U.S. Manufacturing PMI Falls in April 2025: Signs of Persistent Industry Contraction

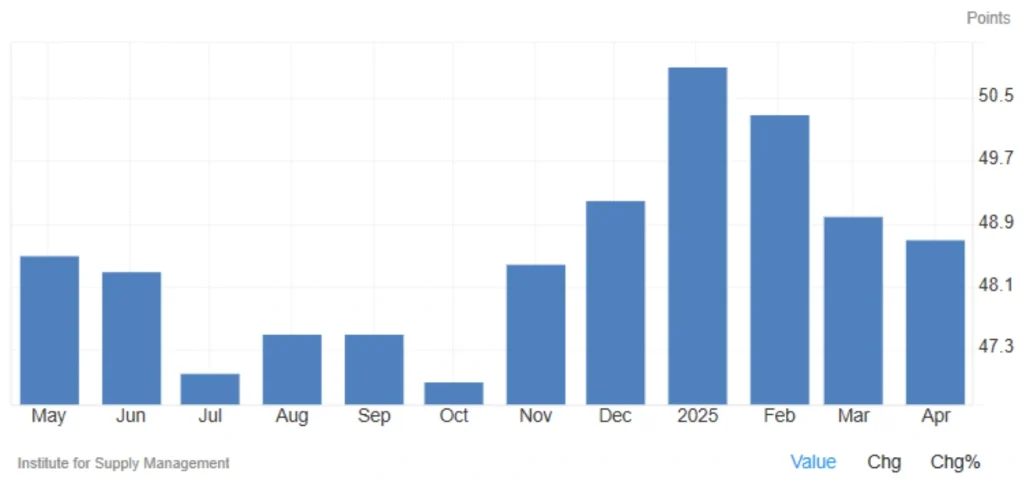

The ISM U.S. Manufacturing PMI fell to 48.7 in April 2025, down from 49.0 in March, slightly above the market forecast of 48.0. This marks the second consecutive month of contraction in the U.S. Manufacturing PMI sector, signaling persistent challenges amid trade disruptions, elevated input costs, and weakening global demand.

Key Highlights – April 2025 ISM Report

| Indicator | Reading | Change | Interpretation |

|---|---|---|---|

| Headline Manufacturing PMI | 48.7 | ▼ from 49.0 | Ongoing contraction |

| Production Output | 44.0 | ▼ sharply from 48.3 | Significant decline in manufacturing activity, reflecting the U.S. Manufacturing PMI trend. |

| Prices Paid | 69.8 | ▲ slightly from 69.4 | Increased cost pressure |

| New Orders | 47.2 | ▲ from 45.2 | Decline easing; tentative demand recovery |

| New Export Orders | Declining | ▼ further due to tariffs and trade issues | Weak global demand |

| Employment Index | 46.5 | ▲ from 44.7 | Job losses continue but at a slower pace |

| Customer Demand Volatility | Increasing | ↑ due to price shifts and order delays | Higher uncertainty in short-term demand |

Educational Note: What Is the Manufacturing PMI?

The Purchasing Managers’ Index (PMI) is a forward-looking indicator that reflects the health of the manufacturing sector. A reading above 50 indicates expansion, while a reading below 50 indicates contraction. The ISM Manufacturing PMI, in particular, is one of the most closely watched indicators for gauging U.S. industrial health and overall economic momentum. This month’s industrial health reflection indicates a broader economic condition in the U.S. Manufacturing PMI.

Analysis: Tariffs, Trade Disruptions Continue to Weigh on Manufacturing

🔻 Steep Decline in Output:

The production index plunged to 44.0, signaling a deeper contraction in factory output. This sharp drop could weigh on GDP growth and reflects broad-based weakness across key industrial sectors. This is clearly seen in the U.S. Manufacturing PMI performance.

🔻 Cost Pressures Intensify:

The Prices Paid index rose to 69.8, indicating escalating input costs—largely driven by tariffs, supply chain disruptions, and rising raw material prices. These added cost pressures affect profit margins and are reflected in the U.S. Manufacturing PMI outlook.

🔺 Slower Decline in New Orders Offers Some Hope:

While new orders remained in negative territory (47.2), the pace of decline moderated, suggesting a tentative stabilization in demand. Volatile customer demand, however, continues to be a major concern due to delayed orders and unpredictable pricing, impacting the U.S. Manufacturing PMI.

Read More: US Tariffs and the Decline of the US Dollar: Key Insights for Traders

Summary: Sector Still Under Pressure, but Signs of Stabilisation Emerging

Despite persistent challenges from tariffs, supply bottlenecks, and rising costs, a few silver linings are beginning to emerge:

- The decline in new orders is slowing.

- The pace of job losses is easing. These signals may point to a bottoming out of the U.S. Manufacturing PMI downturn, but any sustained recovery will depend on broader macroeconomic conditions, easing of trade tensions, and improvements in global demand.

📌 Outlook: If global trade disruptions and the current U.S. trade policy path—shaped significantly by the Trump administration—persist, the manufacturing sector could face prolonged weakness in the quarters ahead.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *