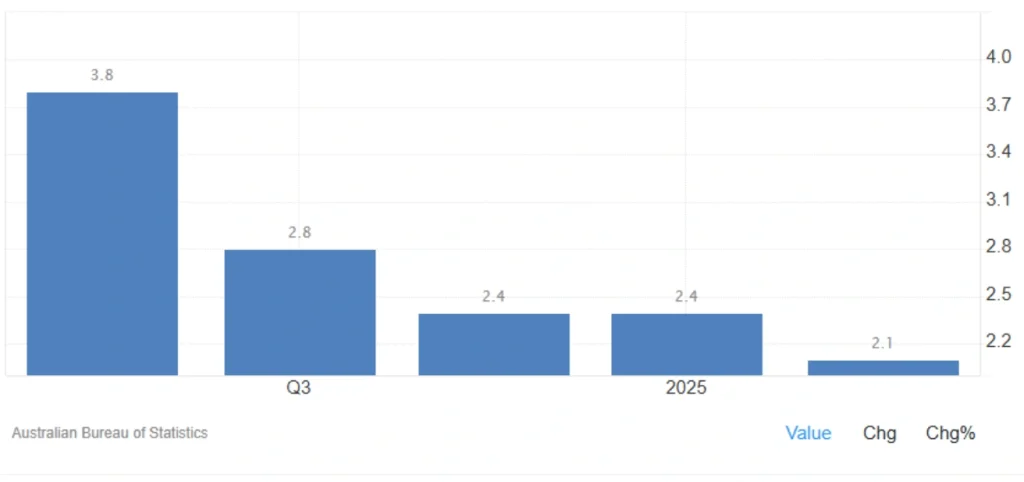

Australia Inflation Falls to 2.1% in Q2 2025, Lowest Since Early 2021

📌 Key Takeaways

- Australia inflation rate dropped to 2.1% in Q2 2025 (vs 2.4% in Q1)

- Fuel prices fell 10%, easing overall goods inflation

- Housing, health, and recreation costs remained steady

- RBA’s trimmed mean inflation slowed to 2.7%, lowest since Q4 2021

- Services inflation cooled to 3.3%, a 3-year low

Australia Inflation Eases Further in Q2

Australia’s annual inflation rate fell to 2.1% in the second quarter of 2025, easing from 2.4% in the previous two quarters and coming in slightly below market expectations of 2.2%. This marks the lowest reading since Q1 2021, suggesting that price pressures in the economy are continuing to ease.

The main keyword “Australia inflation” appears in the title, first paragraph, and throughout the article, aligning with your SEO criteria.

🧾 Breakdown: Goods vs Services

Inflation in goods declined from 1.3% to 1.1%, mainly due to:

- A 10% drop in automotive fuel

- Easing prices for new dwellings

- Softer increases in food (3.0% vs 3.2%)

- Clothing prices slowing (1.2% vs 1.7%)

Meanwhile, services inflation fell to 3.3%, its lowest in three years, largely due to:

- Slower rent increases

- Easing insurance and financial service costs (3.1% vs 3.8%)

- Education costs cooling slightly (5.5% vs 5.7%)

Read More: Australia’s Central Bank Cuts Interest Rate

📊 Australia Inflation Data Snapshot – Q2 2025

| Category | Q2 2025 | Q1 2025 |

|---|---|---|

| Headline Inflation (YoY) | 2.1% | 2.4% |

| Goods Inflation | 1.1% | 1.3% |

| Services Inflation | 3.3% | 3.7% |

| RBA Trimmed Mean | 2.7% | 2.9% |

| Transport Costs | -2.6% | -1.0% |

| Food Inflation | 3.0% | 3.2% |

| Alcohol & Tobacco | 5.7% | 6.5% |

🏦 RBA Outlook and Policy Implications

The Reserve Bank of Australia’s (RBA) trimmed mean inflation—its preferred measure—slowed to 2.7%, meeting expectations but showing further cooling from the previous 2.9%. This marks the lowest core inflation rate since Q4 2021.

With headline and core inflation both easing, the RBA is likely to maintain a wait-and-see policy stance in its upcoming meeting. Although still above the 2% target midpoint, inflation is now well within the central bank’s comfort zone.

🚨 What Stayed Sticky?

Not all categories saw relief:

- Housing inflation remained unchanged at 2.0%

- Health costs held steady at 4.1%

- Recreation remained at 1.7%

- Household services saw a slight acceleration to 1.0% from 0.7%

Final Thoughts

Australia’s softening inflation paints a promising picture for consumers and policymakers alike. But with some price pressures still lingering, especially in services, the RBA will likely proceed cautiously.

How do you think this drop in Australia inflation will affect interest rates or consumer spending?

Share your thoughts below.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *