Understanding Bitcoin: The Pioneer of Cryptocurrency

Estimated reading time: 7 minutes

Table of contents

Understanding Bitcoin is essential to grasp the significance of the first and most well-known cryptocurrency, which was introduced to the world in 2009 by an anonymous entity known as Satoshi Nakamoto. Since its inception, Bitcoin has sparked a financial revolution, challenging traditional currencies and financial systems. In this blog post, we will explore the fundamentals of Bitcoin, the enigma surrounding its creator, its underlying technology, its economic implications, and its potential future.

The Mystery of Bitcoin’s Creator

The true identity of Satoshi Nakamoto remains one of the greatest mysteries in the world of technology and finance. Nakamoto published the Bitcoin white paper in 2008, outlining a peer-to-peer electronic cash system. Despite significant speculation over the years, including theories suggesting Nakamoto could be a group of individuals or even prominent figures in technology, no definitive proof has emerged to confirm any theory.

- The White Paper: The Bitcoin white paper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” was published on a cryptography mailing list. It proposed a system that allowed for online payments to be sent directly from one party to another without going through a financial institution. This concept laid the foundation for the cryptocurrency revolution.

- Communication and Departure: Nakamoto was actively involved in Bitcoin’s development in its early years, communicating with developers and users via online forums and email. However, in 2010, Nakamoto gradually faded from the scene, leaving Bitcoin’s development to others. The last known communication from Nakamoto was in 2011, sparking endless speculation about their identity and reasons for withdrawal.

- Speculation on Identity: Various individuals have been suggested as potential candidates for Nakamoto’s true identity, including computer scientists, cryptographers, and even a group of people. Notable figures mentioned include Hal Finney, Nick Szabo, and Craig Wright, who claims to be Nakamoto but has not provided sufficient evidence to support his assertion. The allure of the mystery adds to Bitcoin’s intrigue and narrative.

What is Bitcoin?

Bitcoin is a decentralized digital currency that enables peer-to-peer transactions without the need for intermediaries like banks. It is based on blockchain technology, which is a distributed ledger that records all transactions across a network of computers. This decentralization is one of Bitcoin’s key features, as it reduces the risks associated with centralized financial systems, such as fraud and censorship.

Read More: What Does Lower Bitcoin-Ether Correlation Mean for Investments?

How Does Bitcoin Work?

- Blockchain Technology: Bitcoin transactions are recorded on a public ledger known as the blockchain. Each block in the chain contains a list of transactions, and once a block is filled, it is added to the chain. This chain is maintained by a network of nodes (computers) that validate transactions and ensure the integrity of the data. The blockchain’s transparency and immutability are fundamental to Bitcoin’s trustworthiness.

- Mining: Bitcoin mining is the process through which new bitcoins are created and transactions are verified. Miners use powerful computers to solve complex mathematical problems, and when they succeed, they are rewarded with newly minted bitcoins. This process is crucial for maintaining the security of the network and preventing double-spending.

- Proof of Work: Bitcoin uses a consensus mechanism called Proof of Work (PoW). Miners compete to solve cryptographic puzzles, and the first to solve the puzzle gets to add the next block to the blockchain. This process is energy-intensive and ensures that the network remains secure against attacks.

- Wallets: Bitcoin is stored in digital wallets, which can be software-based (online or mobile wallets) or hardware-based (physical devices). These wallets store the user’s private keys, which are necessary to access and manage their bitcoins. Understanding wallet security is critical, as losing access to a wallet can result in the irreversible loss of funds.

The Economic Implications of Bitcoin

Bitcoin’s total supply is capped at 21 million coins, making it a deflationary asset. This scarcity, combined with increasing demand, has contributed to its price volatility. Investors often view Bitcoin as a hedge against inflation and a store of value, leading to its comparison with gold as a “digital gold.”

Bitcoin offers a decentralized alternative to traditional banking systems, providing financial services to individuals without access to banking. This potential for financial inclusion has gained traction in developing countries, where many people remain unbanked. Bitcoin enables these individuals to participate in the global economy without the need for intermediaries.

Over the years, Bitcoin has attracted investors looking to capitalize on its price movements. Its rapid appreciation has led to speculation, drawing both institutional and retail investors. However, this speculative nature also contributes to its volatility, leading to significant price fluctuations in short periods.

Bitcoin transactions can experience high fees and slow processing times during peak demand. This has led to the development of second-layer solutions, such as the Lightning Network, which aim to facilitate faster and cheaper transactions.

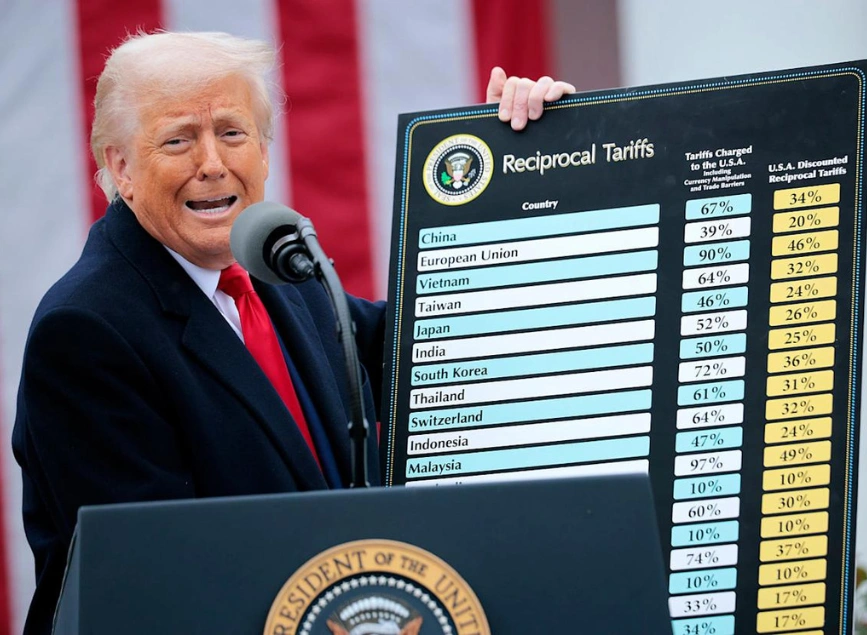

Read More: Bitcoin Amid the Tariff Storm: Investors Seeking a New Financial Refuge

Challenges and Criticisms

Governments worldwide are grappling with how to regulate Bitcoin. Some countries have embraced it, while others have imposed strict regulations or outright bans. Regulatory uncertainty can impact Bitcoin’s adoption and price, with potential implications for its status as a currency or asset class.

Bitcoin mining consumes significant energy, leading to concerns about its environmental impact. Critics argue that the carbon footprint associated with mining operations contradicts the goal of creating a sustainable financial system. Proponents, however, argue that the benefits of a decentralized currency outweigh the environmental costs, and efforts are being made to explore renewable energy sources for mining.

While the Bitcoin network itself is highly secure, users can be vulnerable to hacking and fraud if they do not take adequate security measures. The loss of private keys or falling victim to phishing attacks can result in the permanent loss of bitcoins. Furthermore, cryptocurrency exchanges have experienced high-profile hacks, leading to substantial losses for investors.

The Future of Bitcoin

Bitcoin’s future remains a topic of debate among experts and enthusiasts. As the cryptocurrency landscape evolves, several potential developments could shape its trajectory. More businesses and individuals are beginning to accept Bitcoin as a form of payment, which could lead to greater mainstream adoption. The integration of Bitcoin into payment systems and financial products may further legitimize its use.

Innovations such as the Lightning Network aim to improve Bitcoin’s scalability and transaction speed. These advancements could enhance its usability for everyday transactions, making it a more viable alternative to traditional currencies. Institutional investment in Bitcoin has surged, with companies like MicroStrategy and Tesla adding Bitcoin to their balance sheets. As more institutional players enter the market, it could stabilize prices and encourage wider acceptance.

How governments choose to regulate Bitcoin will play a significant role in its future. Clear and favorable regulations could foster innovation and adoption, while overly restrictive policies could stifle growth. As the cryptocurrency ecosystem grows, Bitcoin faces competition from other digital assets that aim to improve upon its limitations. However, Bitcoin’s established network, brand recognition, and first-mover advantage position it favorably in the market.

Read More:Exploring Alternative Investments: Gold, Crypto & Beyond

Conclusion

Bitcoin has undoubtedly revolutionized the way we think about money and finance. Its enigmatic creator and the underlying technology continue to captivate the imagination of investors and enthusiasts alike. While Bitcoin presents both opportunities and challenges, its impact on the global financial system is undeniable. As Bitcoin continues to evolve, its future will depend on technological advancements, regulatory developments, and the willingness of individuals and businesses to embrace this new digital asset. Whether viewed as a speculative investment or a revolutionary financial tool, understanding Bitcoin is essential in navigating the future of finance. The journey of Bitcoin, marked by mystery, innovation, and controversy, is just beginning, and its story will continue to unfold in the years to come.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *