What is ATH (All-Time High)? A Complete Guide for Traders and Investors

In the world of finance, especially trading and investing, you may often hear the term ATH. This abbreviation stands for All-Time High, a key metric used by traders, investors, and analysts to gauge the performance of an asset. Whether you’re dealing with stocks, cryptocurrencies, commodities, or indices, understanding ATH can provide critical insights into market trends and help you develop better investment strategies.

In this comprehensive guide, we’ll dive deep into what ATH means, its significance, how it influences market behavior, and how traders can effectively use it in their decision-making process.

What is ATH (All-Time High)?

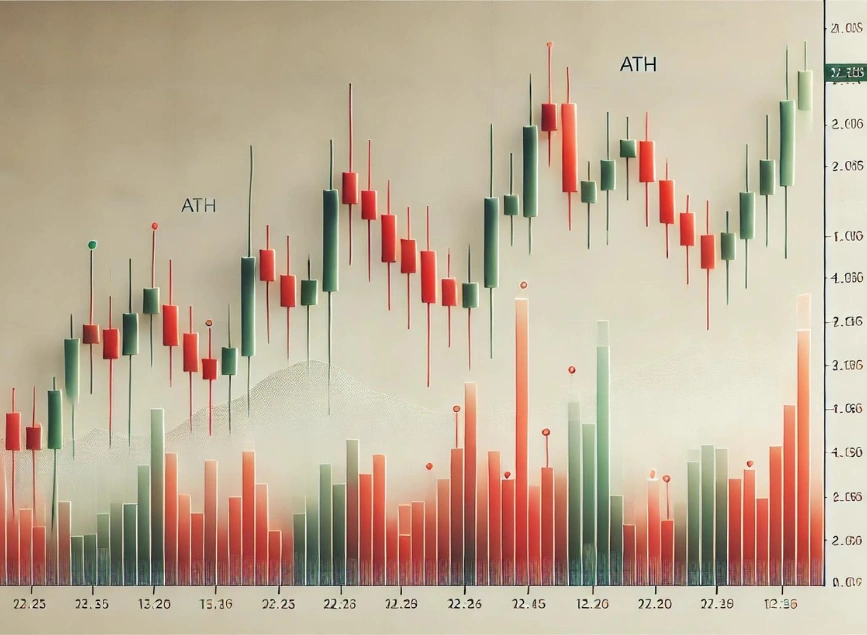

The term All-Time High (ATH) refers to the highest price that an asset has ever achieved in its trading history. This price is considered the peak or record level for that asset, marking a significant milestone in its performance.

For example, if a particular stock reaches a price of $100, which is the highest it has ever been, we say that the stock has reached its ATH. Similarly, cryptocurrencies like Bitcoin or Ethereum often hit new ATHs during periods of market hype or positive sentiment.

When an asset hits its ATH, it indicates that the market has never valued the asset higher, often reflecting strong investor demand and favorable market conditions.

Why ATH is Important for Traders and Investors

Reaching an ATH typically reflects strong bullish sentiment. Investors believe in the asset’s future growth potential, and the rising demand pushes the price to new heights. When an asset hits its ATH, it usually draws attention from both institutional and retail investors, leading to increased trading activity.

New ATHs can create a momentum effect, where traders jump in with the expectation of further gains, resulting in what is often called a “buying frenzy”. On the flip side, hitting an ATH can also trigger selling, as some traders decide to lock in profits.

Psychological Milestone

An ATH level often acts as a psychological barrier for both traders and investors. It’s common for people to adjust their trading strategies when an asset nears or surpasses its previous ATH. For example:

- Buyers may perceive the ATH as a sign of strength, leading them to enter the market in anticipation of future gains.

- Sellers may see the ATH as an opportunity to cash in their profits, believing the asset could experience a price correction after reaching its peak.

These psychological triggers often result in high volatility as both sides of the market—buyers and sellers—clash over the asset’s future direction.

Signal for Trend Reversal or Continuation

Traders use ATHs as a critical tool for technical analysis. When an asset consistently breaks through its ATH, it signals a strong uptrend. Investors may interpret this as a sign of sustained bullish momentum, possibly driving the price higher.

On the other hand, if an asset repeatedly fails to break through its ATH, it may indicate resistance, suggesting that the market is overbought or reaching a saturation point. In such cases, investors often anticipate a trend reversal or correction, where the price could fall after testing the ATH level multiple times.

ATH as a Benchmark for Performance

For long-term investors, ATHs serve as key performance indicators. Investors often compare current prices with past ATHs to measure the asset’s growth potential or to evaluate their investment returns. For example, if a stock’s current price is near or above its ATH, it could be a signal of good performance, and a sign that the company or asset is on a positive trajectory.

How to Identify ATH in Trading

Identifying an asset’s ATH is quite straightforward. Most trading platforms and charting tools provide historical price data that makes it easy to pinpoint the highest recorded price for any given asset. Here’s how traders typically identify and use ATHs:

- Using Price Charts and Historical Data

The simplest way to find an asset’s ATH is to check its price chart. Platforms like MetaTrader, TradingView, or any financial news site offer visual representations of price history, which can help you identify peak levels. In these charts, ATH levels often appear as noticeable peaks, representing the highest points the price has reached over time. - Utilizing Technical Indicators

To gain further insights, traders often use technical analysis tools like:- Fibonacci Retracement Levels: These help to predict potential future resistance and support levels based on previous ATHs.

- Moving Averages: Tracking moving averages over different periods can help traders understand the momentum leading to the ATH.

- Relative Strength Index (RSI): This can be used to check whether an asset is overbought or oversold as it approaches its ATH.

- Staying Informed on Market Events

New ATHs are often driven by fundamental factors such as positive earnings reports, new partnerships, or favorable economic conditions. For cryptocurrencies, factors like network upgrades or increased adoption can push prices to new ATHs. Keeping an eye on market news and upcoming events is crucial for anticipating these moves.

ATH in Different Markets: Stocks, Cryptocurrencies, Commodities

While the concept of ATH applies universally across various asset classes, its dynamics can vary depending on the market:

- Stocks: When a stock reaches its ATH, it may attract more attention from the broader market. However, stocks may experience pullbacks after reaching their ATH due to profit-taking or concerns over valuations.

- Cryptocurrencies: The cryptocurrency market is particularly known for its frequent and volatile ATHs. Given the speculative nature of digital assets, cryptos like Bitcoin and Ethereum often hit new ATHs in short periods, only to experience rapid corrections afterward.

- Commodities: In the commodities market, ATHs can be triggered by supply and demand imbalances. For example, during times of geopolitical tensions or natural disasters, prices for commodities like gold, oil, or wheat may hit new ATHs due to limited supply or increased demand.

How to Trade Around ATH

- Breakout Trading

One of the most popular strategies for trading around ATH levels is breakout trading. This strategy involves entering a trade when the price breaks above the previous ATH, with the expectation that the asset will continue its upward momentum. - Cautious Trading

However, not every breakout leads to sustained upward movement. In many cases, the price might fall back after reaching a new ATH, a phenomenon known as a false breakout. To manage this risk, traders often wait for a confirmation, such as multiple candlesticks closing above the ATH level, before entering a trade. - Profit-Taking at ATH

On the opposite side, some traders view the ATH as a good opportunity to take profits. If an asset has been on an extended bullish run, hitting an ATH could signal the peak of the trend, encouraging traders to sell before a potential correction.

Conclusion: Mastering the ATH for Better Trading Outcomes

Understanding the concept of ATH is crucial for traders and investors looking to maximize their market performance. ATHs not only serve as a benchmark for the highest price an asset has reached but also provide valuable insights into market sentiment, potential resistance levels, and future trends.

By incorporating ATH analysis into your trading strategy—whether through breakout trading, profit-taking, or simply gauging market confidence—you can better navigate the complexities of today’s dynamic markets. Stay informed, use the right tools, and always be mindful of the risks when trading around ATH levels.

Share

Hot topics

Federal Reserve’s Challenges to Trump’s New Policies

As the Federal Reserve Open Market Committee (FOMC) prepares for its upcoming meeting, all eyes are on how the Fed will respond to Donald Trump’s latest economic policies. With the...

Read more

Submit comment

Your email address will not be published. Required fields are marked *