Warren Buffett’s Golden Rule of Investing: Never Lose Money!

Estimated reading time: 3 minutes

Table of contents

In the fast-paced, often emotional world of finance — driven by greed, fear, and hype — Warren Buffett stands out as a calm and reliable compass for investors. Unlike many who chase flashy predictions or take reckless risks, Buffett built one of the greatest fortunes of the 21st century on simple, profound principles.

One of his most famous quotes perfectly sums up his investment philosophy:

“Rule number one: Never lose money. Rule number two: Don’t forget rule number one.”

Far from just a witty quip, this statement distills decades of experience, analysis, and steadfast commitment to fundamental investing principles.

In this article, we’ll explore the deeper meaning of Buffett’s golden rule, how to apply it in today’s markets, and practical tips for protecting your capital.

What Does This Rule Really Mean?

At first glance, Buffett’s rule seems straightforward — avoid losing money. But its depth reveals a sophisticated understanding of:

| Aspect | Meaning |

|---|---|

| Preserve capital | Your primary goal is to keep your money safe, even when exciting growth opportunities arise. |

| Prioritize safety | In all market conditions — bullish or bearish — protecting your principal comes first. |

The rule is not just about avoiding losses but about valuing risk, time, and the asymmetry between losing and gaining money.

Why Preserving Capital Is More Important Than Making Huge Gains

Consider this simple example:

| Scenario | Amount | Explanation |

|---|---|---|

| Initial Capital | 100 million Toman | Your starting investment |

| After 50% loss | 50 million Toman | Half your capital is lost |

| Required gain to recover | 100% | You need to double 50 million to get back to 100 million |

The takeaway: A 50% loss requires a 100% gain to break even. This asymmetry means every unit of loss is much more expensive than the same unit of gain, hence preserving capital is crucial.

How Warren Buffett Applies This Rule in Practice

- Invest Only in What You Understand

Buffett never invests in businesses or industries he doesn’t understand. He studies their business model, market future, and management thoroughly. - Buy at a Discount

He looks for stocks whose intrinsic value exceeds their market price — in other words, buying with a margin of safety, not chasing hype. - Avoid Excessive Leverage

Buffett warns that borrowing money for investments can turn small mistakes into disasters. - Think Long-Term

Buffett compares investing to planting trees — it takes time to grow. He avoids short-term trading and focuses on durable value.

Read More: Warren Buffett’s Advice for the Middle Class

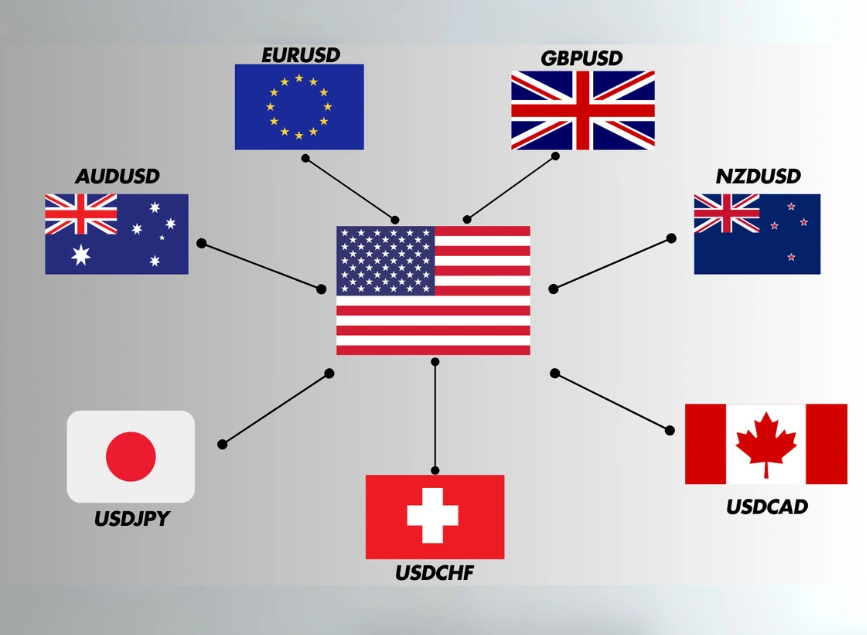

Applying Buffett’s Rule in Modern Markets (Forex, Crypto, Stocks)

| Tip | Why It Matters | Emoji |

|---|---|---|

| Set Stop-Loss Orders | Prevents losses from becoming too deep to recover | ✅ |

| Calculate Risk vs. Reward | Ensure potential profits justify risks before entering a trade | ⚖️ |

| Invest in What You Know | Avoid speculation on rumors or hype, especially in volatile markets like crypto | 📚 |

| Be Wary of High Leverage | High leverage amplifies risk and can wipe out accounts with small market moves | ⚠️ |

Beyond Markets: Buffett’s Golden Rule in Personal Finance

This rule isn’t just for investors and traders — it’s a wise principle for everyday money management:

- Avoid excessive borrowing

- Don’t count on high-risk, high-return shortcuts

- Always save before you invest

- Keep emergency cash reserves

Final Thoughts: One Rule, One Path

Warren Buffett’s golden rule is a fundamental truth that protects investors from destructive mistakes, emotional decisions, greed, and unnecessary risks.

Remember:

It’s sometimes okay to miss out on profits, but losing your capital is always the most expensive lesson.

Share

Hot topics

Best broker for gold trading

There’s always been a certain magic about gold. Before online charts and trading applications, people stored their wealth in coins and bars, trusting that gold would retain its value during...

Read more

Submit comment

Your email address will not be published. Required fields are marked *