Goldman Sachs Warning: S&P 500 Could Drop 5% Following Trump’s Tariffs

Goldman Sachs analysts have raised concerns that new tariffs imposed by the Trump administration could cause a 5% drop in the S&P 500 in the coming months. These tariffs are set to impact global trade and corporate earnings, fueling investor uncertainty.

What Are the New Tariffs?

The latest measures include:

- 25% tariff on imports from Mexico and Canada

- 10% tariff on imports from China

- Potential new tariffs on the European Union

These unexpected moves have unsettled investors, who had anticipated tariffs only if trade talks failed.

How Could This Impact the Market?

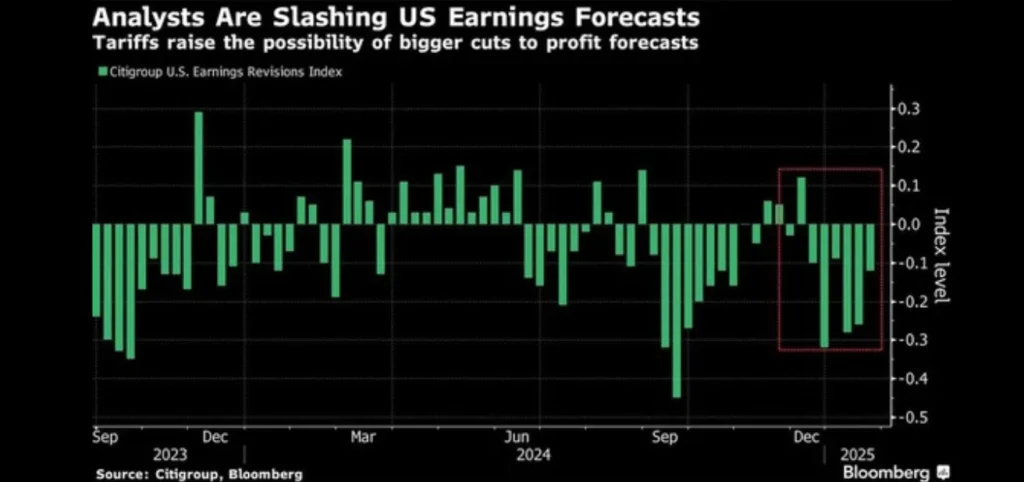

Lower Corporate Profits

Higher import costs could cut profit margins, particularly for manufacturing and tech companies.

Increased Inflation Risks

Tariffs could push up prices, leading to higher inflation and forcing the Federal Reserve to maintain high interest rates.

Rising Recession Fears

A prolonged trade conflict could slow economic growth and trigger a broader market sell-off.

What Experts Are Saying

- David Kostin, Goldman Sachs: Persistent tariffs may reduce S&P 500 earnings by 2%–3% and lead to a 5% market drop.

- Michael Wilson, Morgan Stanley: The market has reacted mildly, but prolonged tariffs will increase selling pressure.

- Lori Calvasina, RBC Capital Markets: There’s now a higher chance of a 5%–10% S&P 500 decline.

Should Investors Be Worried?

With growing trade tensions, the market outlook remains uncertain. Investors should stay alert to policy updates, monitor inflation risks, and consider diversifying their portfolios to navigate potential volatility.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *