Reserve Bank of Australia Holds Interest Rates Steady in November 2024

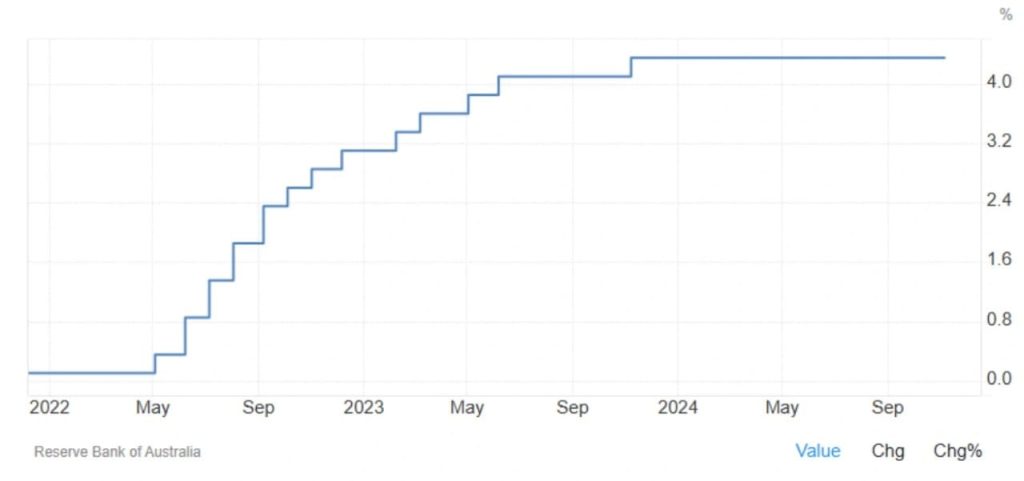

In November 2024, the Reserve Bank of Australia (RBA) opted to keep its cash rate steady at 4.35%, marking the eighth consecutive meeting without a change and aligning with market expectations. This decision underscores the RBA’s cautious approach amid mixed economic signals, as it monitors inflation and other economic indicators closely.

Inflation and Monetary Policy Stance

While headline inflation in Australia has shown signs of easing, the RBA expressed concerns that underlying inflation remains elevated. The board reiterated its commitment to maintaining restrictive monetary policy until there is clear and sustainable progress in reducing inflation toward the target levels. The RBA’s vigilance reflects the ongoing uncertainty around inflationary pressures and the need to manage potential risks that could impact long-term economic stability.

Household Spending and Economic Recovery

Household spending showed growth in the third quarter of 2024, indicating some resilience in consumer demand. However, the RBA cautioned that the economic recovery is slower than anticipated, which could pose risks to overall growth and the labor market. This slower pace of recovery may affect employment trends and wage growth, leading the RBA to remain cautious in its economic outlook.

Interest Rate on Exchange Settlement Balances

Alongside the decision to hold the cash rate steady, the RBA also kept the interest rate on Exchange Settlement balances unchanged at 4.25%. This rate impacts the overnight funds that financial institutions hold with the RBA, playing a role in maintaining financial stability and supporting the broader monetary policy framework.

Conclusion: A Watchful Approach to Economic Stability

In conclusion, the RBA’s decision to keep the cash rate at 4.35% reflects a balanced approach, acknowledging both progress and risks in the current economic environment. While headline inflation has moderated, the persistence of underlying inflation means that the RBA remains cautious about future rate changes. As the economy navigates a slow recovery, the RBA’s stance highlights the importance of patience and vigilance in ensuring sustained progress toward economic stability.

Share

Hot topics

Trading with price action

When they start, most traders will believe that they must discover the ideal indicator for success. At otet markets, we see this every day.They test a variety of indicators, including...

Read more

Submit comment

Your email address will not be published. Required fields are marked *