Bitcoin Soars Past $117K, $1.14B in Liquidations Shake Crypto Market

📌 Key Takeaways

- 💥 Bitcoin surges past $117,250, up 24% YTD

- 💸 $1.14B in leveraged crypto positions liquidated in 24 hours

- 📉 Short traders account for $1.02B of total liquidations

- 🏦 Bitcoin ETFs have purchased $15B since mid-April

- 🏛️ Trump’s pro-crypto policies strengthen bullish momentum

- 🔮 Analysts eye $130K–$133K as the next major price target

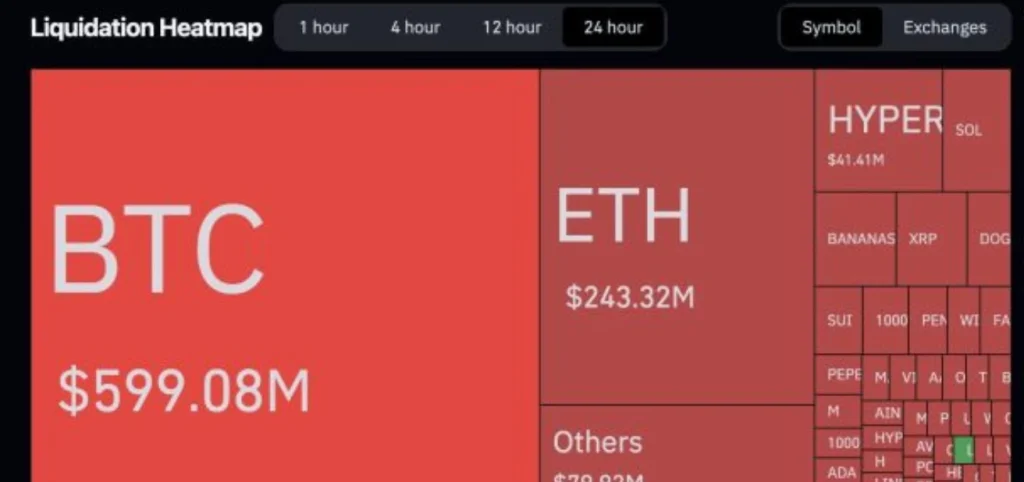

📊 Crypto Liquidation Breakdown – Past 24 Hours

| Asset | Liquidations (USD) |

|---|---|

| Total Crypto Market | $1.14 Billion |

| Bitcoin (BTC) | $599 Million |

| Ethereum (ETH) | $243 Million |

| Short Positions | $1.02 Billion |

| Long Positions | ~$120 Million |

💥 Bitcoin Explodes Past $117K on Institutional Demand and Trump Tailwinds

Bitcoin (BTC) hit a new all-time high of $117,250 on Friday, fueled by accelerating ETF inflows, institutional demand, and renewed optimism from pro-crypto Trump policies.

The breakout shocked many traders, triggering $1.14 billion in liquidations—the largest in recent years. Of that total, a massive $1.02 billion came from short positions, suggesting that bears were caught off guard by the sudden upward momentum.

According to 10X Research, the price action confirms a bullish structural shift. In a note to clients, the firm reported a short-term breakout signal, which historically precedes median gains of 20%, putting $133,000 in view as a potential target by September.

Read More: Trump Family-Backed American Bitcoin Raises $220M

🧨 ETF Demand and Trump’s Pro-Crypto Moves Push Market Higher

Bitcoin’s rally is also being driven by continued strength in ETF buying. Analysts note that since mid-April, Bitcoin ETFs have absorbed over $15 billion in BTC, significantly reducing market supply and supporting higher prices.

Adding to the bullish backdrop are favorable political developments:

- 🇺🇸 Trump’s executive order in March established a national crypto reserve.

- 🏛️ Pro-crypto figures like Paul Atkins and David Sacks have taken key regulatory positions.

- 💼 Trump Media & Technology Group filed to launch a multi-token crypto ETF.

These moves have sparked fresh institutional interest and provided a regulatory green light that had been missing from previous crypto bull runs.

📉 Volatility Ignites Massive Liquidations

The surge in Bitcoin’s price didn’t come without casualties. According to CoinGlass, $1.14B in leveraged positions were wiped out, the majority from over-leveraged short traders.

Bitcoin alone accounted for $599M in liquidations, followed by Ethereum at $243M, with losses also seen in Solana, Hyperliquid, and XRP.

This liquidation wave indicates a strong reversal in market sentiment, with traders scrambling to reposition themselves in a fast-moving bull trend.

🔍 What’s Next for Bitcoin?

Analysts say the next key resistance lies near $130,000, with a breakout above that level potentially opening the door to $133,000 or higher in Q3.

But the market remains sensitive to macro triggers. All eyes are now on:

- 🧾 U.S. CPI data next week

- 🇺🇸 The start of Crypto Week in Washington, where fresh regulatory signals could emerge

According to crypto strategist Markus Thielen,

“Bitcoin may be transitioning into a higher trading range. The combination of ETF buying, regulatory support, and institutional demand makes this rally fundamentally stronger than previous ones.”

💬 Final Thoughts

This could mark the start of a new crypto bull market phase but as always, volatility remains high, and sentiment can turn quickly. Traders should keep a close eye on macro data and policy updates for further direction.

📢 What’s your BTC price target this summer? Share your thoughts below and follow us for more high-impact crypto coverage.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *