Otet View on Saturday, May 25, 2024

Recent U.S. economic data has once again surprised market participants with better-than-expected PMI numbers and a strengthening labor market, as only 215,000 people applied for unemployment benefits. Additionally, durable goods orders exceeded expectations, suggesting that the manufacturing sector is on firmer footing.

In Canada, inflation slowed more than forecasted, supporting the Bank of Canada’s earlier rate cut, likely in June. In the UK, economic data was mixed: economic activity was lackluster, and inflation decelerated less than anticipated, maintaining the prospect of an interest rate reduction in August or later. Meanwhile, in the Eurozone, optimistic data confirmed a slow increase in economic activities, with PMI numbers exceeding expectations.

On the central banks’ front, the April minutes of the FOMC meeting and comments from Fed officials throughout the week indicated that more time and evidence are needed to be certain that inflation is on track to reach the 2% target.

The Reserve Bank of New Zealand (RBNZ) held its policy rate steady at 5.50%, but its accompanying statements and economic forecasts were hawkish. In Turkey, the Central Bank of the Republic of Turkey (CBRT) also kept the one-week repo rate unchanged at 50%.

Looking ahead to the coming week, key U.S. data releases include Consumer Confidence (Tuesday), the Beige Book (Wednesday), Q1 2024 GDP (Thursday), and Personal Income & Spending (Friday). Additionally, important international data to watch includes China’s PMIs, Eurozone CPI, and Canada’s GDP, all due on Friday.

Wall Street

Looking more closely at the published U.S. data, the effects of prolonged high interest rates are becoming more apparent. The 30-year fixed mortgage rate steadily climbed from 6.6% in early February to over 7.0% in mid-April. Persistent inflation in the first quarter and comments from FOMC members delayed expectations for a rate cut. This environment caused a slump in single-family home demand, prompting existing home sales to dip 1.9% in April. Meanwhile, new home sales fell by a sharper-than-anticipated 4.7% over the month.

On the positive side, the labor market delivered surprising numbers. Initial jobless claims for the week ending May 17 were only 215,000, much lower than estimates and the previous week’s figures. Additionally, durable goods orders rose by 0.7% in April, defying expectations of a 0.9% decline. This marks three consecutive months of increasing orders, suggesting that the manufacturing sector is on a firmer footing compared to 2023 and other global economies.

In the coming week, the most significant data points will be the Consumer Confidence report on Tuesday and the Personal Income & Spending numbers on Friday. PCE and Core PCE numbers for the first quarter will also be released on Thursday. Consumer confidence, measured by the CB index, has been declining from above 114 in January to 97 in April. For May, we expect this trend to continue, potentially dropping further to around 95. On Friday, the personal income and spending numbers are expected to confirm last week’s CPI data, showing both PCE and Core PCE increasing at a slower pace alongside personal spending.

Given the anticipated data and the signs of a softening labor market and inflation, the first rate cut could still occur in September, potentially supporting bullish stock market trends. However, if the PCE data on Thursday and Friday indicates persistent inflation, we can expect increased pressure on stock trends. Additionally, risks from geopolitical tensions and profit-taking could lead to opposite reactions in the markets.

Forex

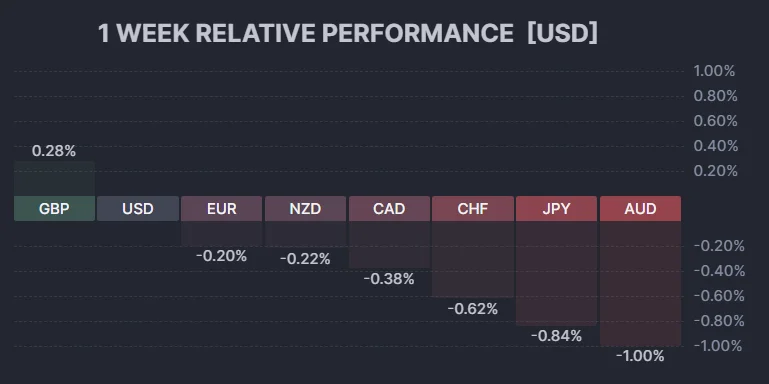

In the currency market, the British Pound had the best performance of the week, gaining 0.3% against the U.S. Dollar. Among other major currencies, the Euro and the New Zealand Dollar (Kiwi) also performed well. The Reserve Bank of New Zealand (RBNZ) held its target rate steady at 5.50%, but its comments and economic forecasts were hawkish. With higher inflation expectations, we do not anticipate signs of monetary easing until mid-2025.

USD:

Despite positive data, the US dollar managed to recover its losses from the previous week. Looking ahead, given the expected data releases mentioned earlier, it’s unlikely that the USD will increase significantly. However, bearish trends may also struggle to challenge the overall trend. The pivot point for now is 104.60. Holding above this level will support the bulls, with 104.95 and 105.30 as the first and second resistance levels (R1 and R2). Conversely, if bears prevail, 104.40 and 104.10 serve as the first and second support levels.

Pound:

In the UK, despite mixed PMI data and weaker retail sales, inflation has not shown any acceptable signs of being under control, questioning the expectations of an interest rate cut in August and supporting the pound’s growth. For the week ahead, the UK economic calendar is very quiet, meaning the GBP/USD movement will be primarily influenced by the US dollar. From a technical standpoint, GBP/USD remains bullish, with 1.2800 as its next target. If the pair drops below 1.2650, the trend could change in the short term.

Euro:

In Europe, upcoming inflation and GDP numbers from most Eurozone members will be closely watched. Generally, inflation is expected to move higher, and combined with the better-than-expected PMI numbers from last week, this could support the Euro against its crosses. From a technical perspective, the EUR/USD chart continues to show an overall uptrend, with no significant changes anticipated.

Commodities

Gold:

Gold prices reached an all-time high of $2,450 last Monday but experienced a decline, dropping to $2,330 by Thursday before a slow recovery on Friday. Renewed expectations for a rate cut boosted gold prices following the release of the U.S. inflation report last week. However, better-than-expected labor market data and durable goods orders paused the trends for both the USD and gold. In the upcoming week, if the Fed’s preferred inflation index shows any sign of easing, it may pave the way for the U.S. Federal Reserve to start cutting interest rates by September, which would be positive news for gold bulls. Conversely, if the inflation index remains stubbornly high, it could pressure gold prices.

From a technical standpoint, gold remains bullish, with its all-time high of $2,450 as the next target. However, despite the most fundamental news and data supporting gold, if prices decline below the key pivot of $2,270, the trend could reverse.

Oil:

Oil prices slipped last week, with WTI crude dropping to a weekly low of $76.50 per barrel. Despite a recovery on Friday, WTI ended the week with more than a 2% loss. Market participants are now expecting higher interest rates for a longer period in most economies, which could affect market demand and pressure oil prices. On the other hand, supply concerns provide support for oil prices, as the crisis in the Middle East continues to threaten oil distribution.

In the week ahead, economic data could impact the energy market. Recently published data show mixed economic activity in China. First-quarter GDP growth was solid at 5.3% year-over-year, and March PMIs were encouraging. For May, we expect the manufacturing PMI to increase slightly to 50.5 and the non-manufacturing PMI to rise modestly to 51.5. If realized, these mixed figures would be consistent with our outlook for the economy to slow down in the medium-to-long term, which could pressure WTI prices, though this is unlikely. The main event for oil this week is the OPEC meeting on Saturday, June 1.

Cryptocurrency

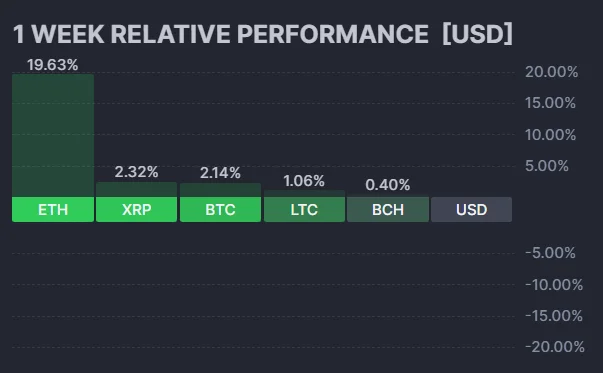

In the cryptocurrency market, Ethereum (ETH) was the standout performer of the week, gaining nearly 20% following the SEC’s approval of the first-ever Ethereum ETF. This major development is seen by investors and traders as a potential turning point for the cryptocurrency industry, possibly heralding a new bull cycle. While there may be challenges in the short term, Ethereum’s regulatory acceptance sets a precedent, and attention is now shifting to other leading projects like Solana.

From a technical perspective, ETH/USD remains bullish. The first support level is at $3,500, followed by $3,200. Bulls are targeting $4,000 in the short term.

Share

Hot topics

What Is Spot Trading?

Spot trading refers to the buying or selling of an asset for immediate delivery in the current market (or “spot”) and does not contain any future obligations, expiration dates, or...

Read more

Submit comment

Your email address will not be published. Required fields are marked *